Domestic silver prices

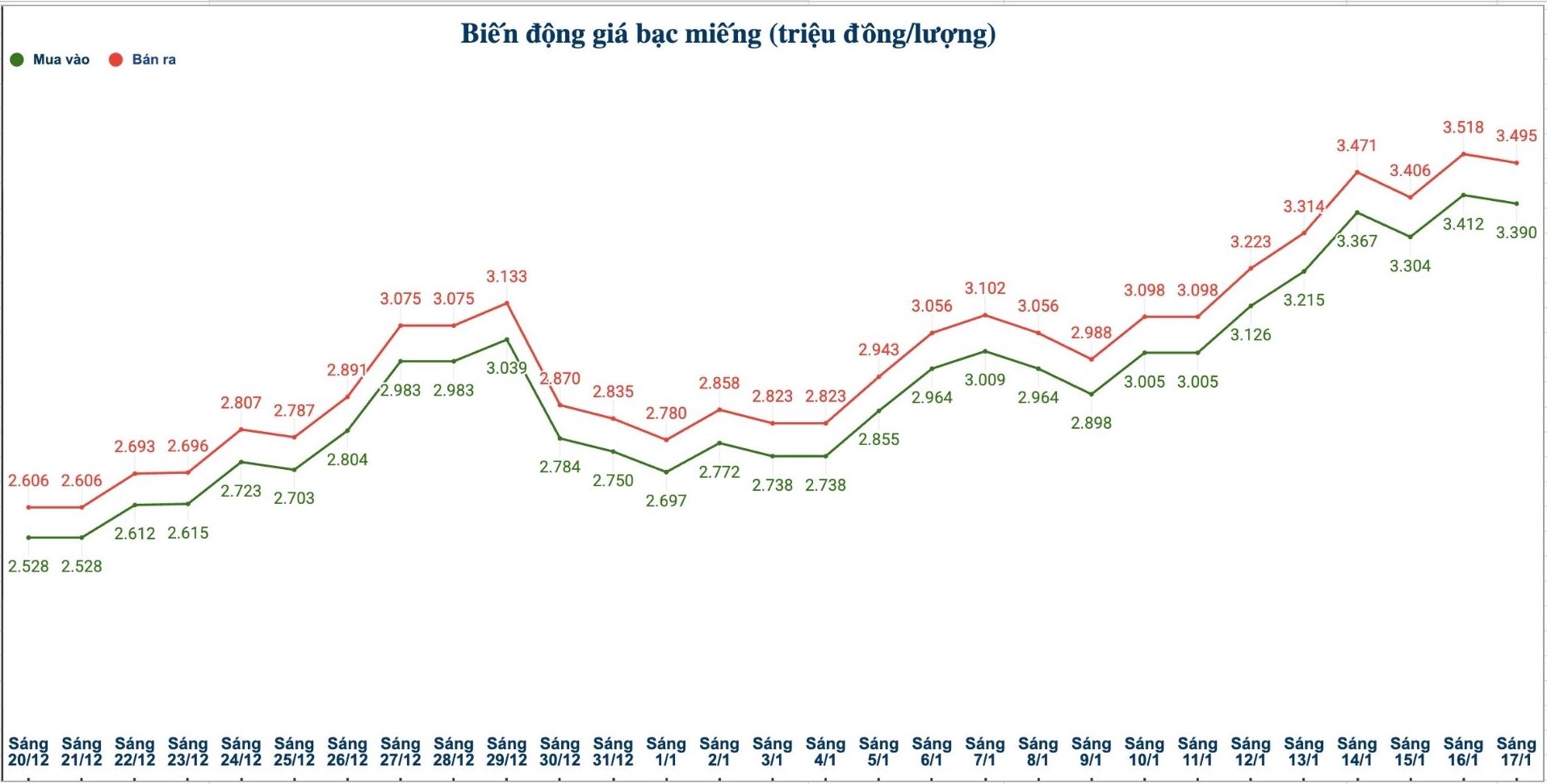

As of 9:50 am on January 17, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 3.393 - 3.476 million VND/tael (buying - selling); down 6,000 VND/tael on the buying side and down 7,000 VND/tael on the selling side compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) in Ancarat Jewelry Company is listed at 89.474 - 92.194 million VND/kg (buying - selling); down 176,000 VND/kg on the buying side and down 186,000 VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) is listed at the threshold of 3.492 - 3.579 million VND/tael (buying - selling).

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.390 - 3.495 million VND/tael (buying - selling); down 22,000 VND/tael on the buying side and down 23,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 90.399 - 93.199 million VND/kg (buying - selling); down 587,000 VND/kg on the buying side and down 614,000 VND/kg on the selling side compared to yesterday morning.

World silver prices

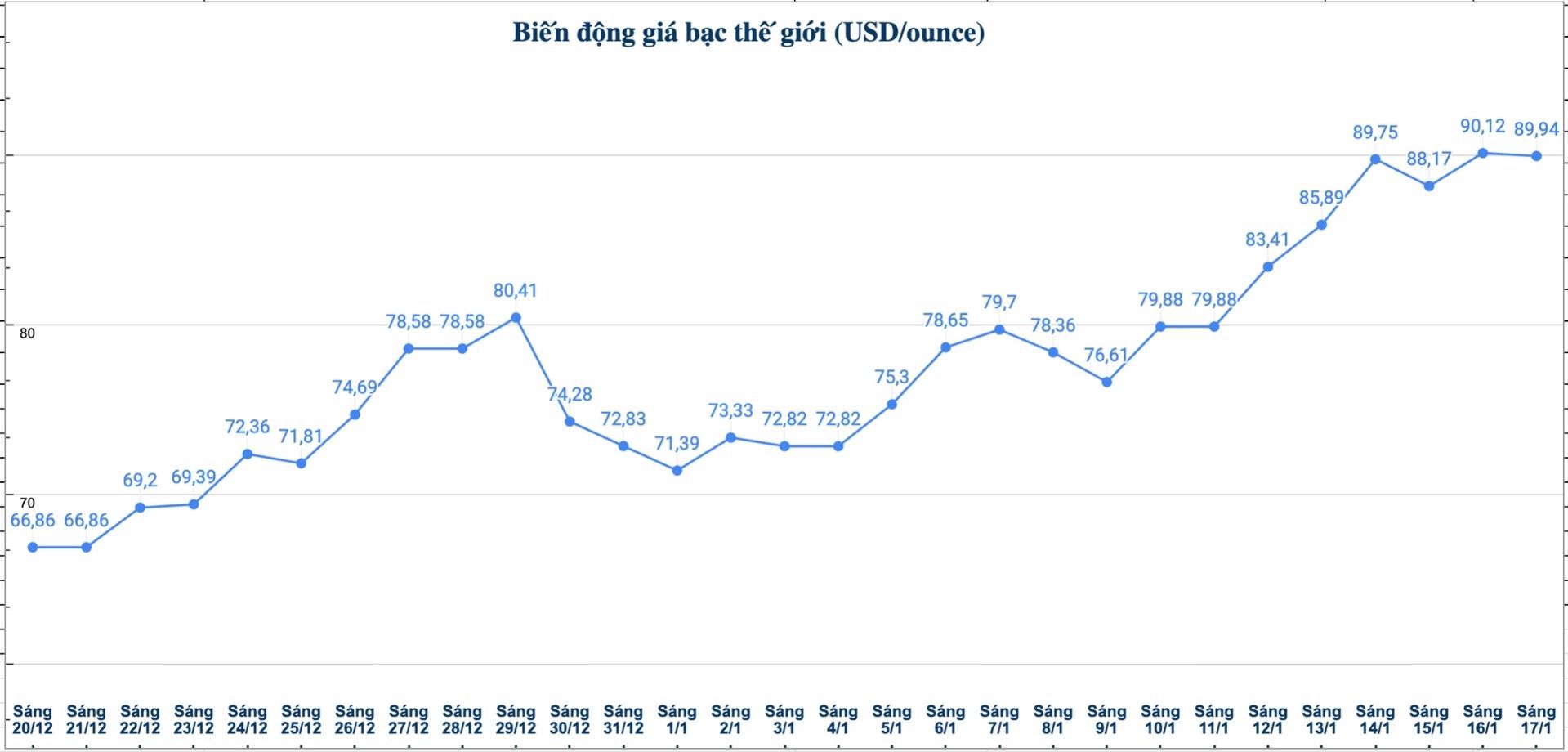

On the world market, as of 10:05 am on January 17 (Vietnam time), the world silver price was listed at 89.94 USD/ounce; down 0.18 USD compared to yesterday morning.

Causes and forecasts

The silver market continues to record strong fluctuations in recent trading sessions. According to precious metals analyst Christopher Lewis at FX Empire, the silver market is currently in a "overbought" state, showing that short-term correction risks are still present.

Observing price movements shows that every time silver increases by about 10 USD/ounce, buying and selling activities become more active. This shows that silver prices react quite strongly to technical signals, thereby attracting great attention from investors" - Christopher Lewis said.

Despite some corrections, he believes that the target of 100 USD/ounce is still an attractive milestone that the market is aiming for. In that context, short-term price reductions are seen as an opportunity for investors to participate in the market at prices considered "more affordable".

Christopher Lewis added that the 90 USD/ounce mark is currently considered an important support zone, capable of playing a supporting role whenever prices adjust to this area.

The upward momentum of silver is still quite strong. The market may need more sideways time to accumulate and attract new cash flow. Even in the scenario of silver prices deeply adjusting to around the 80 USD/ounce mark, the medium-term outlook is still considered positive" - the expert assessed.

However, Mr. Christopher Lewis also reminded investors to be cautious in managing the scale of their positions, avoiding betting too heavily in the face of unpredictable market fluctuations.

See more news related to silver prices HERE...