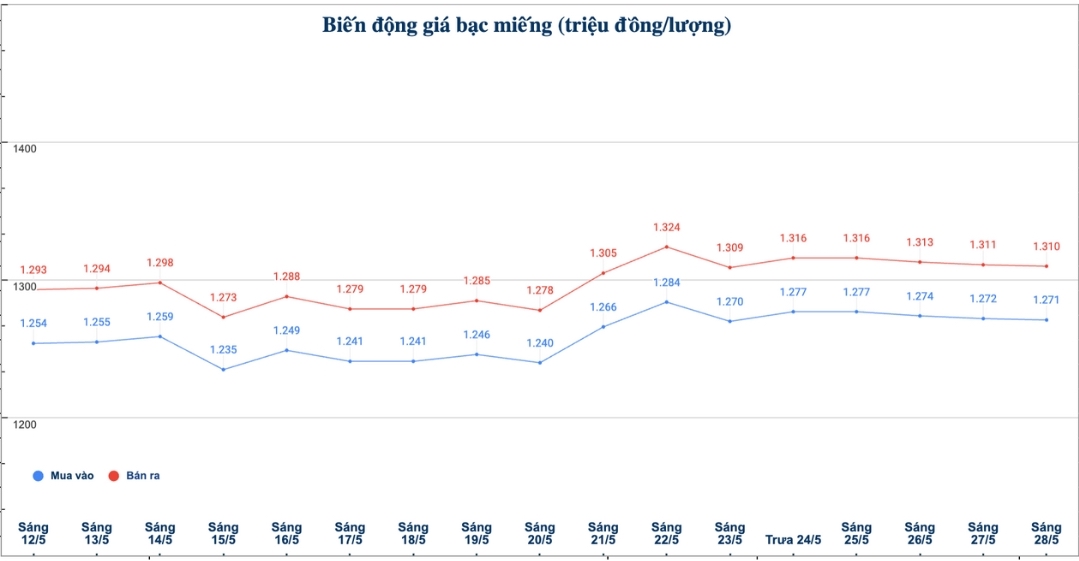

Domestic silver price

As of 9:17 a.m. on May 28, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.271 - 1.310 million/tael (buy - sell); down VND1,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.271 - 1.310 million VND/tael (buy - sell); down 1,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at 33.893 - 34.933 million VND/kg (buy - sell); down 26,000 VND/kg in both buying and selling directions compared to early this morning.

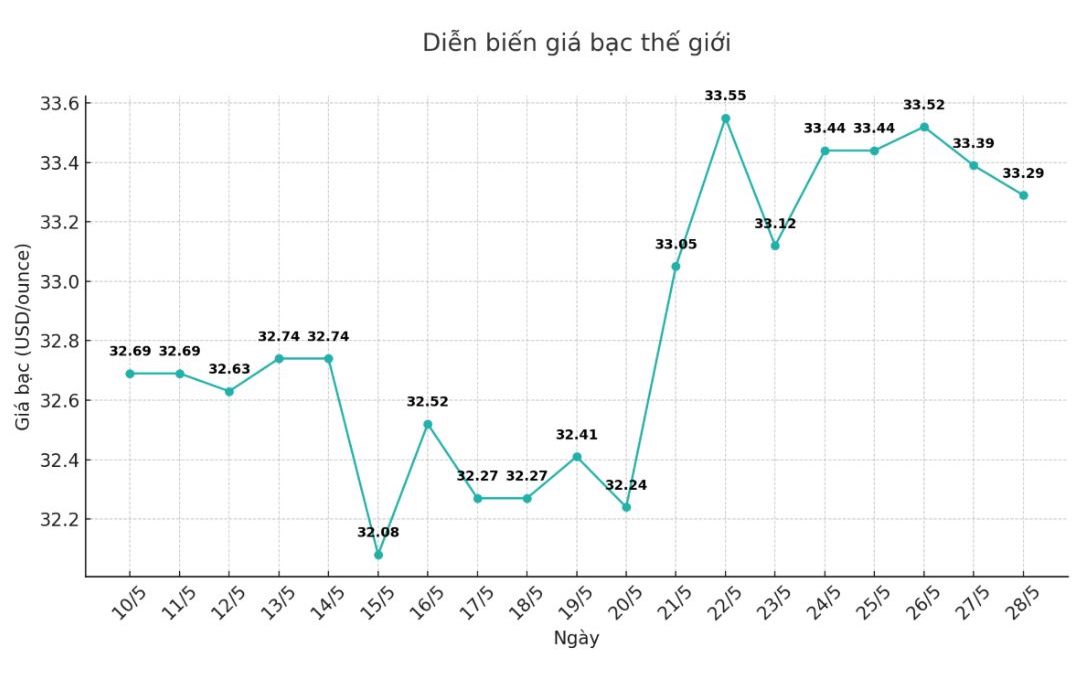

World silver price

On the world market, as of 9:18 a.m. on May 28 (Vietnam time), the world silver price listed on Goldprice.org was at 33.29 USD/ounce; down 0.10 USD compared to early this morning.

Causes and predictions

According to FX Empire, silver prices plummeted, continuing the weakening trend of gold in the context of the USD increasing in price and geopolitical tensions cooling down.

The US dollar index's 0.3% increase has put pressure on assets priced in greenback, making silver more expensive for international buyers and reducing demand.

James Hyerczyk - market analyst at FX Empire - commented: "The momentum for the USD to increase comes from US President Donald Trump's more towards the issue of tariffs on Europe. Thereby supporting the stock market and reducing the attractiveness of safe-haven assets such as gold and silver".

The expert said the market is currently waiting for statements from the US Federal Reserve official (Fed) along with the upcoming core PCE inflation report. Investors expect the Fed to cut interest rates a total of 47 basic points at the end of the year, with the first batch that can take place in October.

"If the inflation data is lower than expected or the Fed's statements are moderate, the market could see a return to precious metals," said James Hyerczyk.

However, until clearer signals appear, James Hyerczyk maintains that the short-term trend of gold and silver is still under downward pressure.

The sell-off on Tuesday coincided with the second consecutive session of gold's decline, showing that silver is moving more and more similar to gold and is affected by market risk sentiment.

According to Ole Hansen - an expert at Saxo Bank: "Gold's weakness is mainly due to reduced safe-haven demand and a strong stock market - which also affects silver similarly".

See more news related to silver prices HERE...