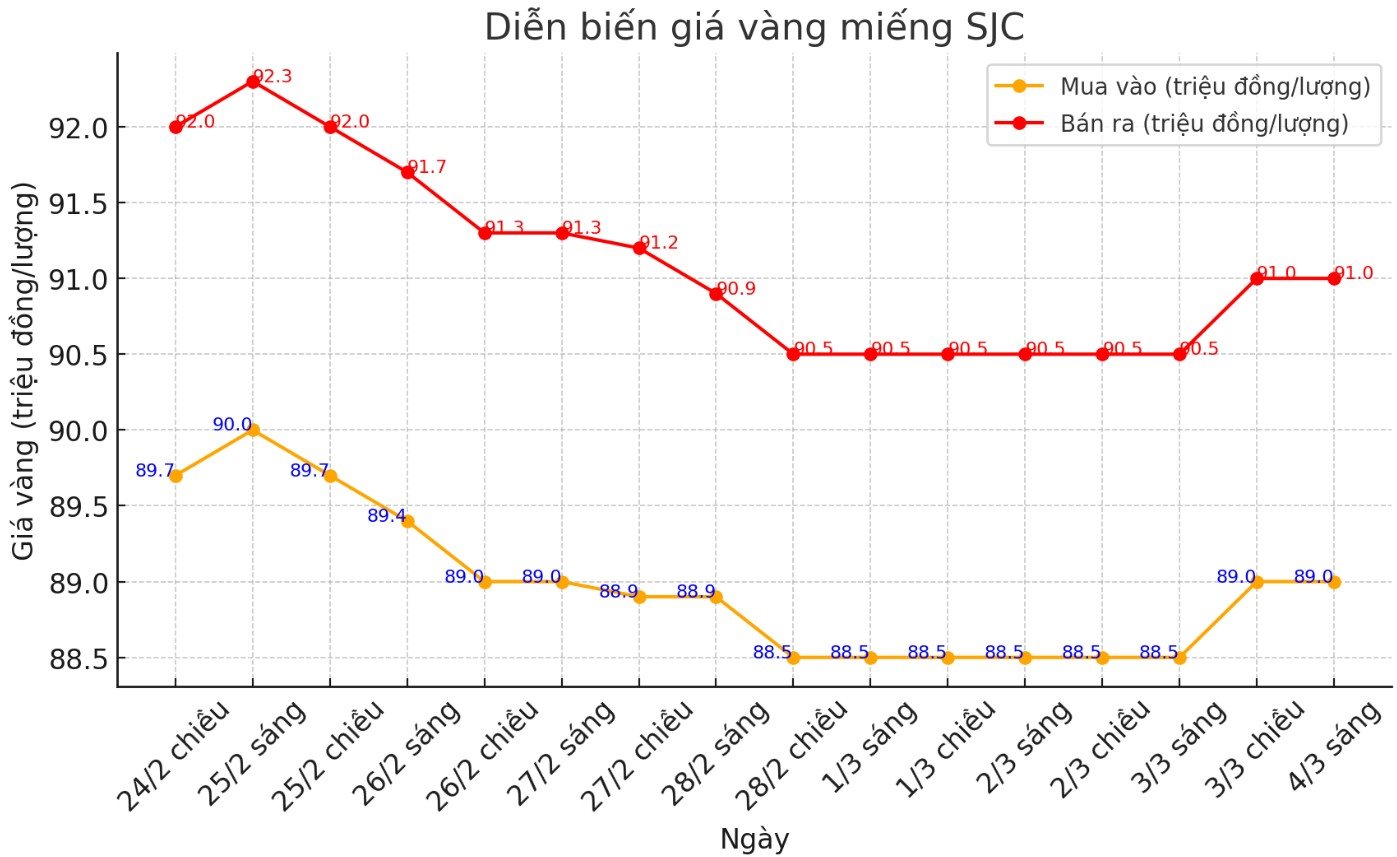

Updated SJC gold price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND89-91 million/tael (buy - sell), an increase of VND500,000/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company at VND89-91 million/tael (buy - sell), an increase of VND500,000/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 89.3-91 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 1.7 million VND/tael.

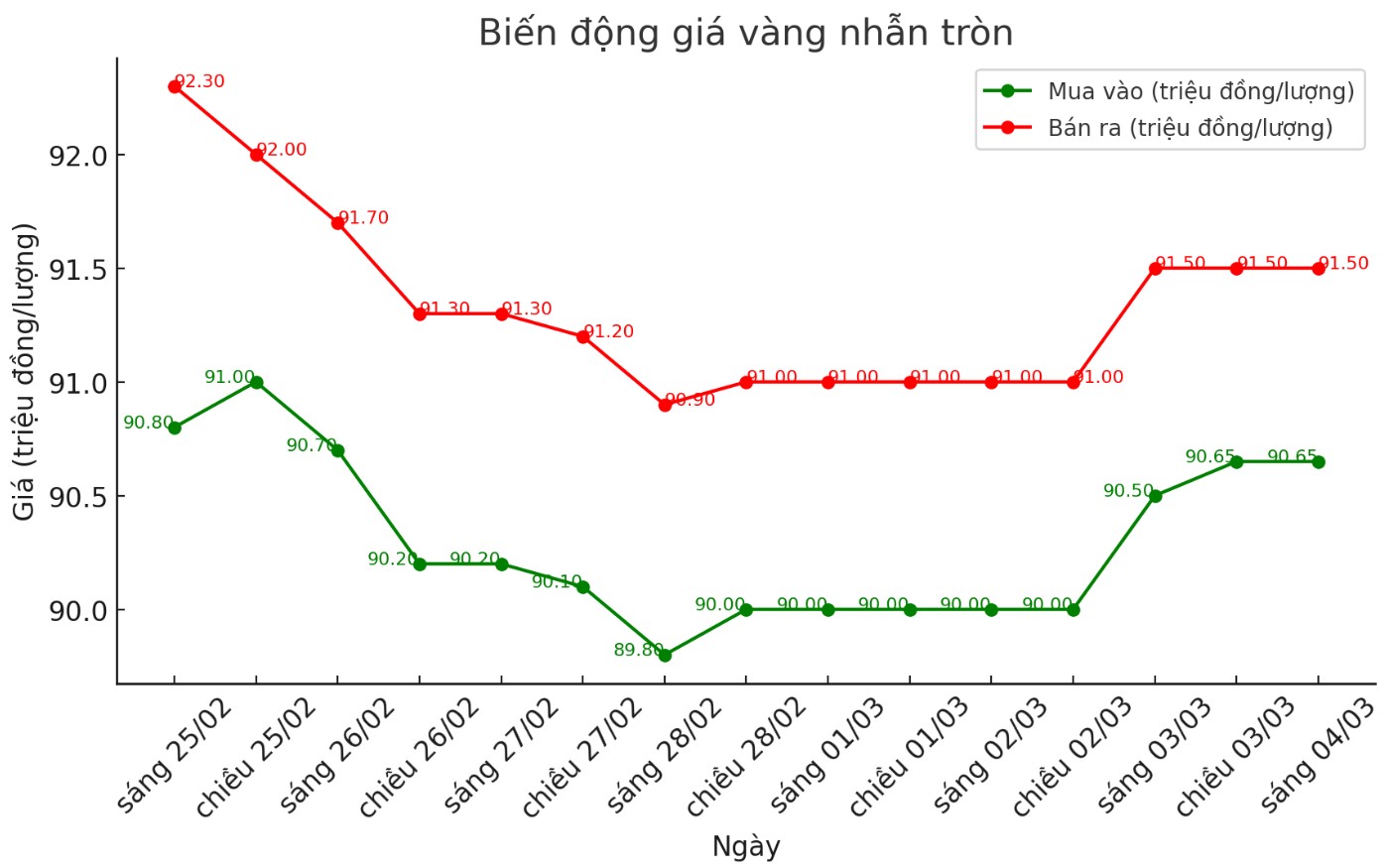

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 90.65-91.5 million VND/tael (buy - sell); increased by 650,000 VND/tael for buying and increased by 500,000 VND/tael for selling. The difference between buying and selling is listed at 850,000 VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.6-91.8 million VND/tael (buy - sell); increased by 500,000 VND/tael for both buying and selling. The difference between buying and selling is 1.2 million VND/tael.

Recent trading sessions of plain gold rings have often fluctuated in the same direction as the world. In the context of the world market recording a strong increase, the domestic gold ring price this morning may increase.

World gold price

As of 6:00 a.m. on March 4, the world gold price listed on Kitco was at 2,892.5 USD/ounce, up 34.4 USD/ounce.

Gold price forecast

World gold prices increased sharply in the context of the USD plummeting. Recorded at 6:30 a.m. on March 4, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.480 points (down 1%).

Gold and silver prices recorded a very strong increase thanks to increased safe-haven demand due to escalating geopolitical tensions, along with a sharp decline in the USD index when the trading week began.

Gold futures for April increased by 54.7 USD, to 2,902.7 USD/ounce. The price of silver futures for May increased by 0.929 USD, to 32.425 USD/ounce.

Market risks have increased since the beginning of the week, following a tense meeting on Friday between US President Donald Trump and Ukrainian President Volodymyr Zelensky, raising concerns about US-Ukraine relations as well as the prospect of a ceasefire between Ukraine and Russia.

Meanwhile, US trade tariffs on Mexico, Canada and China are expected to take effect on Tuesday. Gold prices started the new week with a strong increase after recording the worst trading week in the past three months.

For April gold futures, buyers will still dominate in the short term, but the uptrend on the daily chart has temporarily been disabled. The next target for buyers is to close above a solid resistance level at a contract high of $2,974/ounce.

Meanwhile, the target for the sellers is to push the price below the important support level at 2,800 USD/ounce. The first resistance was at 2,920 USD/ounce, followed by 2,942 USD/ounce. First support was at an overnight low of $2,866.30 an ounce, then $2,850 an ounce.

In key outside markets, Nymex crude oil futures fell slightly, trading around 69.5 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.199%.

Economic calendar affecting gold prices this week

This week, the market will focus on employment data, with the US February non-farm payroll report released on Friday morning. Other key economic events include the ADP jobs report and US ISM services PMI on Wednesday, along with weekly unemployment data on Thursday.

Another major event of the week is the European Central Bank's monetary policy decision (ECB) on Thursday, with many experts expecting the ECB to make a rate cut.

See more news related to gold prices HERE...