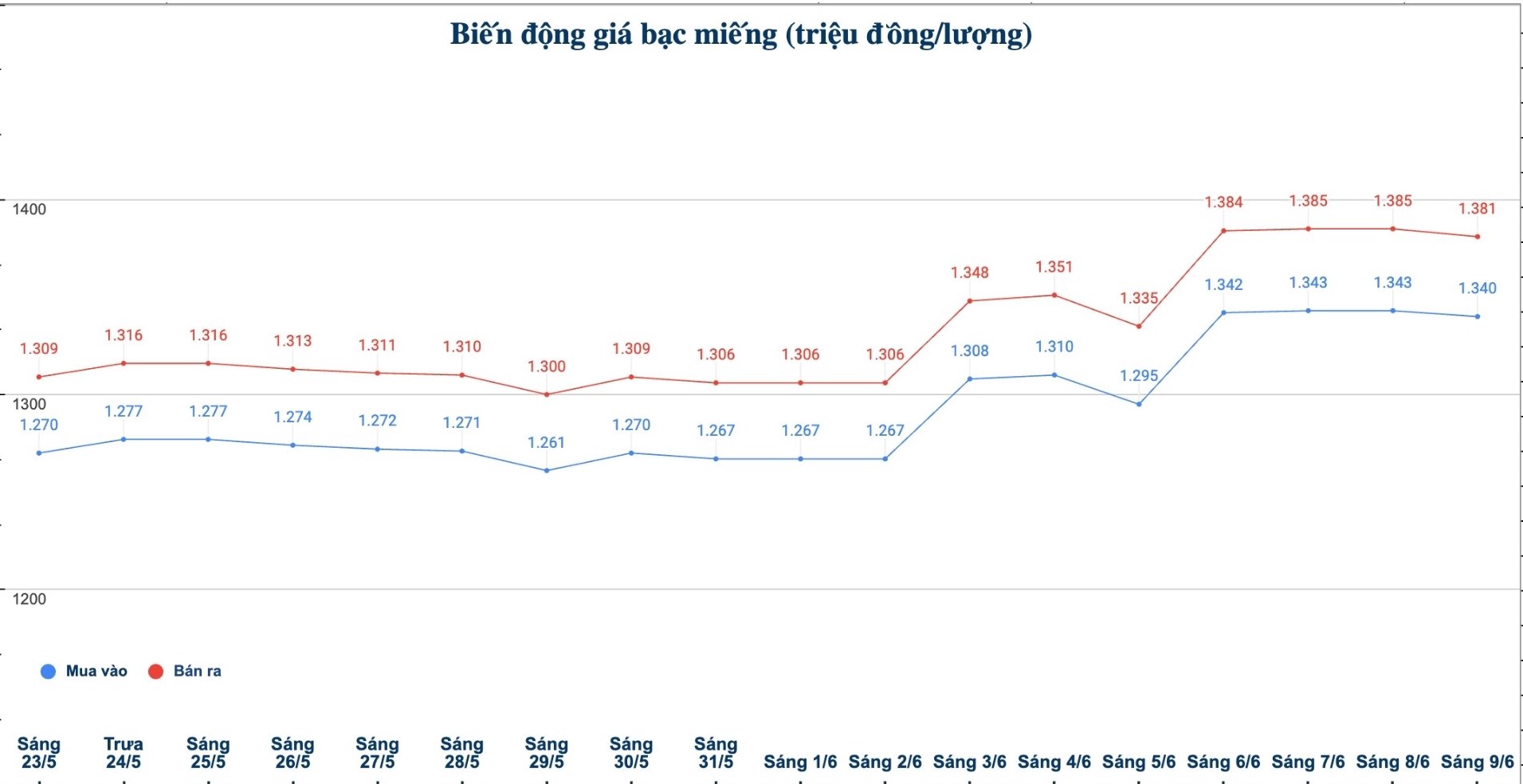

Domestic silver price

As of 9:05 a.m. on June 9, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.340 - VND1.381 million/tael (buy - sell); down VND3,000/tael for buying and down VND4,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1,340 - 1.381 million VND/tael (buy - sell); down 3,000 VND/tael for buying and down 4,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 35.733 - 36.826 million VND/kg (buy - sell); down 80,000 VND/kg for buying and down 107,000 VND/kg for selling compared to early this morning.

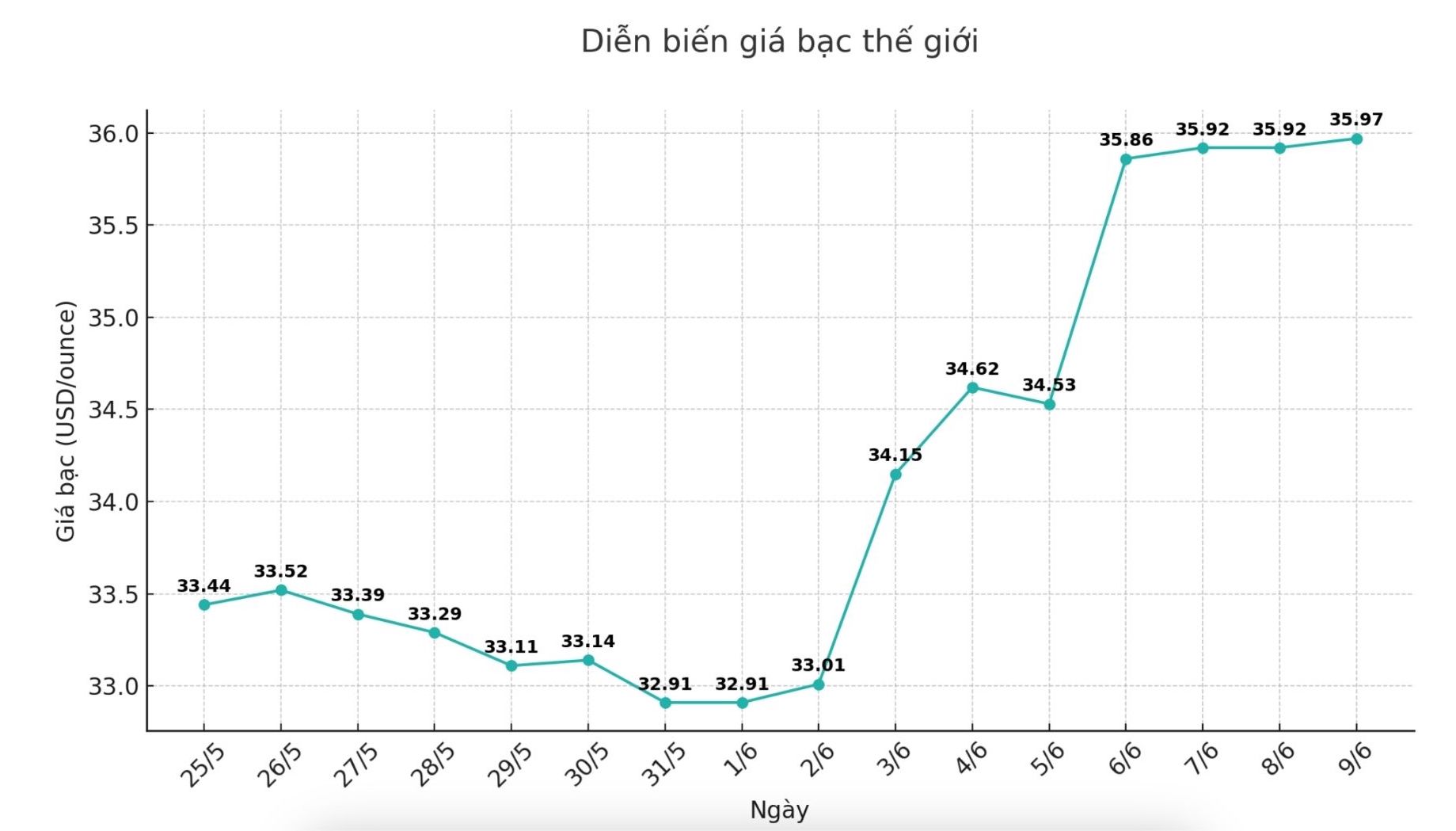

World silver price

On the world market, as of 9:03 a.m. on June 9 (Vietnam time), the world silver price was listed at 35.97 USD/ounce; up 0.05 USD compared to early this morning.

Causes and predictions

Silver prices continue to attract attention when they surpass the threshold of 35 USD/ounce. This shows that investment demand for silver is increasing strongly, especially in the context of the market recording the 5th consecutive year of lower mining output than consumption.

According to the traditional trend, silver often follows gold in price increases, but then accelerates more strongly and outperforms when speculative flows begin to pour into the precious metal, said David Erfle, an analyst at the precious metals and mining stocks market.

He added that it is noteworthy that silver prices are still priced much lower than the historical peak of $50/ounce, which was set in 1980 and repeated in 2011.

"However, the metal is gradually narrowing the gap and shows signs of catching up with gold's rally," David Erfle emphasized.

Neils Christensen - a financial expert - commented that record demand from central banks over the past three years has helped gold maintain its position as a currency.

Meanwhile, silver has not received similar support from central banks. However, investors are gradually realizing the value of silver, especially as increasing industrial demand is causing a serious tightening of supply.

"With increased industrial demand, silver has become a more effective anti-inflation counter than gold. The solar industry is currently the biggest factor driving silver demand," said Neils Christensen.

Economic data to watch this week

Wednesday: US Consumer Price Index (CPI)

Thursday: US Producer Price Index (PPI), weekly jobless claims

Friday: University of Michigan Consumer Psychology Index

See more news related to silver prices HERE...