Domestic silver prices

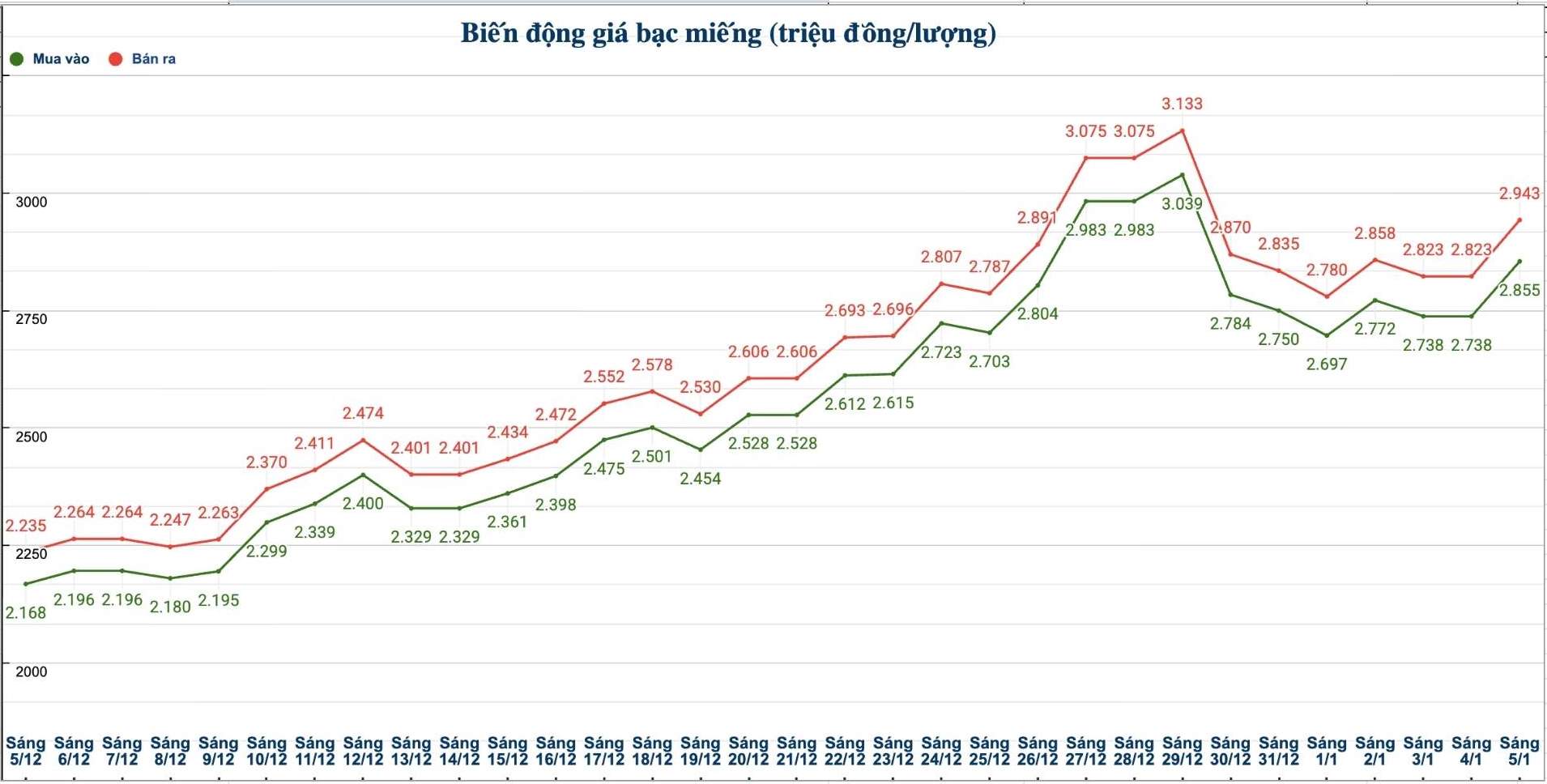

As of 10:30 am on January 5, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 2.854 - 2.924 million VND/tael (buying - selling); an increase of 114,000 VND/tael on the buying side and an increase of 117,000 VND/tael on the selling side compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 75.184 - 77.474 million VND/kg (buying - selling); an increase of 3.02 million VND/kg on the buying side and an increase of 3.12 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Gold, Silver and Gems One Member Limited Liability Company (Sacombank-SBJ) is listed at the threshold of 2.886 - 2.961 million VND/tael (buying - selling); an increase of 93,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.855 - 2.943 million VND/tael (buying - selling); an increase of 117,000 VND/tael on the buying side and an increase of 120,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 76.133 - 78.479 million VND/kg (buying - selling); an increase of 3.12 million VND/kg on the buying side and an increase of 3.2 million VND/kg on the selling side compared to yesterday morning.

World silver prices

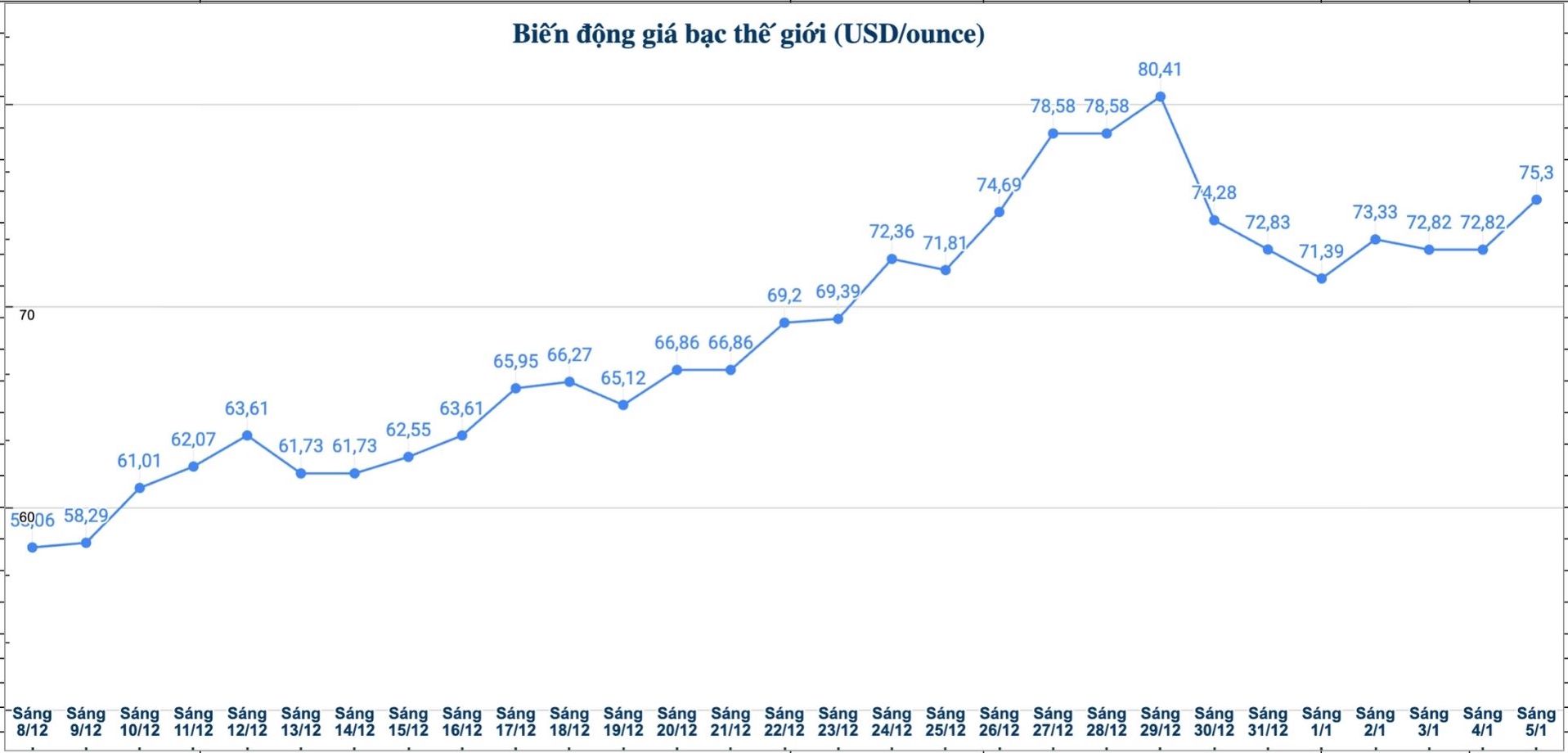

On the world market, as of 10:45 am on January 5 (Vietnam time), the world silver price was listed at 75.3 USD/ounce; up 2.48 USD compared to yesterday morning.

Causes and forecasts

Last week, silver prices experienced a strong reversal after jumping to a record high of $84.03/ounce. The upward momentum was blocked when the Chicago Mercantile Exchange (CME) unexpectedly increased margins twice in just one week, thereby ending the market's hot streak.

According to precious metal analyst James Hyerczyk at FX Empire, CME's decision to increase margin reflects the view that the silver market is trading too "hot". This move is aimed at cooling down the upward momentum, while significantly changing investors' strategies. Instead of chasing the upward trend and buying out of fear of missing opportunities (FOMO), trading now becomes more costly, forcing investors to be cautious and focus on real value.

However, James Hyerczyk believes that the underlying factors of the silver market are still assessed as positive. "Material silver demand continues to remain high, while supply is still in a state of shortage" - he said.

For the upward momentum of silver to return, James Hyerczyk said it is necessary to meet some conditions. First of all, the level of volatility must decrease, this only happens when investors stop chasing high prices with FOMO buying orders. At that time, the market is likely to adjust to a more attractive price range, around 64.79 - 60.25 USD/ounce.

In addition, basic factors need to continue to be maintained stably, including the shortage of supply and strong demand for physical silver.

In addition, US monetary policy also plays an important role. Expectations that the US Federal Reserve (Fed) will cut interest rates more than the current forecast - which has only considered one cut in 2026 - may become a supporting factor for the silver's upward trend in the medium and long term" - James Hyerczyk gave his opinion.

See more news related to silver prices HERE...