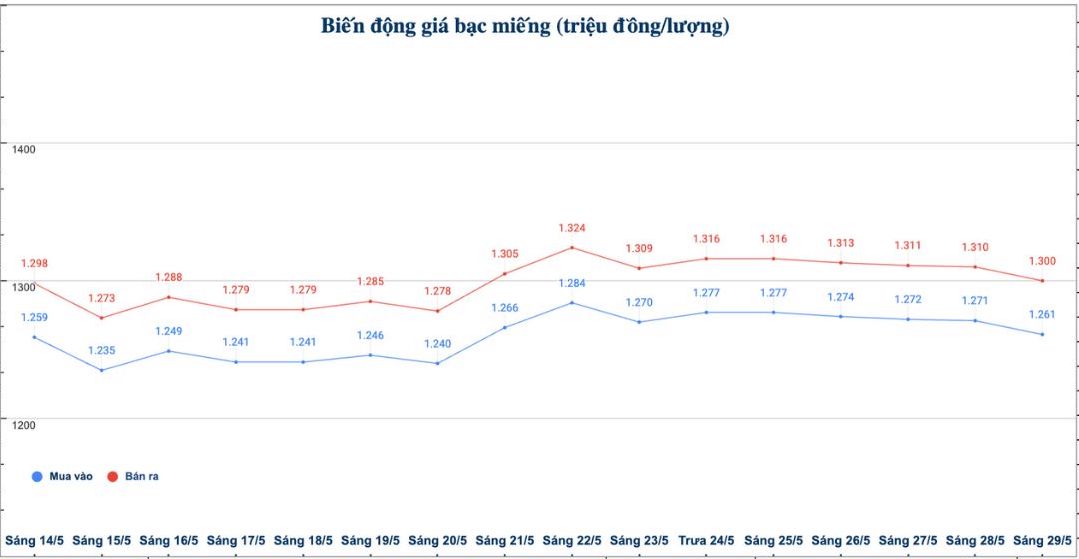

Domestic silver price

As of 9:15 a.m. on May 29, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.261 - VND1.300 million/tael (buy - sell); down VND10,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.261 - 1.300 million VND/tael (buy - sell); down 10,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels at Phu Quy Jewelry Group was listed at 33.626 - 34.666 million VND/kg (buy - sell); down 267,000 VND/kg in both buying and selling directions compared to early this morning.

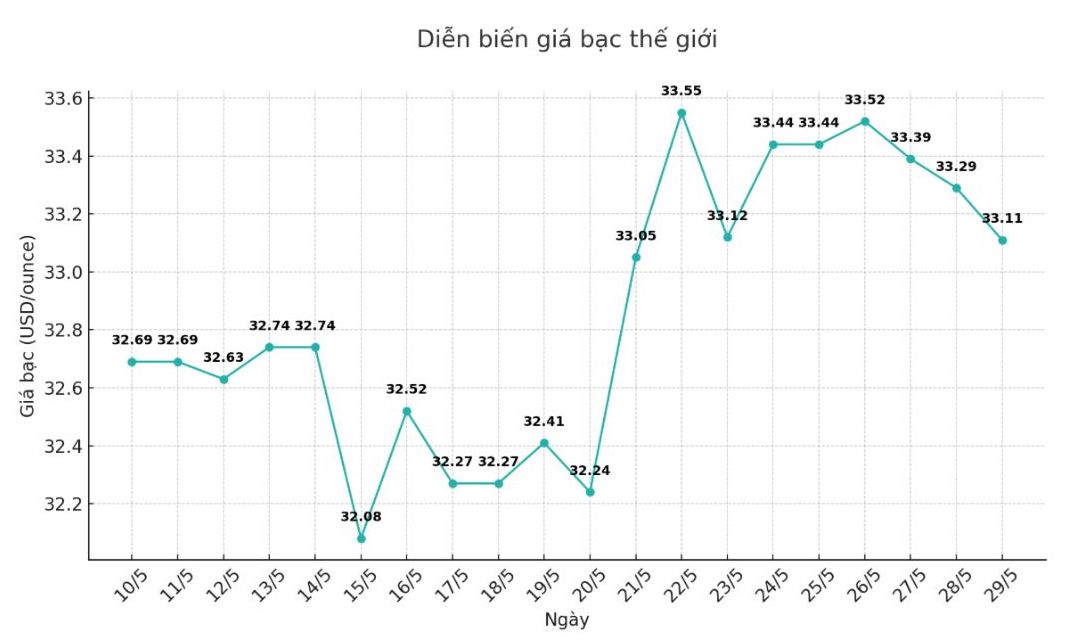

World silver price

On the world market, as of 9:16 a.m. on May 29 (Vietnam time), the world silver price listed on Goldprice.org was at 33.11 USD/ounce; down 0.18 USD compared to early this morning.

Causes and predictions

According to FX Empire, the continued decline in silver prices shows the cautious sentiment of the market before the US announces important economic data.

Despite the decline, silver is still supported by the general positive trend of the precious metal group, especially gold, in the context of traders waiting for new signals from the US Federal Reserve (FED) and inflation data.

James Hyerczyk, market analyst at FX Empire, said: "The market is waiting for the minutes of the Fed's May meeting and the PCE consumer price index due on Friday - two factors that could have a strong impact on the next direction of silver prices.

If the Fed issues a dovish message or the PCE shows that inflation has cooled down, gold and silver could rise again. In particular, 33.70 USD/ounce will be an important trigger for silver's increase".

James Hyerczyk added that before the data is released, the market is likely to move sideways, with limited trading and focused on macro risks. Unexpected fluctuations from economic data will determine whether silver prices will bounce or adjust further.

See more news related to silver prices HERE...