Domestic silver prices

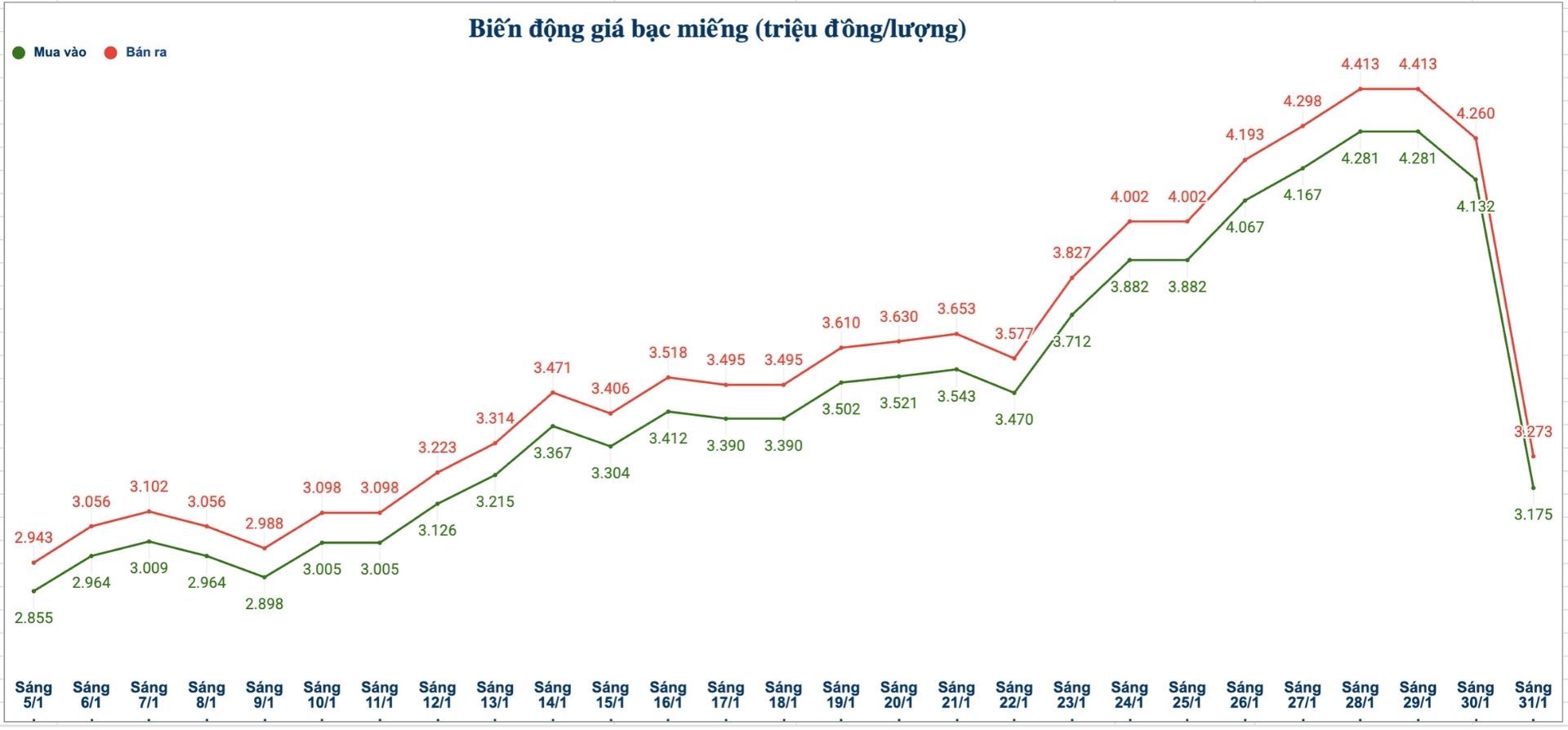

As of 9:00 am on January 31, the price of silver bars 2024 Ancarat 999 (1 tael) at Ancarat Gem Company was listed at the threshold of 3.274 - 3.354 million VND/tael (buying - selling); down 898,000 VND/tael on the buying side and down 893,000 VND/tael on the selling side compared to yesterday morning.

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 86.320 - 88.940 million VND/kg (buying - selling); down 23.104 million VND/kg on the buying side and down 23.814 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) is listed at 4.047 - 4.164 million VND/tael (buying - selling); down 366,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at 3.175 - 3.273 million VND/tael (buying - selling); down 957,000 VND/tael on the buying side and down 987,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 84.666 - 87.279 million VND/kg (buying - selling); down 25.52 million VND/kg on the buying side and down 26.32 million VND/kg on the selling side compared to yesterday morning.

World silver price

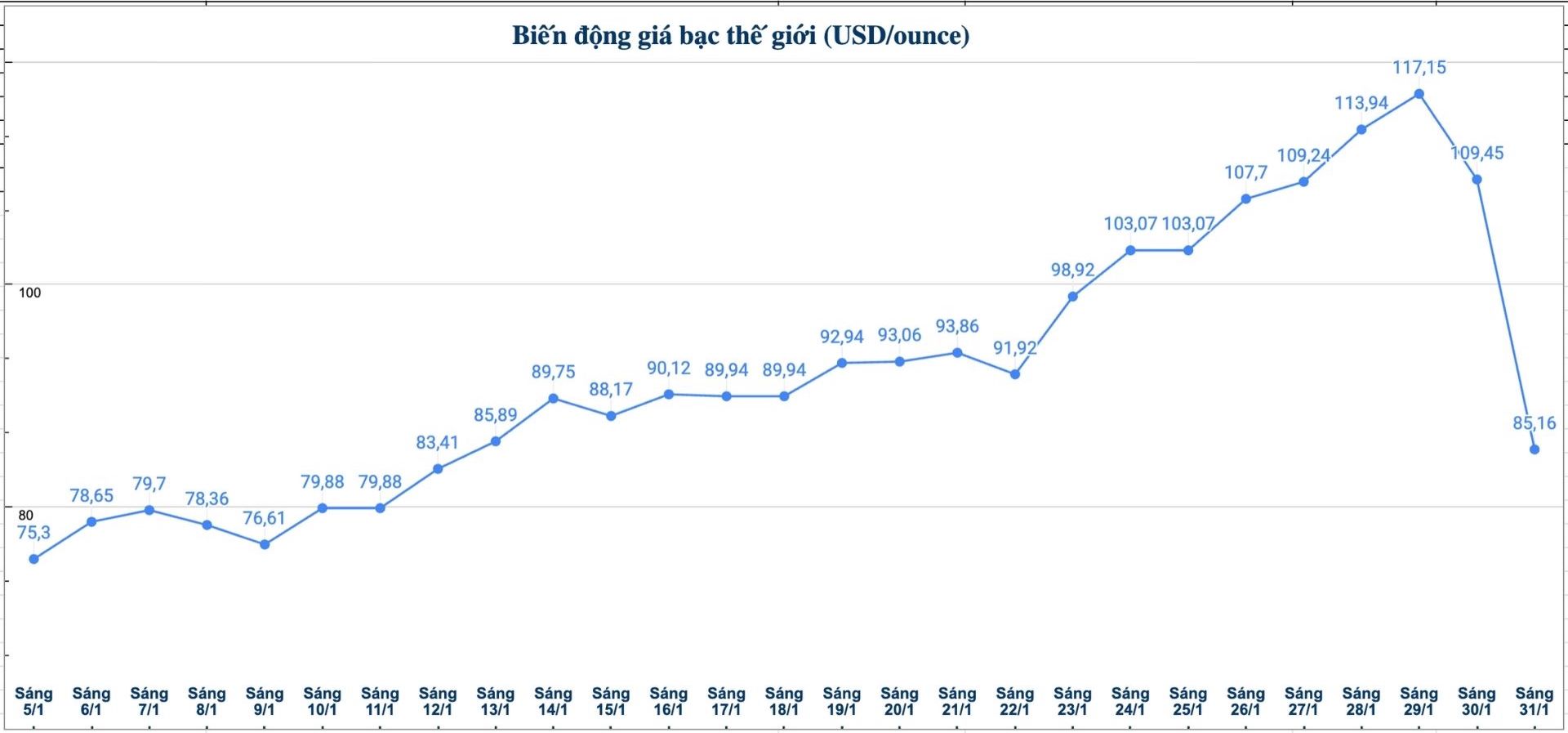

On the world market, as of 9:04 am on January 31 (Vietnam time), the world silver price was listed at 85.16 USD/ounce; down 24.29 USD compared to yesterday morning.

Causes and forecasts

Spot silver prices have decreased by more than 36%, marking one of the strongest corrections since the beginning of the year and showing that selling pressure is still very large in the market. The wave of selling is massive, although called in many ways such as taking profits, closing positions or liquidating purchase contracts, but in general, it all reflects the investor's psychology of fleeing.

According to precious metals analyst James Hyerczyk at FX Empire, this decline does not stem from fundamental changes in the market - no new large-scale silver mines have been discovered, while the material supply shortage has not been resolved.

The main reason comes from the fact that speculative demand has increased too strongly, far exceeding actual usage demand, forcing the market to adjust according to the law of supply and demand in the long term," he said.

James Hyerczyk believes that what is important at this time is not the trend line, but the change in market momentum.

With the current strong decline, the trend line is only considered a target to monitor, because selling pressure following the trend can completely break through this threshold. However, the possibility of recovery still exists if selling pressure weakens" - the expert said.

He added that the difference in the actions of investor groups also became clear during the period of strong fluctuations.

Individual investors often place buy orders right at trend lines with the expectation that prices will stop falling. Meanwhile, professional traders often let the market check, even break through technical thresholds, only participate when the selling momentum actually ends and reversal signals appear" - James Hyerczyk said.

Therefore, according to James Hyerczyk, many individual investors are forced to sell when prices fall sharply, although in fact this is only a supply-demand adjustment.

See more news related to silver prices HERE...