Gold prices fluctuate, buyers lose up to more than 3 million VND/tael

At the end of the trading session of the week on December 21, Saigon Jewelry Company (SJC) listed the price of SJC gold bars at 154.6 - 156.6 million VND/tael (buy - sell). The difference between buying and selling remains around 2 million VND/tael.

Compared to the closing session of the previous week (on December 14), the price of SJC gold bars increased by about 300,000 VND/tael in both directions. However, due to the large difference in the range, if buying gold bars on December 14 and selling in the session of December 21, buyers will still suffer a loss of about 1.7 million VND/tael.

At Bao Tin Minh Chau, the price of SJC gold bars was also listed at 154.6 - 156.6 million VND/tael, an increase of 300,000 VND/tael compared to a week ago. However, short-term investors still cannot avoid losses when settling.

More unfavorable developments were recorded in the gold ring market. Bao Tin Minh Chau currently listed the price of 9999 gold rings at 152.2 - 155.2 million VND/tael, down 100,000 VND/tael compared to before. The difference between buying and selling is up to 3 million VND/tael.

Meanwhile, Phu Quy Jewelry Group listed the price of gold rings at 151.6 - 154.6 million VND/tael, an increase of 1.5 million VND/tael compared to a week ago, but the difference remained around 3 million VND/tael.

Calculations show that if buying gold rings at Bao Tin Minh Chau on December 14 and selling on December 21, buyers will lose up to 3.1 million VND/tael. For Phu Quy gold rings, the loss is also up to about 2.9 million VND/tael.

World gold prices increase but have not yet "absorbed" the domestic market

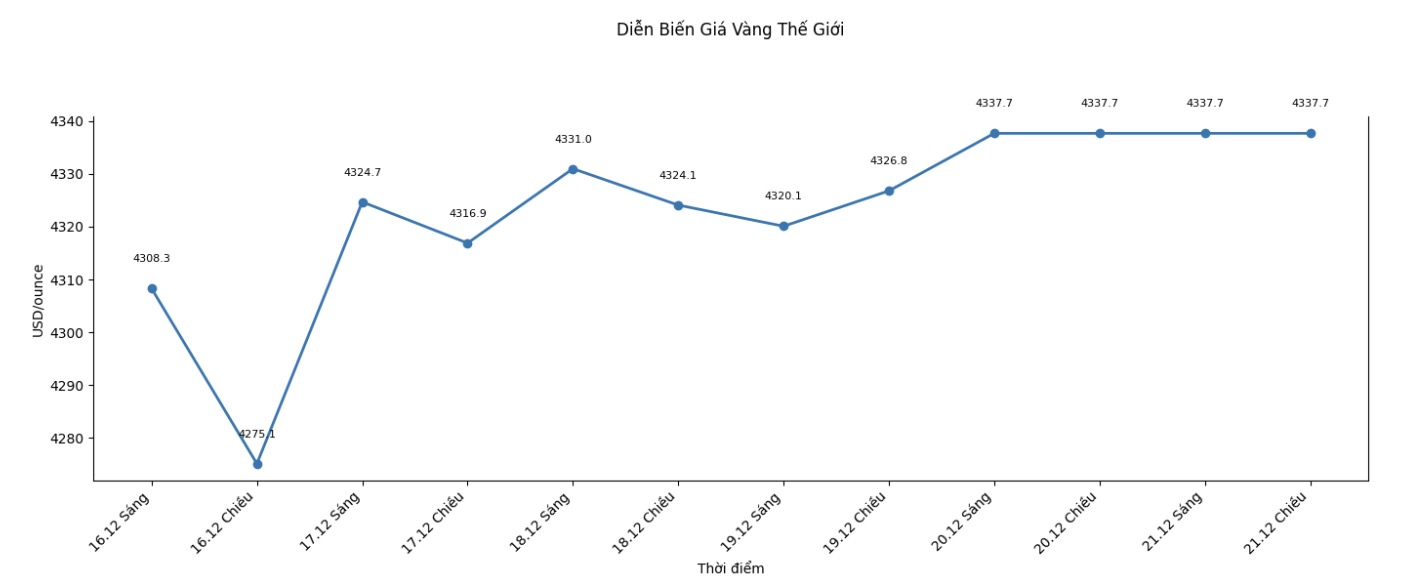

From December 14-21, the world gold price increased by about 39 USD/ounce, to 4,337 USD/ounce when closing the weekend session. The rally is supported by US economic data showing a weakening labor market, raising expectations that the US Federal Reserve (Fed) will soon loosen monetary policy.

However, the increase in world gold prices has not been reflected commensurate with the domestic market. In the context of fluctuating domestic gold prices, the difference between buying and selling at too high a level (2 - 3 million VND/tael) is posing great potential risks to individual investors, especially those who buy gold with the goal of short-term surfing.

As long as the gold price remains stable or is slightly adjusted, buyers can suffer a significant loss when selling. In addition, the FOMO (fear of missing out) mentality when gold prices are constantly mentioned in the highlands can also cause investors to make hasty decisions, buying at unfavorable times.

Silver price skyrockets, buyers earn more than 3 million VND/kg

In contrast to gold, the domestic silver market recorded a strong increase last week.

At the end of the trading session on December 21, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 2.524 - 2.586 million VND/tael. The price of 999 carats (1kg) in 2025 is at 66.440 - 68.460 million VND/kg.

Meanwhile, in the trading session last week (morning of December 14), the price of Ancarat 999 (1kg) silver bars in 2025 was only at VND61 extract266 - 63.126 million/kg. Thus, if buying on December 14 and selling on December 21, buyers will make a profit of about VND 3.314 million/kg.

In Phu Quy, the price of 999 (1kg) silver bars is currently listed at 67.413 - 69.493 million VND/kg. Compared to the price of 62.106 - 64.026 million VND/kg of the session on December 14, buyers made a profit of about 3.387 million VND/kg after a week.

Silver is supported by investment and industrial demand

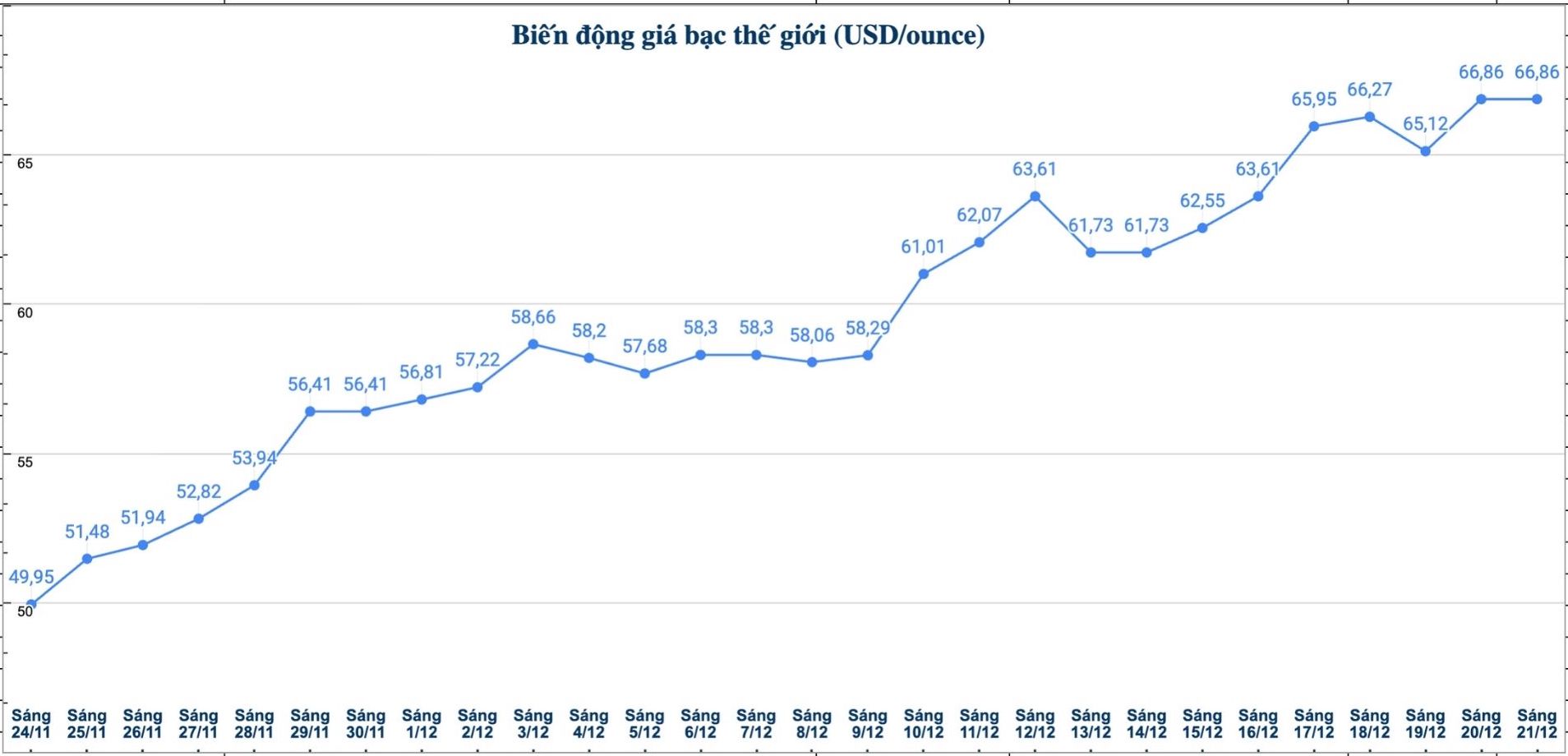

In the world market, at the end of the session on December 21, the silver price was listed at 66.86 USD/ounce. Silver prices maintained their upward momentum thanks to expectations of interest rate cuts and industrial demand.

US inflation in November fell to 2.7%, while core inflation was at 2.6%, reinforcing the view that monetary conditions are gradually easing.

According to Mr. Arslan Ali - currency and commodity analyst at FX Empire, low interest rates cause investors to seek safe-haven assets such as gold and silver. As for silver, the metal is also strongly supported by industrial demand, especially in energy transition areas, helping prices fluctuate less as macro expectations change.

The mixed developments of gold and silver last week showed great risks for surfer investors, especially for gold - a commodity with a high difference between buying and selling.

People need to carefully consider investment strategies, closely monitor domestic and world price differences, avoid chasing the crowd psychology, and limit the use of loans or pump all cash flow into precious metals during the risk period.