Domestic silver price

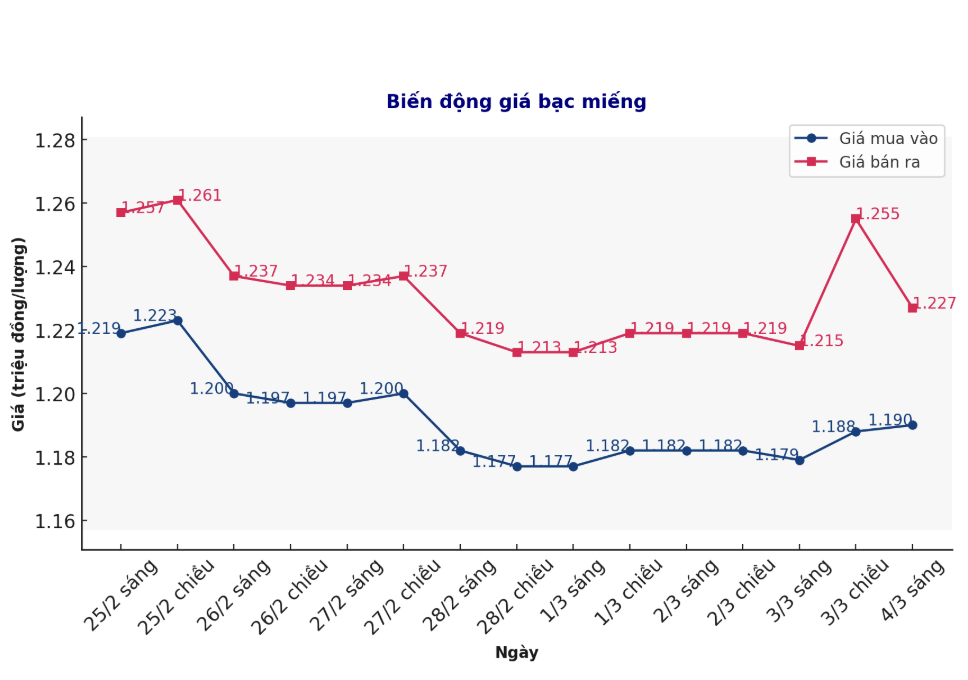

As of 9:15 a.m. on March 4, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.190 - 1.227 million/tael (buy - sell), down VND8,000/tael for both buying and selling compared to early this morning.

If buying silver bars at Phu Quy Jewelry Group in the session of February 25 and selling in today's session (March 4), silver buyers at Phu Quy Jewelry Group will lose up to 67,000 VND/tael.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1.190 - 1.227 million VND/tael (buy - sell), down 8,000 VND/tael for both buying and selling compared to early this morning.

World silver price

In the world market, as of 9:20 a.m. on April 4 (Vietnam time), the world silver price listed on Kitco was at 31.51 USD/ounce.

Causes and predictions

The decline in the precious metal group mainly comes from concerns that the US Federal Reserve (FED) will continue to keep interest rates high at the meeting in March.

Data from the Personal Consumption Expenditures Price Index (PCE) released on February 28 showed that US inflation increased by 0.3% in January compared to December 2024, in line with forecasts. This reinforces the view that the Fed may only start cutting interest rates in June rather than March as previously expected.

In addition, US President Donald Trump's tariff policies are expected to increase inflationary pressures, forcing the Fed to maintain high interest rates to control the economy. High interest rates cause capital flows into the bond market, while reducing the attractiveness of safe-haven assets such as precious metals.

According to Kitco senior analyst Jim Wyckoff, the May silver futures contract is in a state of near-term technical balance between buyers and sellers. However, the price trend on the daily chart is showing signs of decreasing.

The next price target for buyers is to close above a solid resistance level at $33/ounce. Meanwhile, the sellers aim to push prices below the strong support level at $30/ounce.

The first resistance level was at 32.61 USD/ounce, followed by 33 USD/ounce. The most recent support level was at 32 USD/ounce, followed by the lowest level in the overnight session at 31.635 USD/ounce.

In the long term, Ole Hansen - Head of Commodity Strategy at Saxo Bank, believes that silver could surpass gold in 2025.

This years silver price increase has not had a big difference in basic factors compared to previous increases. Silver still reflects gold's fluctuations, but with stronger intensity. Often likened to "upward" gold, silver tends to increase and decrease more strongly than its stable brother, Hansen said.

Hansen said silver will only reach a 12-year high in 2024, while gold has continuously set historical peaks.

With a dual role - both balancing investment demand and meeting industrial demand, silver could outperform gold next year. At Saxo, we predict that the gold- silwer price ratio, currently around 87, could fall to around 75, the level we saw in early 2024.

If this happens and gold reaches the forecast of $3,000/ounce (up 13%), silver prices could reach $40/ounce (up more than 25%) - Hansen concluded.