Domestic silver price

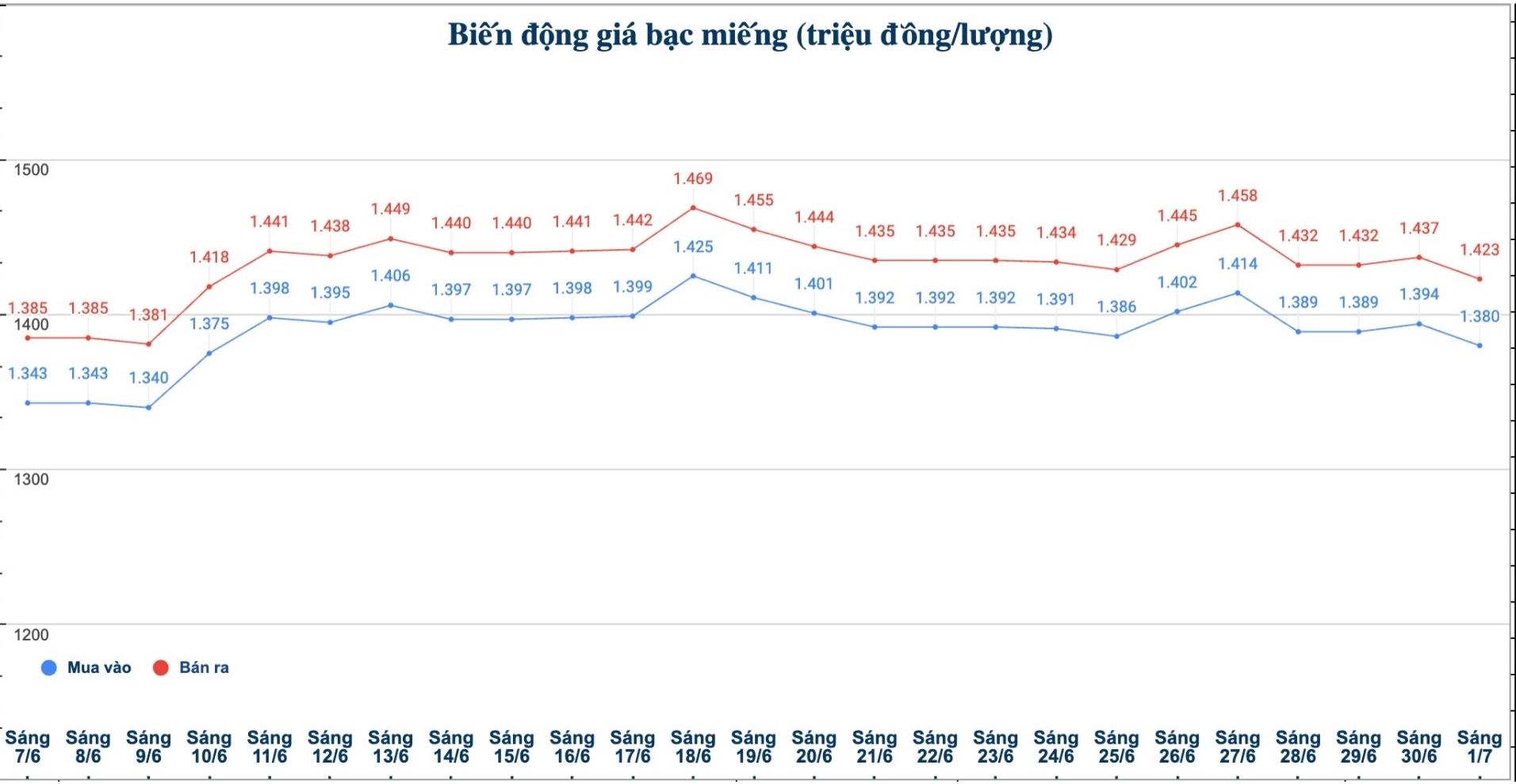

As of 9:30 a.m. on July 1, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.380 - 1.432 million/tael (buy - sell); down VND6,000/tael for buying and down VND5,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.380 - 1.432 million VND/tael (buy - sell); down 6,000 VND/tael for buying and down 5,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 36,799 - 37.946 million VND/kg (buy - sell); down 374,000 VND/kg for buying and down 373,000 VND/kg for selling compared to early this morning.

World silver price

On the world market, as of 9:30 a.m. on July 1 (Vietnam time), the world silver price was listed at 35.31 USD/ounce; down 0.24 USD compared to yesterday morning.

Causes and predictions

Silver prices fell slightly as the support level around 35.40 USD/ounce continued to hold steady - reinforcing the importance of this price range as a decisive milestone for short-term trading orientation.

According to market analyst James Hyerczyk, investors are now waiting for a signal to surpass the 36.30 USD/ounce mark, considering whether buying power is strong enough to overcome the resistance levels and create a new price increase.

"If silver prices break above this level, many investors will close fake selling and speculative buying positions, pushing prices up to the next targets around 36.84 USD/ounce and 37.32 USD/ounce. These are still important prices that trend traders are waiting for to confirm a new increase in line with the long-term uptrend" - the expert said.

James Hyerczyk said that the upward trend of silver prices was reinforced by the weakening of the USD and the growing possibility of an interest rate cut by the US Federal Reserve (FED) in September, factors that have driven investors to turn to precious metals to hedge against currency risks.

At the same time, bond yields are under pressure and political debates surrounding spending plans continue to create more basis for expectations of a rate cut, helping silver maintain upward momentum.

"Industrial demand for silver remains a stable factor as prices adjust, especially thanks to demand in the solar and electronics sectors. At the same time, geopolitical developments, including trade optimism and political tensions, also contributed to supporting prices as investors seek safe assets to balance market risks" - James Hyerczyk commented.

See more news related to silver prices HERE...