Domestic silver price

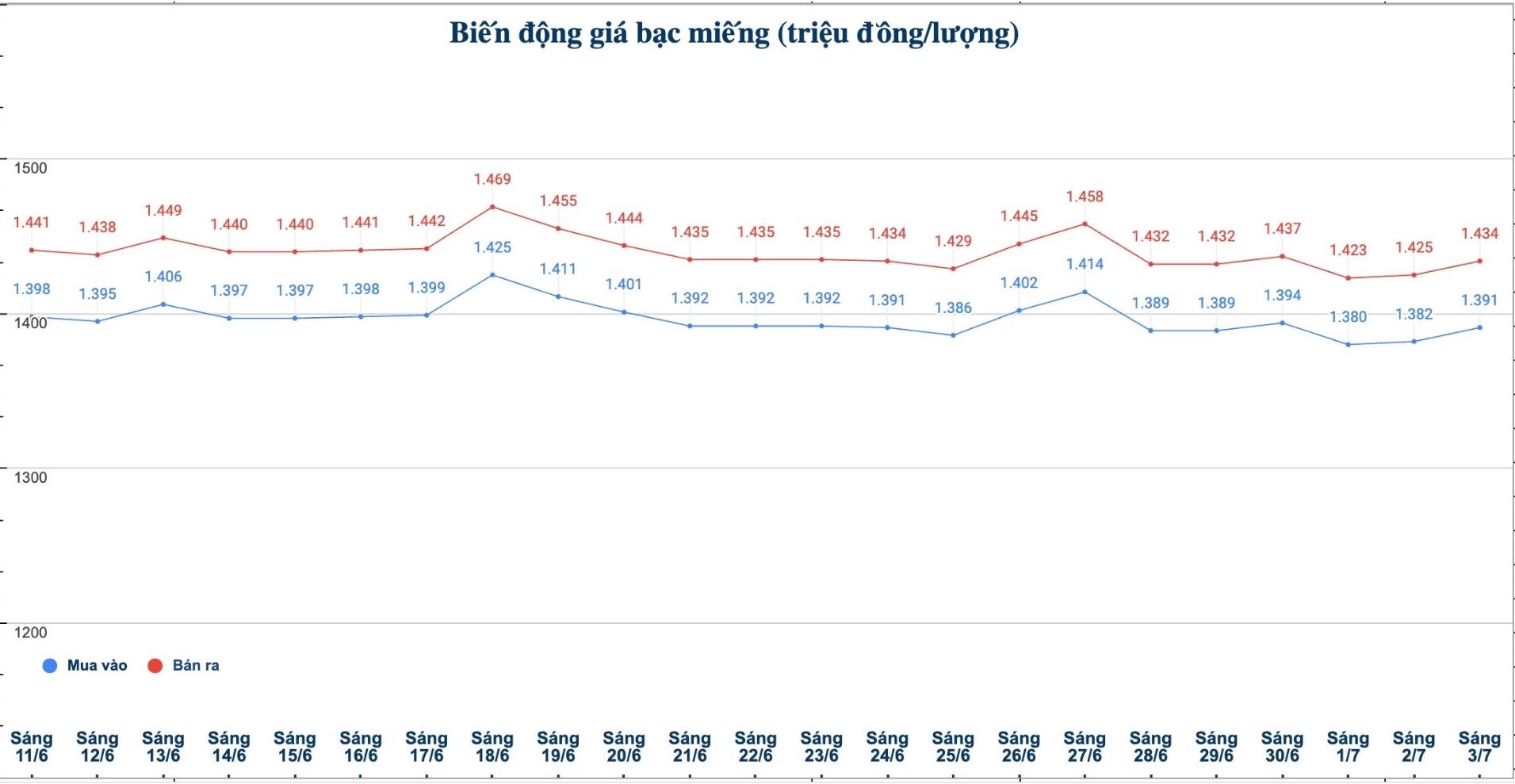

As of 10:30 a.m. on July 3, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.391 - 1.434 million/tael (buy - sell); an increase of VND9,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.391 - 1.434 million VND/tael (buy - sell); an increase of 9,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.093 - 38.239 million VND/kg (buy - sell); an increase of 240,000 VND/kg in both buying and selling directions compared to early this morning.

World silver price

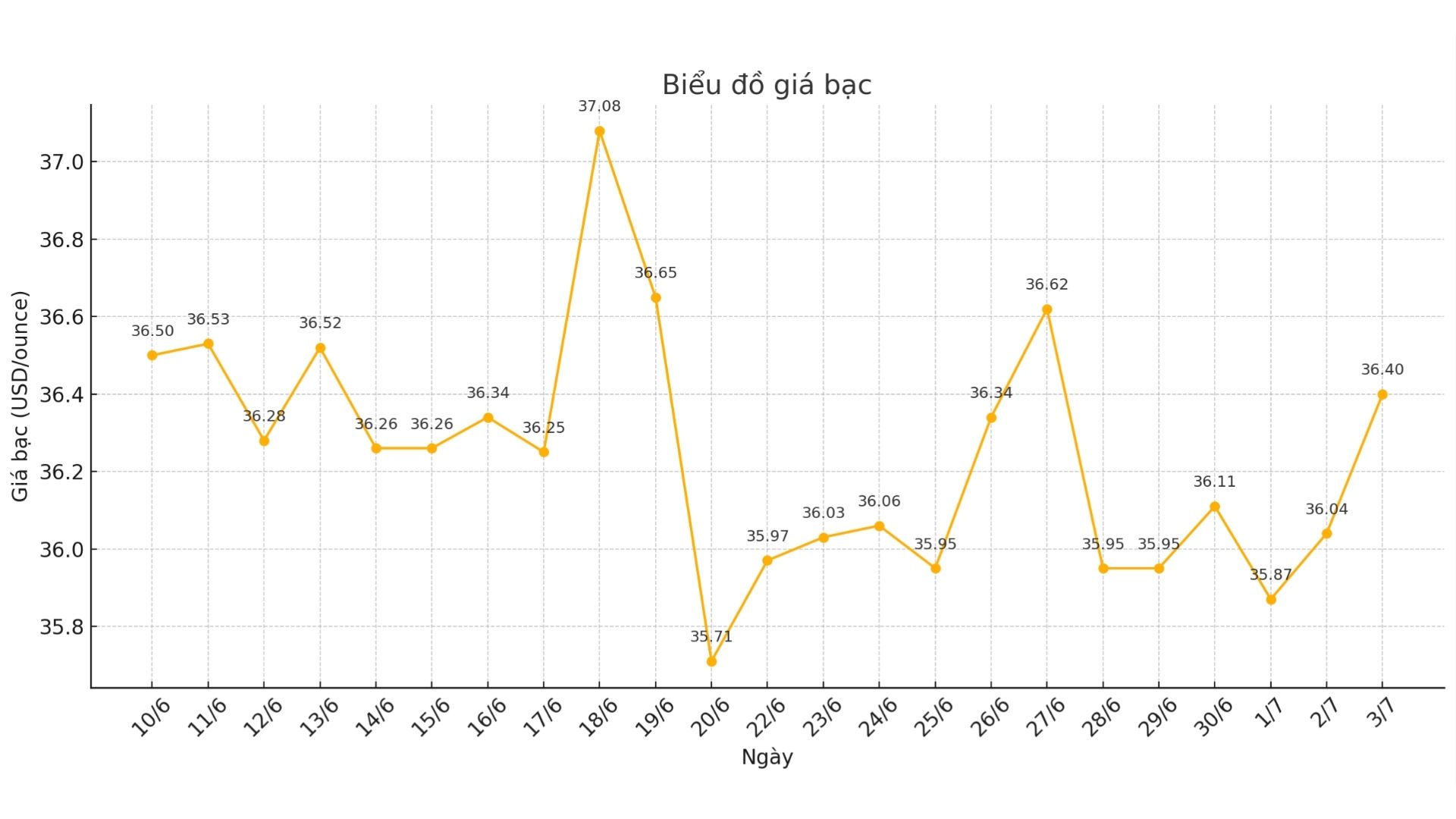

On the world market, as of 10:30 a.m. on July 3 (Vietnam time), the world silver price was listed at 36.4 USD/ounce; up 0.36 USD compared to yesterday morning.

Causes and predictions

Silver prices increased sharply in the middle of the week. According to market analyst James Hyerczyk, the sustained gold price around $3,321.60/ounce is indirectly supporting silver prices, as investors prepare to receive the ADP jobs report for June.

The expert said that if the reporting data weakens, expectations of the US Federal Reserve (FED) to further cut interest rates will weaken the USD and further support the price of precious metals.

Meanwhile, the US Congress's approval of the tax and spending bill has boosted yields on the 10-year Treasury note. This reflects growing concerns about inflation, while the Fed remains hesitant to tighten policy too strongly.

"Usually, rising yields will put downward pressure on precious metals. However, the prolonged budget deficit and the Fed's cautious stance are creating a potential buffer for gold and silver, as investors seek to hedge against inflation risks," said James Hyerczyk.

For metals investor, James Hyerczyk assessed that this context continues to support prices as the USD weakens and silver has the opportunity to hold the high price zone.

"Currently, silver is still in a breakout phase, with the upcoming trend depending heavily on the ADP jobs report and the Fed's stance on interest rates. A weak labor result could be the boost that bulls are waiting for" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...