Domestic silver prices

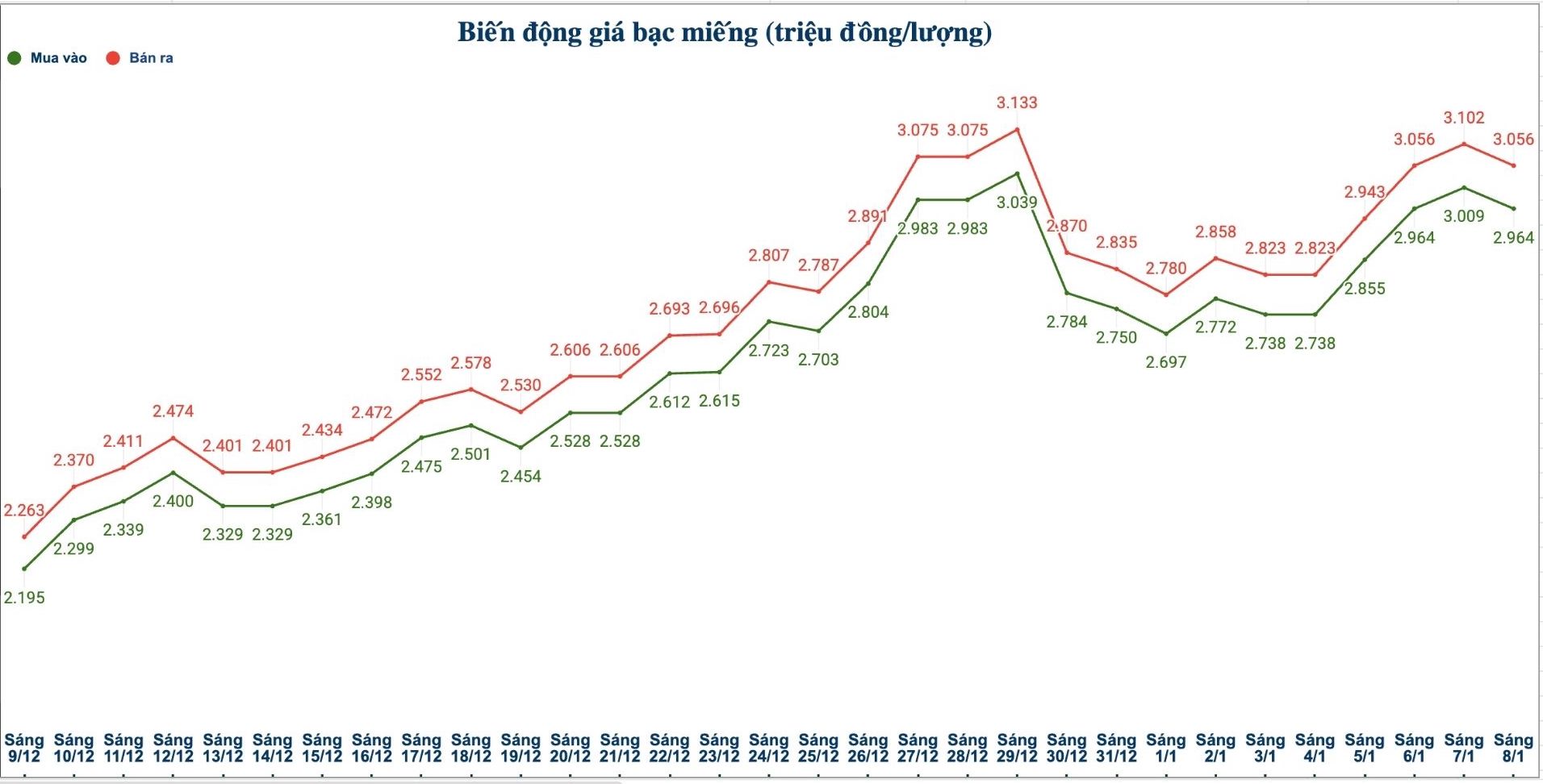

As of 9:20 am on January 8, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 2.957 - 3.030 million VND/tael (buying - selling); down 58,000 VND/tael on the buying side and down 59,000 VND/tael on the selling side compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 78.854 - 80.855 million VND/kg (buying - selling); down 600,000 VND/kg on the buying side and down 1.019 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) is listed at 3.066 - 3.144 million VND/tael (buying - selling); down 42,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at VND 2.964 - 3.056 million/tael (buying - selling); down VND 45,000/tael on the buying side and down VND 46,000/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 79.039 - 81.493 million VND/kg (buying - selling); down 1.2 million VND/kg on the buying side and down 1.226 million VND/kg on the selling side compared to yesterday morning.

World silver prices

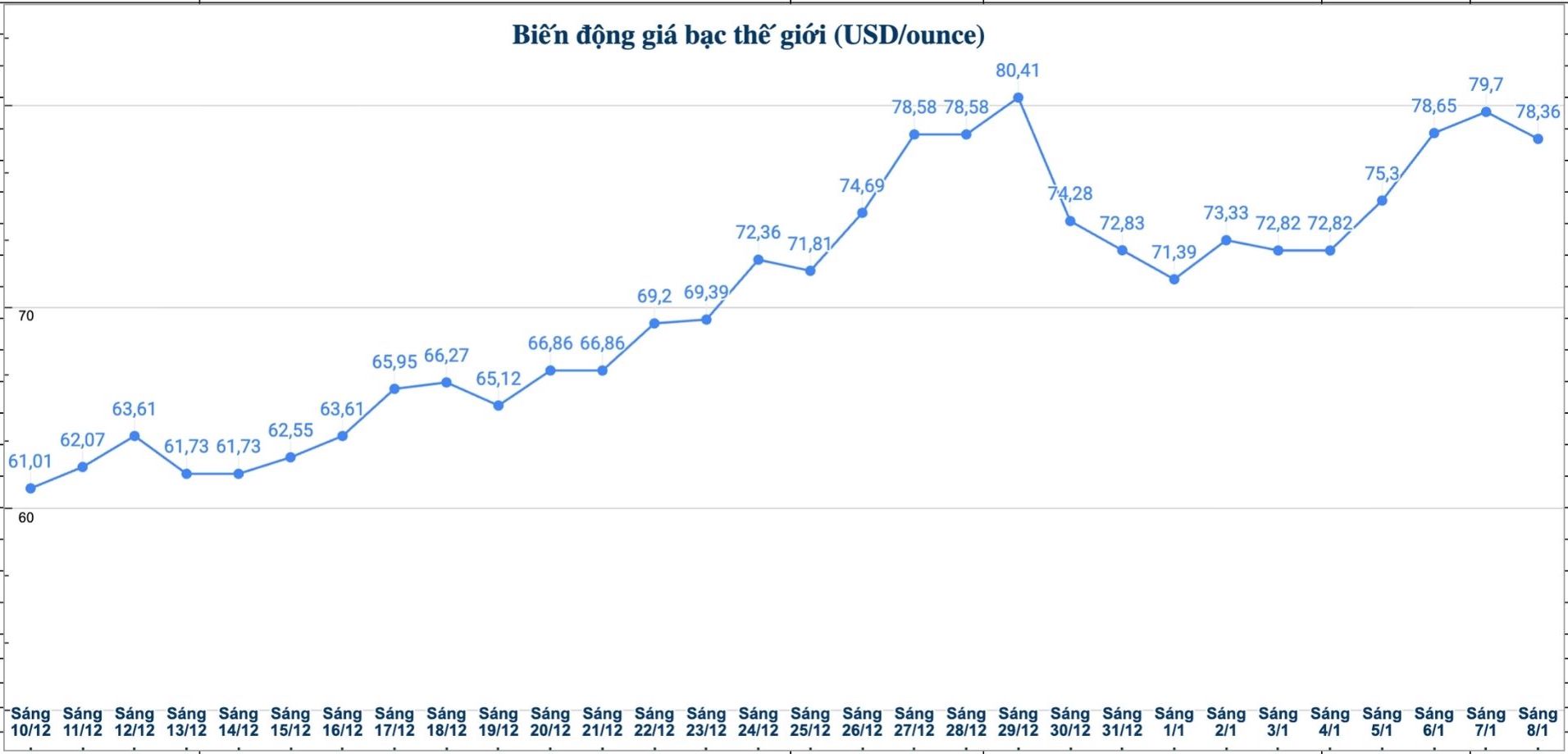

On the world market, as of 9:30 am on January 8 (Vietnam time), the world silver price was listed at 78.36 USD/ounce; down 1.34 USD compared to yesterday morning.

Causes and forecasts

According to precious metal analyst James Hyerczyk at FX Empire, silver prices fell sharply in the mid-week trading session due to selling pressure appearing.

Basically, James Hyerczyk believes that the current developments reflect the tug-of-war between short-term and long-term factors, in which short-term factors are temporarily dominant.

Adjustment pressure mainly comes from profit-taking before the US releases its non-farm payroll report on Friday - data expected to provide more signals about the next interest rate cut roadmap of the US Federal Reserve (Fed). This uncertainty makes a part of investors choose to narrow down their buying positions," he said.

In addition, the Chicago Commodity Exchange (CME) raising the margin level from two weeks ago continues to make speculators use high leverage more cautiously, thereby weakening short-term buying power.

In the short term, James Hyerczyk believes that the dien bien of silver prices will largely depend on the reaction of the market around two key milestones of 77.05 USD/ounce and 78.70 USD/ounce.

In the context that downward pressure still prevails, the possibility of silver prices falling below the 77.05 USD/ounce mark and returning to check the support zone around 73.24 USD/ounce is being closely monitored by investors in the upcoming sessions" - James Hyerczyk gave his opinion.

See more news related to silver prices HERE...