Legal risks if the origin cannot be proven

From July 1, 2025, according to Decree 70/2025/ND-CP and Circular 32/2025/TT-BTC, households and individuals doing business in a number of fields such as retail sales of goods, food and beverage services... with a revenue of VND1 billion/year or more will have to use electronic invoices with the code of the Tax authority, starting from cash registers. The transition from contract tax to invoice tax management is an irreversible trend.

However, many business households still have a large amount of goods with no input invoices, due to being purchased from households that previously paid contract tax - subjects not obliged to issue invoices according to the old regulations. When switching to electronic invoice mode, this inventory can become a significant tax risk if not handled properly.

According to the Law on Tax Administration 2019 (Article 16, Article 17) and Circular 80/2021/TT-BTC, if the legality of input goods cannot be proven, business households can:

Being taxed at reasonable costs, leading to increased taxable income;

Tax collection, fines and late payment;

Being administratively sanctioned for violations of invoices and documents;

In some cases, the tax inspection and examination records were transferred.

This is the reason why un documented inventories can become a tax burden if not proactively handled.

Explaining and making statements to protect rights

To limit tax risks when selling inventory without input invoices, business households can proactively apply a number of following measures, based on current regulations on tax management and use of electronic invoices:

1. Developing documents explaining the origin of inventories

Business households should clearly state the type, time of import, quantity, estimated value and purchase source (from contracted households without invoices). The document must state the reason for not having invoices and a commitment to the legality of the goods.

2. Establishment of statement 01/TNDN according to Circular 78/2021/TT-BTC

This list allows the recording of purchase costs without invoices (purchased from individuals, contracted households), which is the basis for calculating capital prices when selling goods during the period of using electronic invoices.

3. Declare and pay taxes in full when selling inventories

Even if there is no input invoice, business households must still issue an output electronic invoice, declare VAT and personal income tax in accordance with regulations. If there is a valid explanation and table, the tax authority can accept the corresponding cost.

Proactively connect tax authorities for guidance

The tax authority encourages business households to proactively contact local tax officials for advice on procedures and forms. At the same time, you can use the eTax Mobile application or the switchboard for online support.

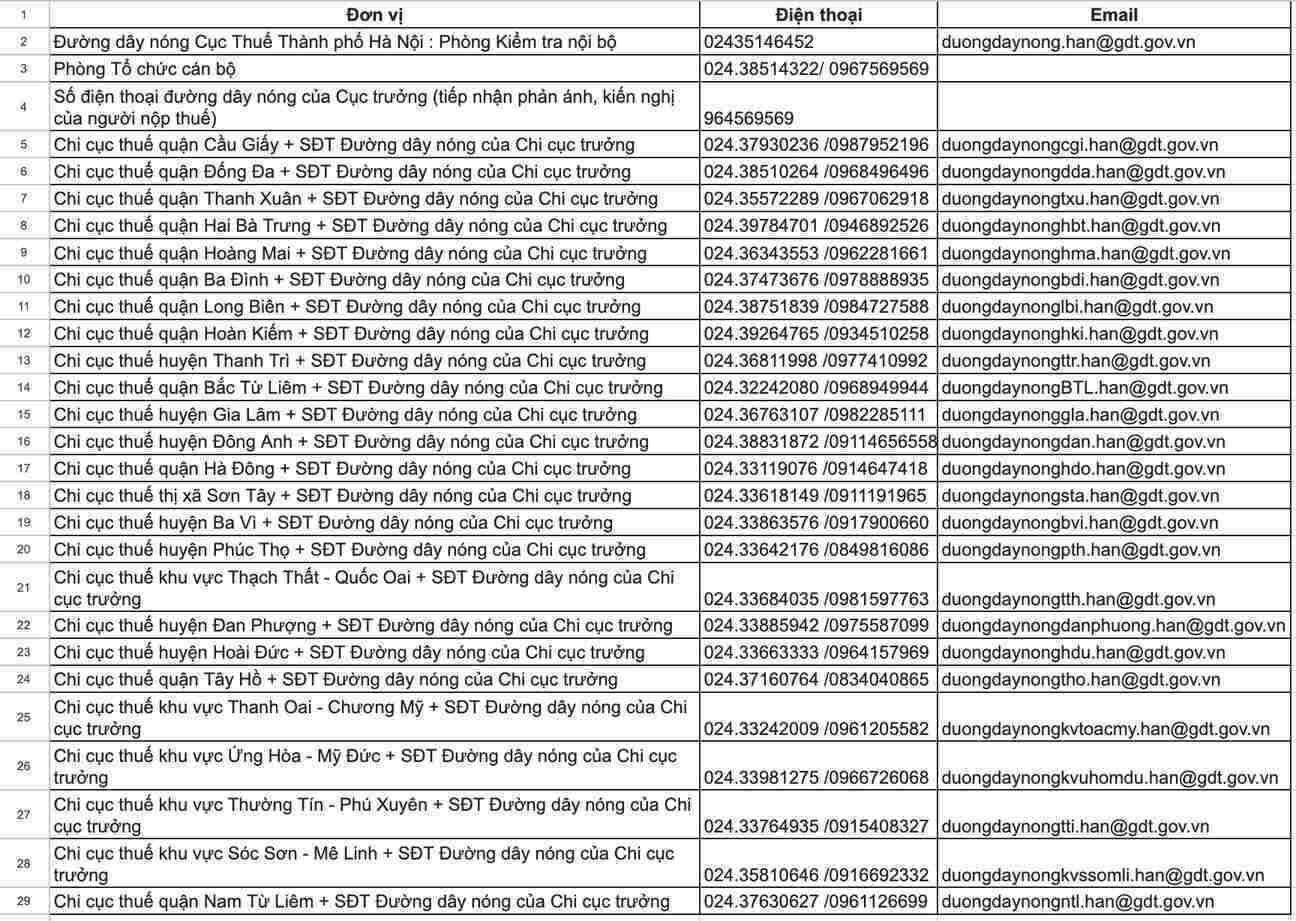

Summary of the latest phone numbers of the Hanoi Tax Department and Tax Branch?

See more articles about business households HERE.