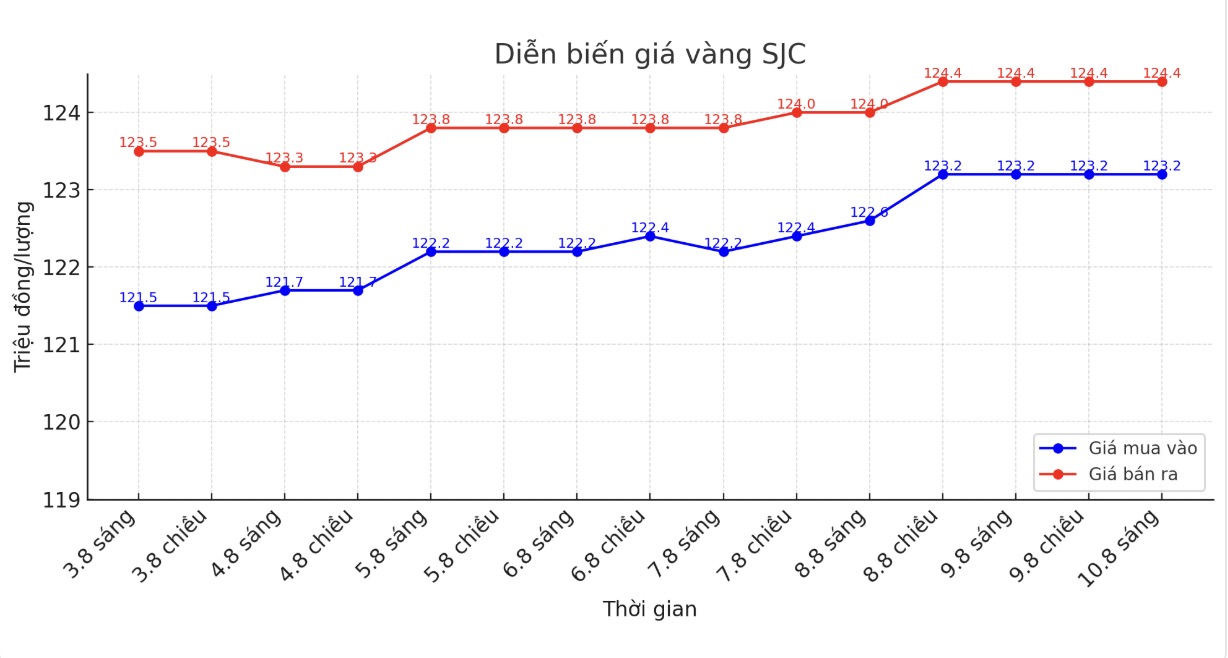

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 123.2-124.4 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (August 3, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 1.7 million VND/tael for buying and increased by 900,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123.2-124.4 million VND/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was increased by 1.7 million VND/tael for buying and increased by 900,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold at Bao Tin Minh Chau is at 1.2 million VND/tael.

If buying SJC gold at Bao Tin Minh Chau and Saigon Jewelry Company SJC in the 3.8 session and selling it in today's session (10.8), buyers will lose 300,000 VND/tael.

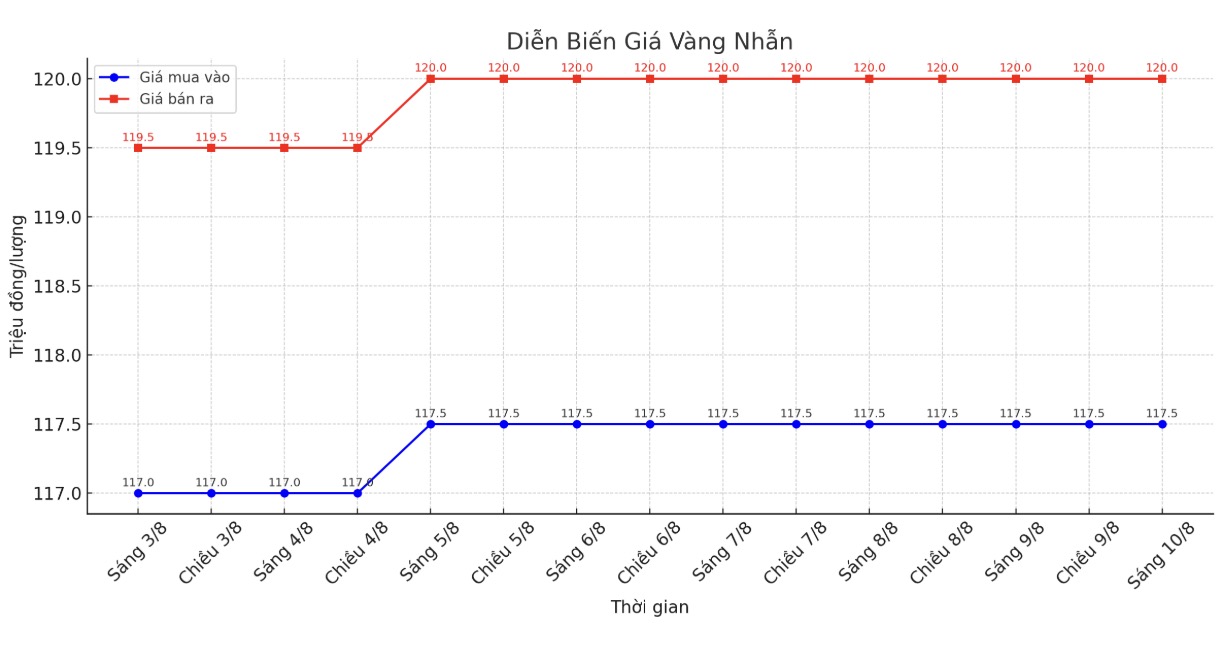

9999 gold ring price

This afternoon, Bao Tin Minh Chau listed the price of gold rings at 117.5-120 million VND/tael (buy - sell); increased by 300,000 VND/tael for buying and decreased by 200,000 VND/tael compared to a week ago. The difference between buying and selling is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 117-120 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the 3.8 session and selling in today's session (10.8), buyers at Bao Tin Minh Chau will lose 2.7 million VND/tael, while the loss when buying in Phu Quy is 2.2 million VND/tael.

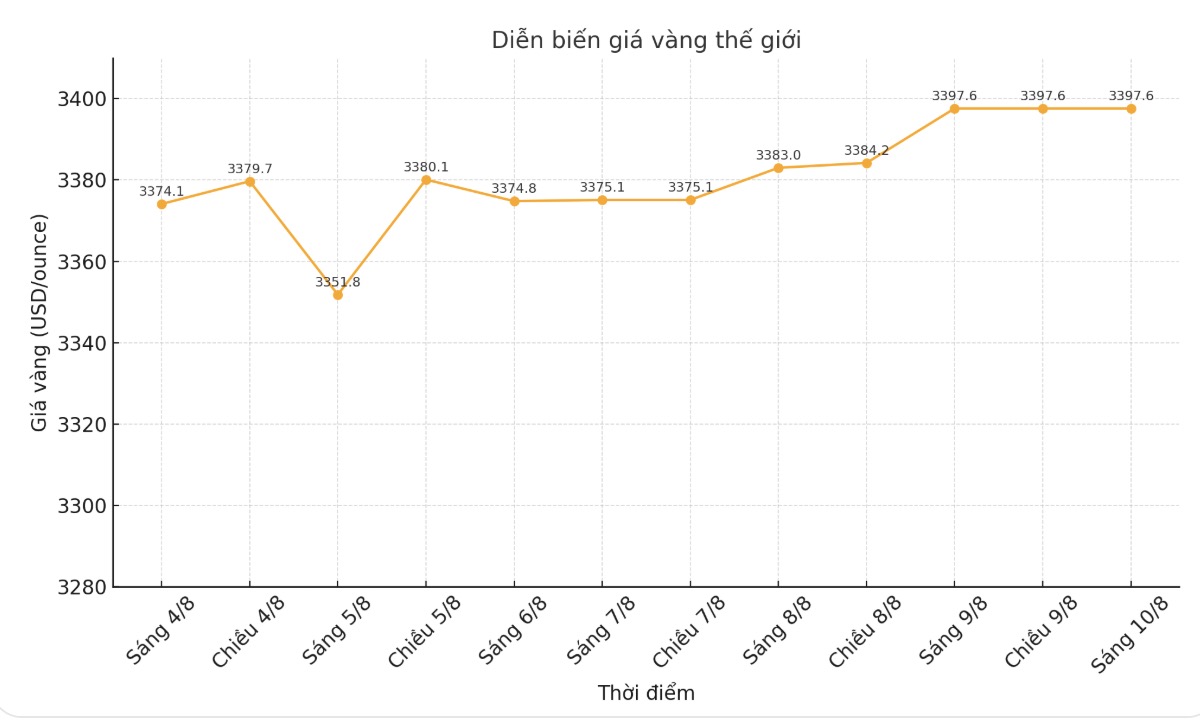

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,397.6 USD/ounce, up 36.1 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

Last week continued to be a turbulent journey for precious metals traders, especially in the last two sessions of the week after information about taxing gold bullion appeared, causing confusion in the market. Although the White House later denied the information, gold prices remained at the peak of the uncertainty period, right at $3,400/ounce.

After a positive week, world gold prices continue to receive optimistic forecasts from experts.

The weekly gold survey of an international financial information platform shows that industry experts have returned to a strong state of optimism, while individual investors still maintain a positive view on the short-term prospects of gold.

This week, 10 analysts participating in a gold survey with Wall Street buyers regained their advantage after fluctuations and solid increases in gold prices during the week.

Six experts (equivalent to 60%) predict gold prices will continue to increase next week; only one (10%) predicts prices to decrease. The remaining three analysts (accounting for 30%) predict that gold prices will move sideways.

Meanwhile, Kitco's online survey received 188 votes, with the majority of Main Street investors remaining optimistic.

129 individual investors (69%) predict gold prices will increase next week; only 23 people (12%) see prices falling. The remaining 36 (19%), forecast prices will continue to accumulate next week.

In another development, the People's Bank of China continued to supplement gold reserves in July, but total foreign exchange reserves decreased due to the strengthening of the USD, according to official data just released by the World Gold Council.

Krishan Gopaul - Senior EMEA analyst at the World Gold Council - wrote: "Date from the People's Bank of China showed that gold reserves increased by 2 tons in July - marking the ninth consecutive month of increase. Since the beginning of the year, net purchases have reached 21 tons, bringing the total gold reserves to 2,300 tons".

In value, China's gold reserves increased by about 1 billion USD in July, reaching a total of 244 billion USD. Since resuming buying activities in November last year, the country's central bank has purchased 1.16 million ounces of gold. Gold currently accounts for about 7% of China's total official reserves, just half of the global average of 15%.

Meanwhile, China's foreign exchange reserves fell in the month as the USD appreciated. The country's total foreign exchange reserves reached 3.3 trillion USD at the end of July, down about 25.2 billion USD compared to June, mainly due to exchange rate fluctuations and asset prices, according to published data.

See more news related to gold prices HERE...