Domestic silver price

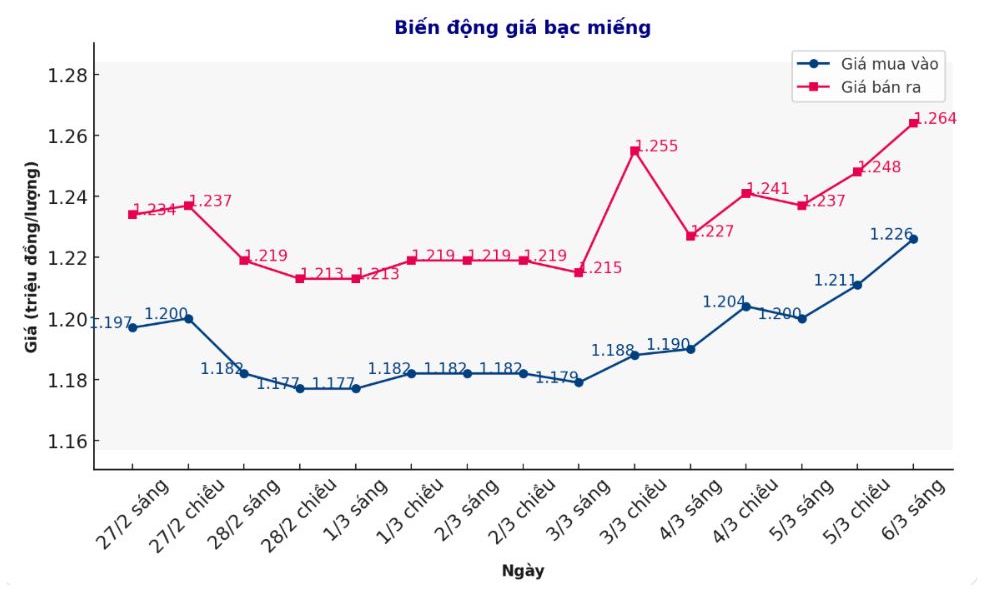

As of 9:20 a.m. on March 6, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.226 - 1.264 million VND/tael (buy - sell), an increase of 26,000 VND/tael for buying and an increase of 27,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1.226 - 1.264 million VND/tael (buy - sell), an increase of 26,000 VND/tael for buying and an increase of 27,000 VND/tael for selling compared to early this morning.

World silver price

On the world market, as of 9:40 a.m. on March 6 (Vietnam time), the world silver price listed on Goldprice.org was at 32.54 USD/ounce, up 2.39% compared to the previous trading session.

Causes and predictions

According to Fxstreet, rising geopolitical tensions have increased the appeal of precious metals such as silver as a safe haven.

Meanwhile, falling bond yields and the US dollar (USD) have also strengthened silver prices. The yield on the 10-year US Treasury note fell to nearly 4.14%. The US Dollar Index (DXY), which tracks the value of the greenback against six major currencies, fell to nearly 106.00.

US bond yields and the US Dollar have faced selling pressure as traders raised their bet in support of the Federal Reserve (FED) cutting interest rates at its policy meeting in June.

According to the CME FedWatch tool, the likelihood of a central bank cutting interest rates in June has increased to 87% compared to 71%, recorded a week ago.

According to UBS, silver prices are likely to continue to increase in 2025. One of the factors supporting this increase is the decline in actual supply in the US, along with the increasingly strong industrial demand for silver.

Although it cannot keep up with the strong increase of gold, silver is still predicted to have a positive outlook. UBS forecasts that silver prices will fluctuate between 36 - 38 USD/ounce by 2025, significantly higher than the current price of 31.88 USD/ounce.

However, the silver market could still face certain pressures if supply increases significantly. However, a decline in mining activities may help maintain the attractiveness of silver and continue to support the price of this metal in the coming time.

According to Kitco, May silver futures are having a slight technical advantage in the short term. The next upside price target for buyers is to close above solid technical resistance at the February peak of 34.56 USD/ounce. In contrast, the downside price target for the bears is to close below the strong support level at the bottom of February at 31.365 USD/ounce.

The first resistance level: 33.50 USD/ounce, followed by 34 USD/ounce.

The next support level: 32.395 USD/ounce (the lowest level in the session last night), followed by 32 USD/ounce.

See more news related to silver prices HERE...