According to Kitco, silver prices are on track to end 2025 with a more than double the closing price at the end of December last year at 29.29 USD/ounce, equivalent to an increase of about 130%.

"In 2026, the silver market is forecast to continue a positive trend thanks to strong industrial demand and increasingly tight supply. However, silver is unlikely to increase as strongly as in 2025," said Kitco analyst Jim Wyckoff.

However, he still predicted that silver prices could reach or exceed 75 - 100 USD/ounce next year. Silver demand is expected to continue to increase thanks to the development of renewable energy, electric vehicles, along with the expansion of data centers and artificial intelligence (AI).

On the supply side, Jim Wyckoff said that the disruption of mining activities, while inventories are low, is creating a large shortage, thereby pushing prices up.

"In addition, the possibility of the US Federal Reserve (Fed) cutting interest rates, a weakening USD and geopolitical risks could continue to boost speculative demand as well as safe-haven demand for silver," the expert said.

Technically, silver prices still maintain a clear uptrend in both the short and long term. However, Jim Wyckoff emphasized that the market is at the end of a strong growth cycle, so it is likely to need to slow down in the next few months.

According to Jim Wyckoff, raw materials, including metals, are often very cyclical, with interspersed explosions and degradations. Currently, silver is in an explosive cycle, which means that the downward cycle will follow.

"What is unclear is just the beginning of this cycle. With the current strong price increase scale, the upcoming adjustment may also be very profound" - he noted.

Jim Wyckoff concluded that silver prices are likely to enter a strong correction phase in mid-2026 or sooner. "However, after each downturn, the commodity market will often open a new growth cycle - that is the proven rule of the raw material market" - Jim Wyckoff emphasized.

Updated silver price

As of 6:00 a.m. on December 21, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 2.524 - 2.586 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 66.440 - 68.460 million VND/kg (buy - sell).

The price of 999 gold bars of the Golden Rooster Bank of Saigon - SBJ (Sacombank - SBJ) is listed at VND2.502 - 2.562 million/tael (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.528 - 2.606 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 67.413 - 69.493 million VND/kg (buy - sell).

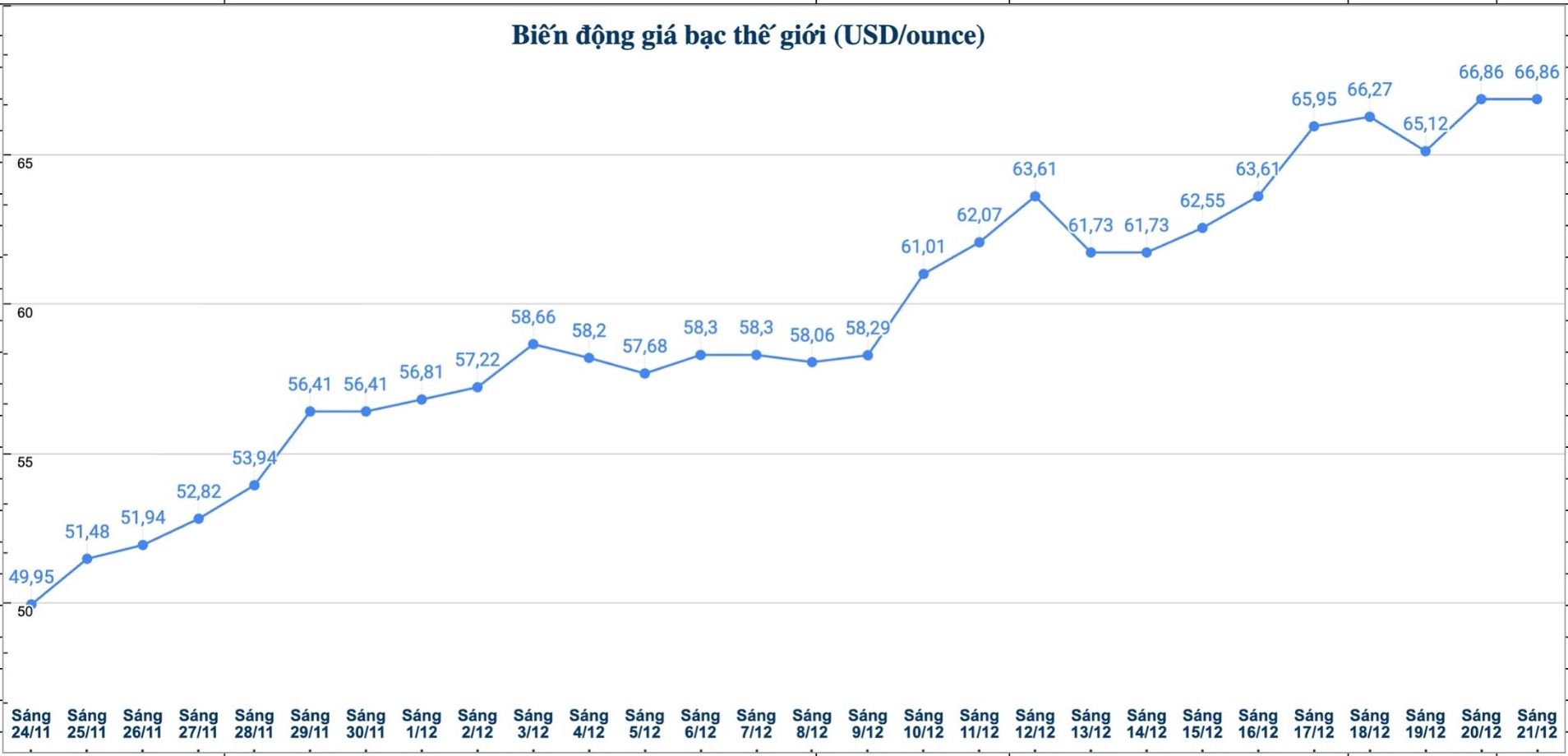

On the world market, as of 6:00 a.m. on December 21 (Vietnam time), the world silver price was listed at 66.86 USD/ounce.

See more news related to silver prices HERE...