Market sentiment is a factor driving silver prices

After many failed expectations - even when gold hit a record high - silver finally started to grow as expected. On Thursday, silver prices surged above $36 an ounce - for the first time since 2011 - with a positive momentum signaling the start of a "super cycle".

With the recent strong increase in silver prices, Peter Krauth - author of The Great Silver Bull and founder of SilverStockInvestor - believes that the change in broader market sentiment is a factor that drives silver prices higher.

This is closely related to the macroeconomic picture. The concept of inflation is eating into the minds of consumers. The core PCE index, an inflation measure favored by the US Federal Reserve (FED), is at 3.5%, while their target is 2%.

This rate has increased from 2.75% to 3.5% in just a few months. This is a real inflation rate for consumer goods. And we know that, although it may be an exception, GDP growth in the first quarter in the US has decreased," he said.

Krauth also pointed out concerns about inflation through the University of Michigan consumer psychology survey, which showed that the forecast annual inflation index increased sharply from 2.75% to 6.5%, an unprecedented level since 2021.

He said this shows that consumers are accepting that inflation may not only not disappear but may also increase sharply next year or many more years.

Regarding why silver is attracting attention in the context of inflation, Krauth said that gold has largely reflected inflationary risks, while silver has not yet been highly valued.

He also pointed out other factors such as the disagreement between President Donald Trump and billionaire Elon Musk, especially details in Trump's budget bill, which have drawn attention to inflation.

"Elon Musk came to cut spending, but President Donald Trump pushed for a major spending bill that could lead to inflation," said Peter Krauth.

Silver could hit $40/ounce this year

Peter Krauth said that the recent momentum driving silver prices could be a factor that creates a breakthrough for this precious metal in the coming time.

In the future, according to Peter Krauth, there will be a number of factors affecting the gold- silvery ratio. Gold may be overbought as trade deals are signed, while silver - which is still priced relatively low - will continue to increase.

"I think silver could hit $40 an ounce in the second half of this year and could hit $50 an ounce next year. Not only is $50/ounce a reality, but it could increase by another $10,000 to $15. If silver breaks above $50 an ounce, we will enter a completely new, unprecedented price zone," Peter Krauth said.

He stressed that silver prices have never exceeded $50 an ounce, so prices could rise at any time.

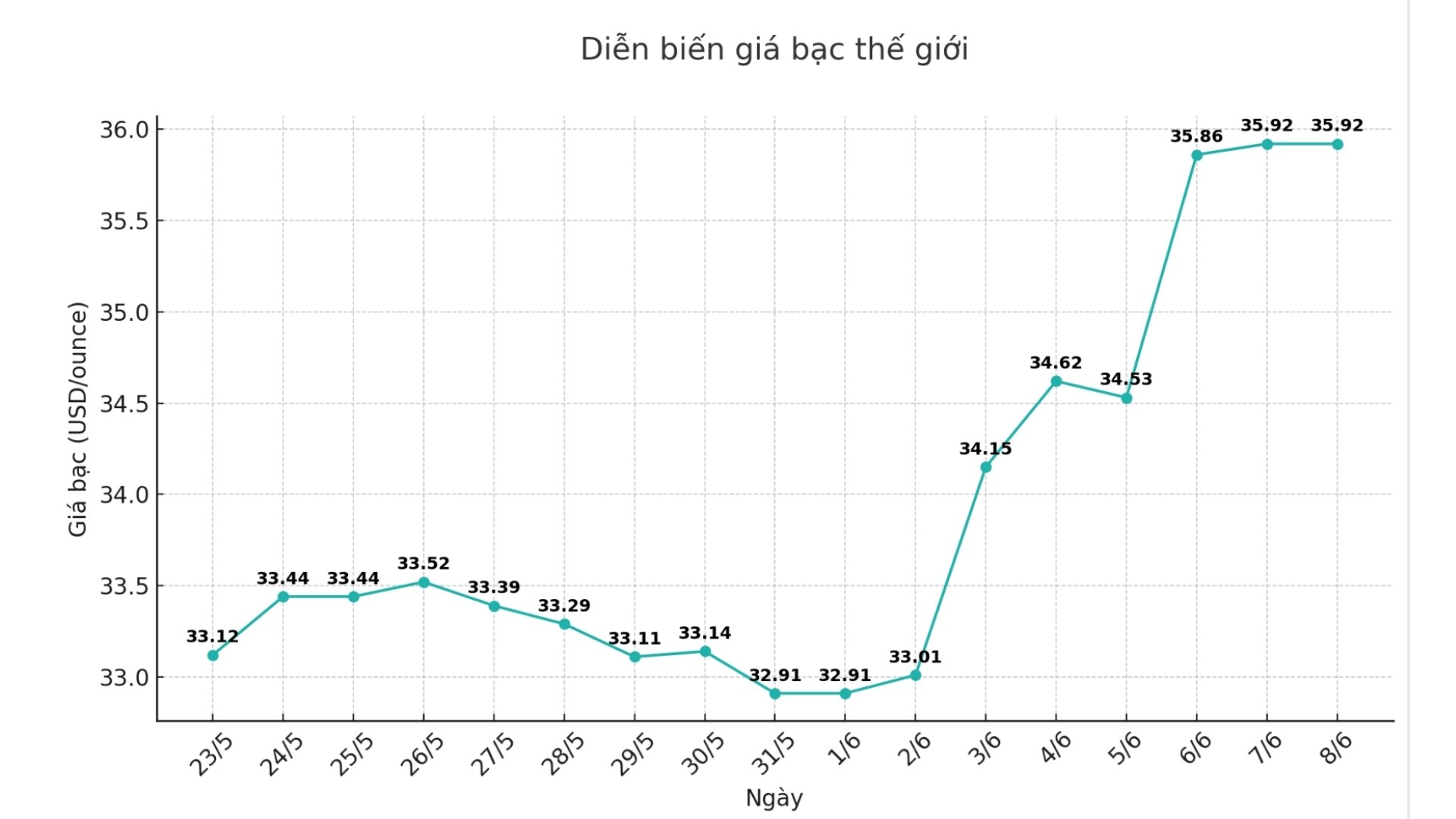

As of 9:56 a.m. on June 8 (Vietnam time), the world silver price was listed at 35.92 USD/ounce.

See more news related to silver prices HERE...