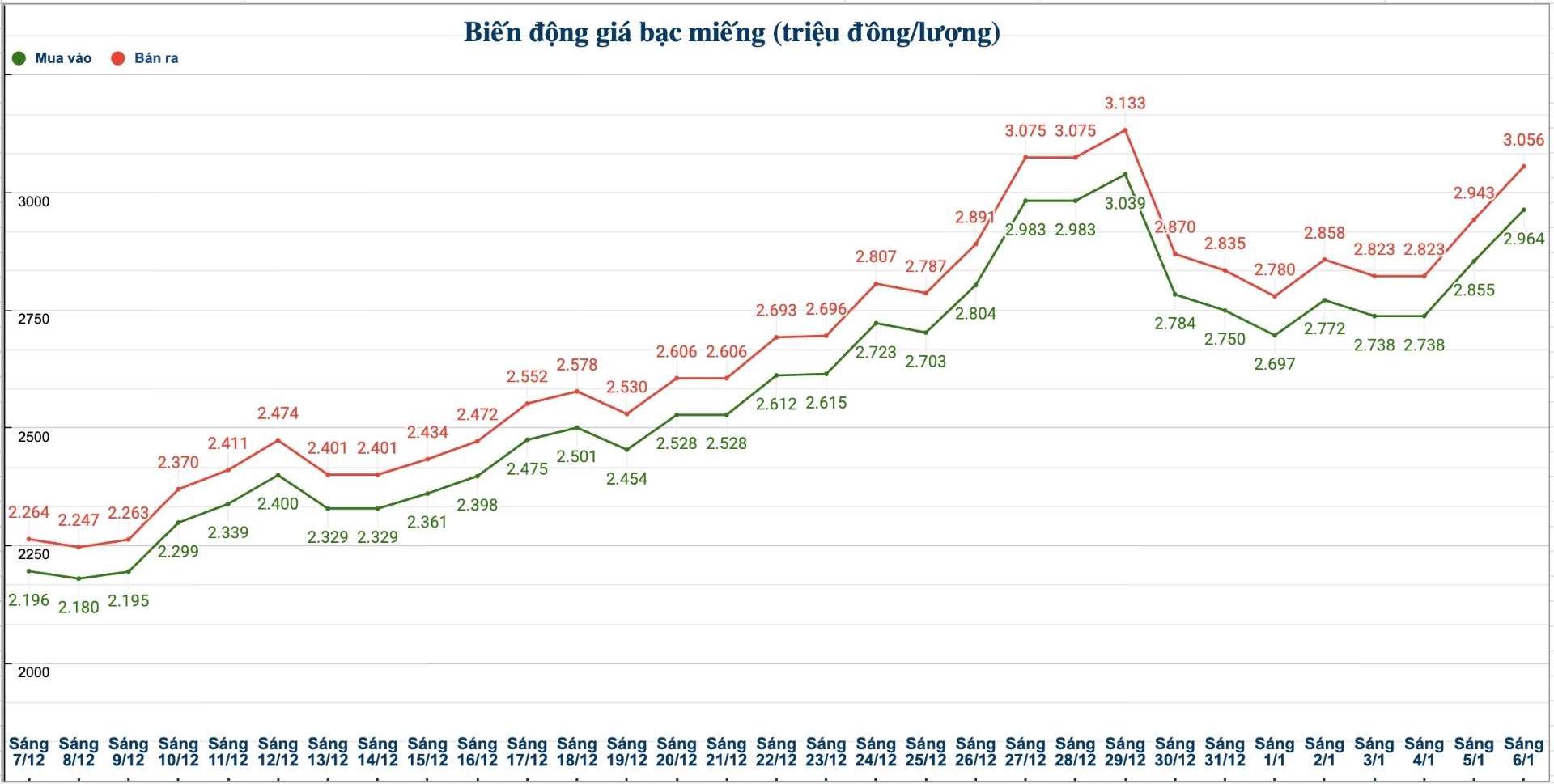

Domestic silver prices

As of 10:30 am on January 6, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Gold, Silver and Gems One Member Limited Liability Company (Sacombank-SBJ) was listed at 2.973 - 3.048 million VND/tael (buying - selling); an increase of 87,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.964 - 3.056 million VND/tael (buying - selling); an increase of 109,000 VND/tael on the buying side and an increase of 113,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 79.039 - 81.493 million VND/kg (buying - selling); an increase of 2.906 million VND/kg on the buying side and an increase of 3.014 million VND/kg on the selling side compared to yesterday morning.

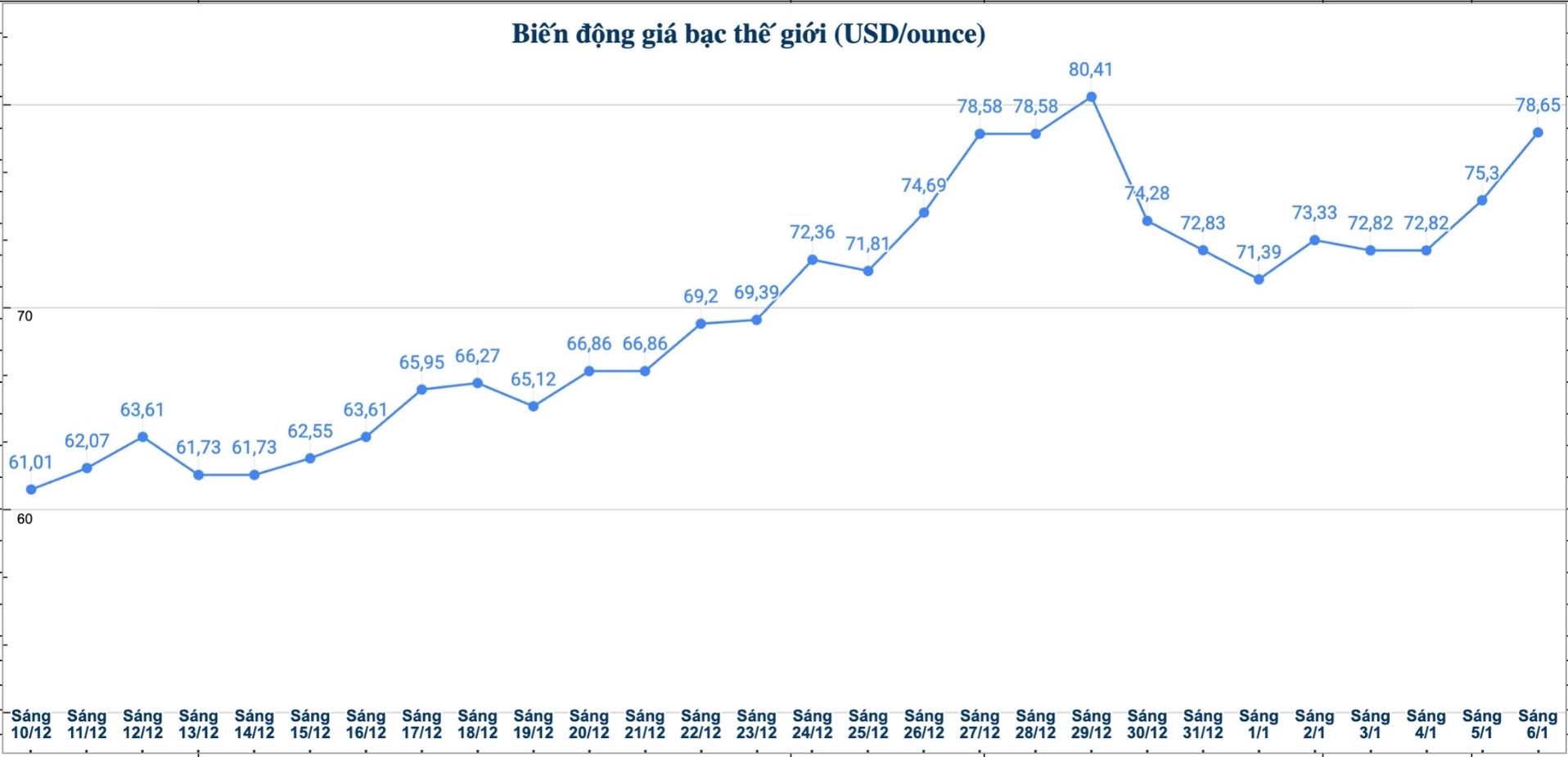

World silver prices

On the world market, as of 10:45 am on January 6 (Vietnam time), the world silver price was listed at 78.65 USD/ounce; up 3.35 USD compared to yesterday morning.

Causes and forecasts

The silver market continues to record optimistic sentiment as prices rebound. According to precious metals analyst Christopher Lewis at FX Empire, this shows that buying power still appears strongly every time the market adjusts down. "This development reflects investors' belief that price declines are only short-term" - he said.

However, he said that if a negative scenario occurs and silver prices lose the 70 USD/ounce mark, the market may witness a rapid decline to the 60 USD/ounce zone.

However, Christopher Lewis said that this risk is not yet the main scenario, in the context that the market is still facing a shortage of silver supply - a factor that many traders consider a potential risk but also a driving force to support prices in the long term.

The silver market is likely to continue to fluctuate strongly and unpredictably. However, the overall trend is still leaning towards increasing prices. In that context, short-term corrections are seen as buying opportunities, but also come with great risks due to the high volatility of the market" - Christopher Lewis said.

From a more cautious perspective, Mr. Lewis believes that the most positive scenario at the present time is not necessarily a sharp sharp increase in silver prices immediately, but a period of correction or sideways movement. "This process will help the market gradually adapt and accept a price level around 70 USD/ounce, thereby creating a more solid foundation for the next steps" - Christopher Lewis said.

See more news related to silver prices HERE...