Domestic silver price

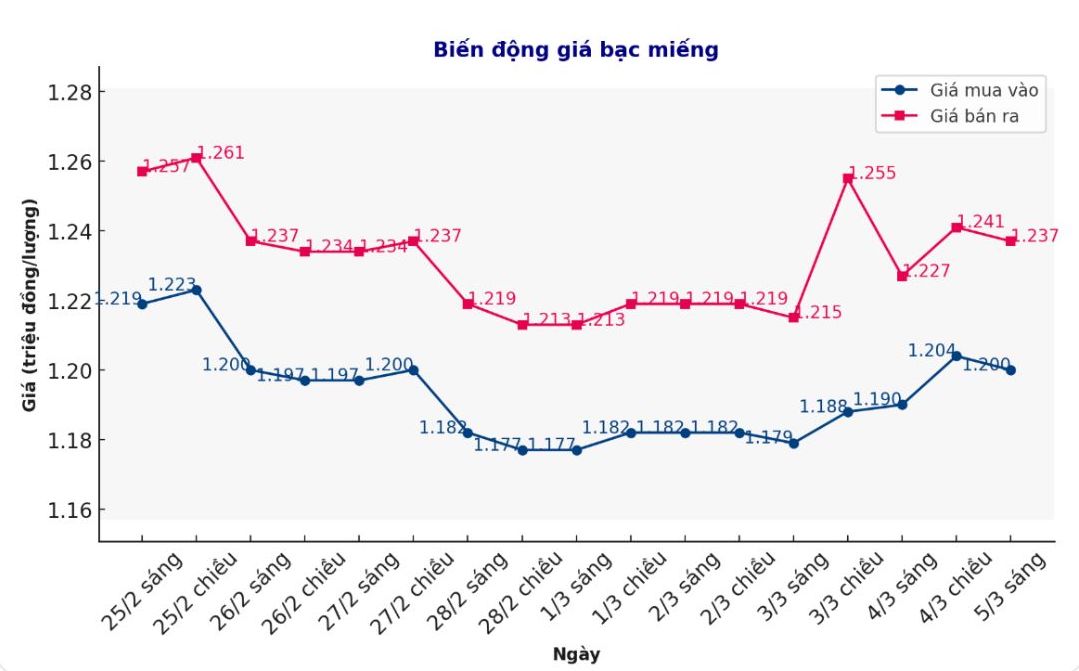

As of 9:20 a.m. on March 5, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.2 - 1.237 million VND/tael (buy - sell), an increase of 10,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1.190 - 1.227 million VND/tael (buy - sell), an increase of 10,000 VND/tael for both buying and selling compared to early this morning.

World silver price

On the world market, as of 9:23 a.m. on March 5 (Vietnam time), the world silver price listed on Goldprice.org was at 31.89 USD/ounce, up 0.72% compared to the previous trading session.

Causes and predictions

A weaker US dollar also supports silver, making it easier to buy for holders of other currencies.

In addition, the latest US personal consumption expenditure (PCE) inflation data has helped ease concerns about escalating inflation, while reinforcing expectations that the Federal Reserve (FED) will cut interest rates. This further increases the appeal of silver as a non-yielding asset.

January's PCE report was in line with market expectations, with monthly PCE stable at 0.3%. Core PCE rose slightly to 0.3% from December's 0.2%, while annual headline PCE stood at 2.6%, slightly above the forecast but unchanged from December. Core PCE fell to 2.6%, down from December's adjusted 2.9%.

UBS Bank forecasts silver prices to increase in 2025. This is driven by lower real US supply and stronger global industrial output, even as the metal struggles to keep up with gold's gains.

Despite these obstacles, UBS remains optimistic, maintaining its target of $36-38/ounce for silver prices by 2025. Increased supply is an obstacle, but a decline in mining could boost the appeal of silver.

According to Kitco, the May silver futures market is in a state of balance in the short term as buying and selling forces do not have a significant difference. However, on the daily chart, silver prices are still in a downtrend.

According to technical analysis, the next target for buyers is to bring closing prices above the important resistance level of 33.00 USD/ounce. On the contrary, the sellers are looking to push the price below the support level of 30.00 USD/ounce.

Currently, important thresholds to be monitored include:

Forward resistance: 32.61 USD/ounce (okening high), followed by 33 USD/ounce.

The most recent support level: $32/ounce, followed by a weekly low of $21.635/ounce.

See more news related to silver prices HERE...