Unexpectedly abundant silver supply

According to the 2026 outlook report of TD Securities (capital market investment and trading banking segment of Toronto-Dominion Bank - TD Bank), silver prices are likely to cool down next year, after the market switches from a state of "restricted supply" to physical supply.

If investors were excited about the silversqueeze phenomenon, now they need to pay special attention to Silverflood, TD Securities analysts said.

TD Securities said that in early 2025, the market was almost "forgotten" by the risk of a physical shortage of silver, in the context of strong investment demand and declining market liquidity. However, by 2026, the situation has completely reversed.

A huge wave of silver has returned to the market, creating the largest free inventory replenishment in history at the London economics and metals market Association (LBMA). There are currently more than 212 million ounces of silver ready to trade in LBMA warehouses - equivalent to nearly two years of global silver deficit before.

According to TD Securities, this fundamentally changes the outlook for silver prices, because the market no longer needs high prices to attract supply back to reserves.

Prices have not decreased sharply, but risks are accumulating

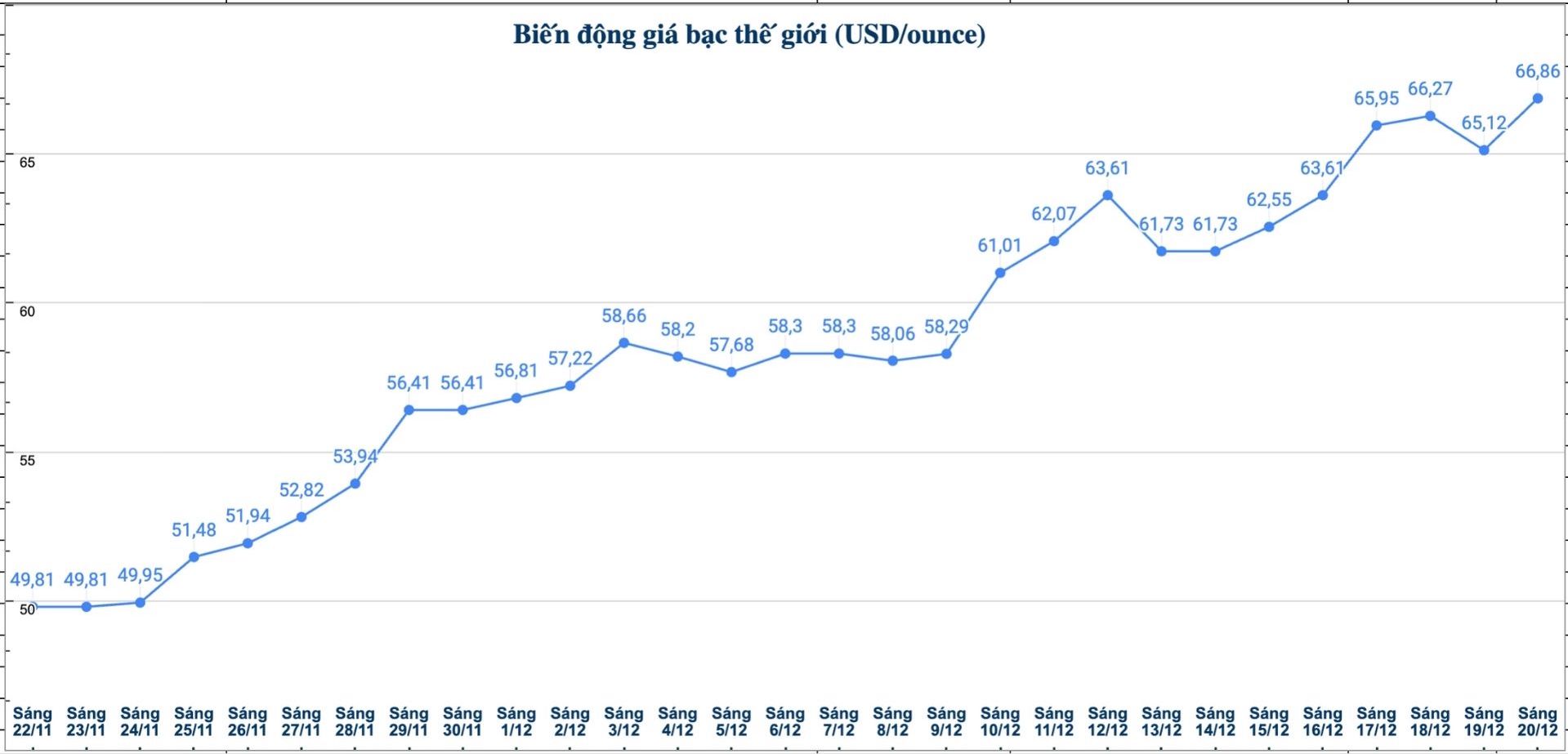

However, silver prices have not decreased immediately after the silverflood. TD Securities noted that, although silver lending rates have fallen sharply from record levels, prices are still fluctuating strongly around historical peaks - a development that goes against the usual relationship between inventory and commodity price fluctuations.

Notably, spot silver trading volumes have fallen more than 65% from their October peak, raising concerns about likelihood gaps. This could make the precious metals market vulnerable to speculative flows and derivatives risk protection activities.

TD Securities believes that the risk of adjustment is increasing, especially in the context of increased global tangible inventories, weak industrial demand and the possibility of applying new taxes on silver is very low.

The bank expects silver prices to average around $42 an ounce in the first quarter of 2026 and is unlikely to return to current peaks, with the base scenario being around $40 an ounce for the whole year.

Contrasting forecasts from large organizations

While TD Securities has been cautious, some other organizations have issued more bullish forecasts, but have also acknowledged the risk of adjustments.

BMO Capital Markets forecasts that the average silver price will be around 56.3 USD/ounce in 2026, with the peak of the year possibly reaching around 60 USD/ounce in the fourth quarter. However, the bank warned that silver is showing signs of overbought after a period of hot gains.

From another perspective, Maria Smirnova - Investment Director at Sprott Asset Management - said that the problems of structural silver supply have not been resolved, while investment demand continues to increase, especially in China - the world's largest solar battery manufacturing center.

However, technical experts issued clearer warning signals. Mr. Avi Gilburt - veteran analyst and Mr. Jim Wyckoff said that the silver market is in the very late stage of the price increase cycle.

Siliver is in a clear boom cycle. And after the explosion, there is always a recession - the only uncertain thing is the timing, Wyckoff said.

Investors need to be cautious

In the context of increasingly differentiated forecasts, many opinions say that 2026 could be a "fire-tests" period for the silver market. The faster-than-expected supply return, while industrial and investment demand shows signs of slowing, is increasing the risk of silver prices cooling sharply.

Analysts recommend that investors should be cautious with deep correction scenarios, especially if silver prices do not maintain their upward momentum in the first half of 2026 and gradually slide to the mid-40 USD/ounce range as predicted by TD Securities.