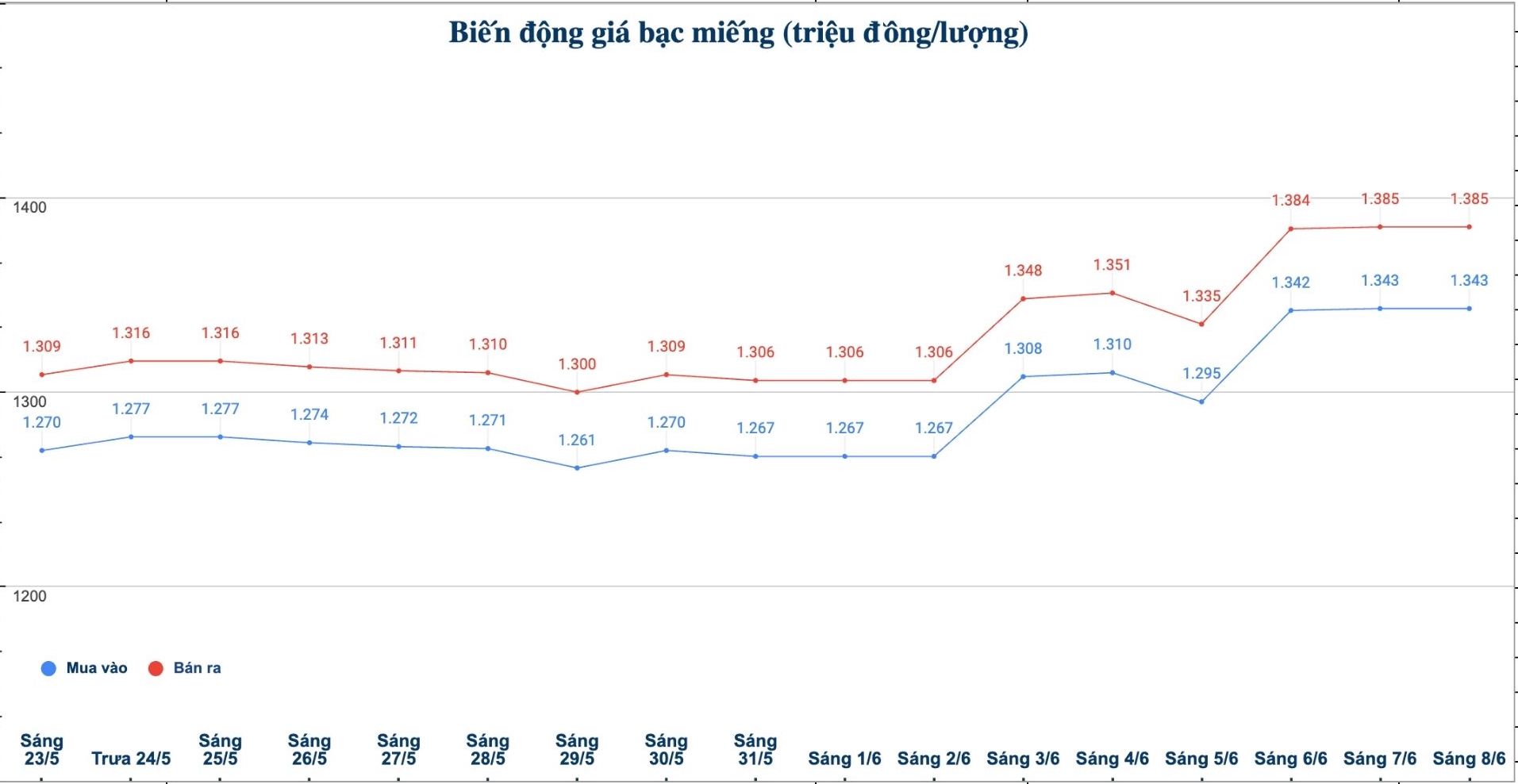

Domestic silver price

As of 10:55 on June 8, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.343 - 1.385 million/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.343 - 1.385 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 35.813 - 36.933 million VND/kg (buy - sell); unchanged in both buying and selling directions compared to early this morning.

In the trading session of 2 months ago (morning of April 8, 2025), the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 31,439 - 32,399 million VND/kg (buy - sell).

Thus, if buying 999 (1kg) of gold bars at Phu Quy Jewelry Group on April 8 and selling it this morning (6.), buyers will make a profit of VND 3.414 million/kg.

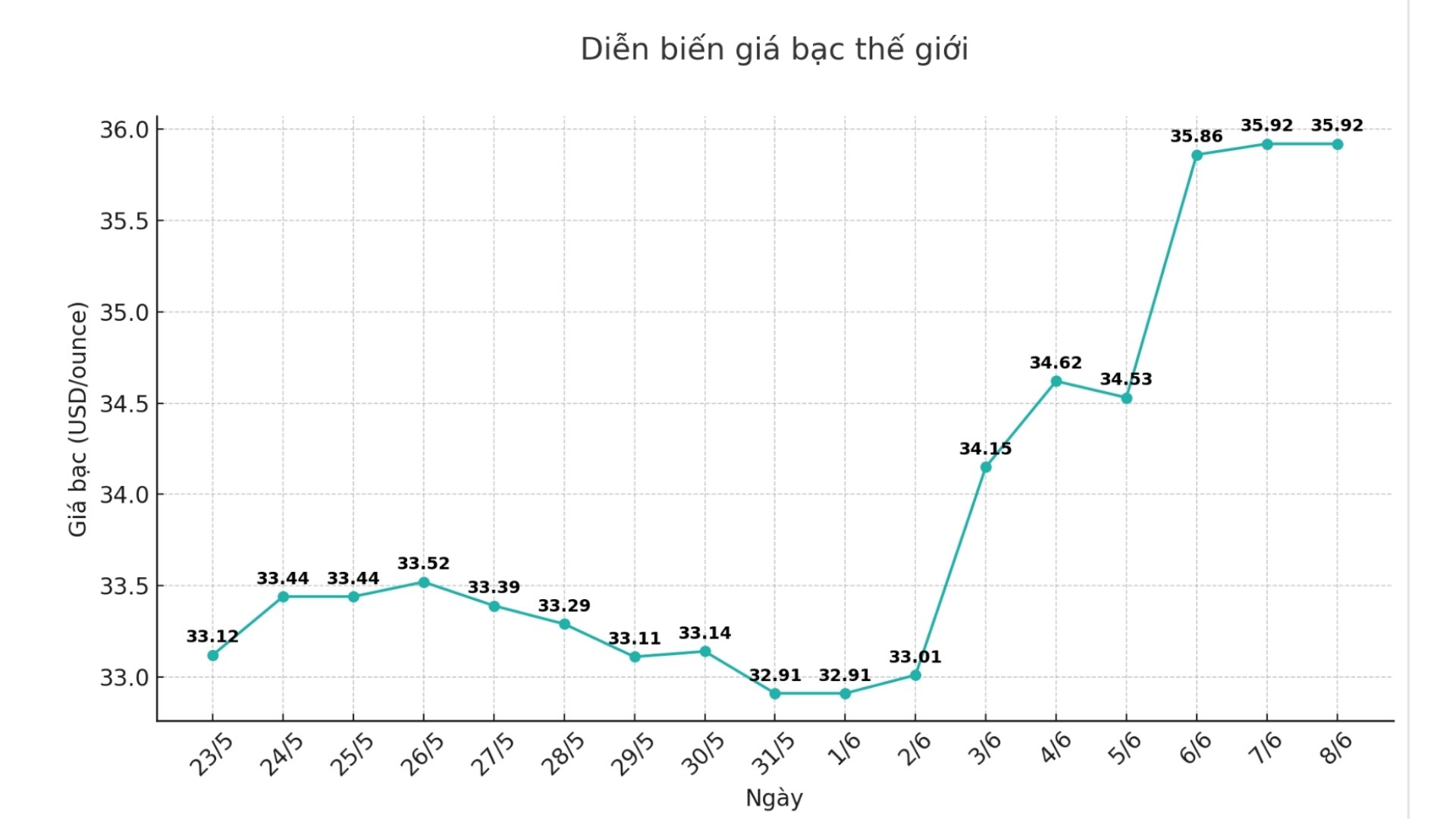

World silver price

On the world market, as of 10:56 on June 8 (Vietnam time), the world silver price was listed at 35.92 USD/ounce; unchanged from early this morning.

Causes and predictions

Although silver prices failed to hold above $36 an ounce, they still maintained a strong uptrend with a 9% increase at the end of the week.

Silver is currently trading at its highest level in the past 13 years. Despite some volatility, breaking above $35 an ounce is a major milestone. This is the third time in history that silver has reached this price.

According to experts at TD Securities, a multinational investment bank, a financial services provider, the last time silver reached this level was in 2010, after only 6 weeks, silver prices have peaked at $50/ounce.

Interest in silver has been rising over the past month, since gold prices set a record above $3,500 an ounce, pushing the gold-esilient ratio to an all-time high in 11 years, surpassing 100. However, analysts at TD Securities pointed out that silver has been priced lower than gold for many years.

Looking back, gold has outperformed silver in times of economic uncertainty and geopolitical tensions, as demand for safe-haven assets increased.

"record demand from central banks over the past three years has helped gold maintain its position as a currency. Meanwhile, silver is not bought by central banks" - Neils Christensen - a financial expert - commented.

However, Neils Christensen also said that investors are gradually realizing the value of silver, as industrial demand continues to create a significant shortage of supply.

"With increased industrial demand, silver has become a more effective anti-inflation counter than gold. The solar industry is currently the biggest factor driving silver demand," said Neils Christensen.

See more news related to silver prices HERE...