Gold price developments last week

Last week continued to be a turbulent journey for precious metals traders, especially in the last two sessions of the week after information about taxing gold bullion appeared, causing confusion in the market. Although the White House later denied the information, gold prices remained at the peak of the uncertainty period, right at $3,400/ounce.

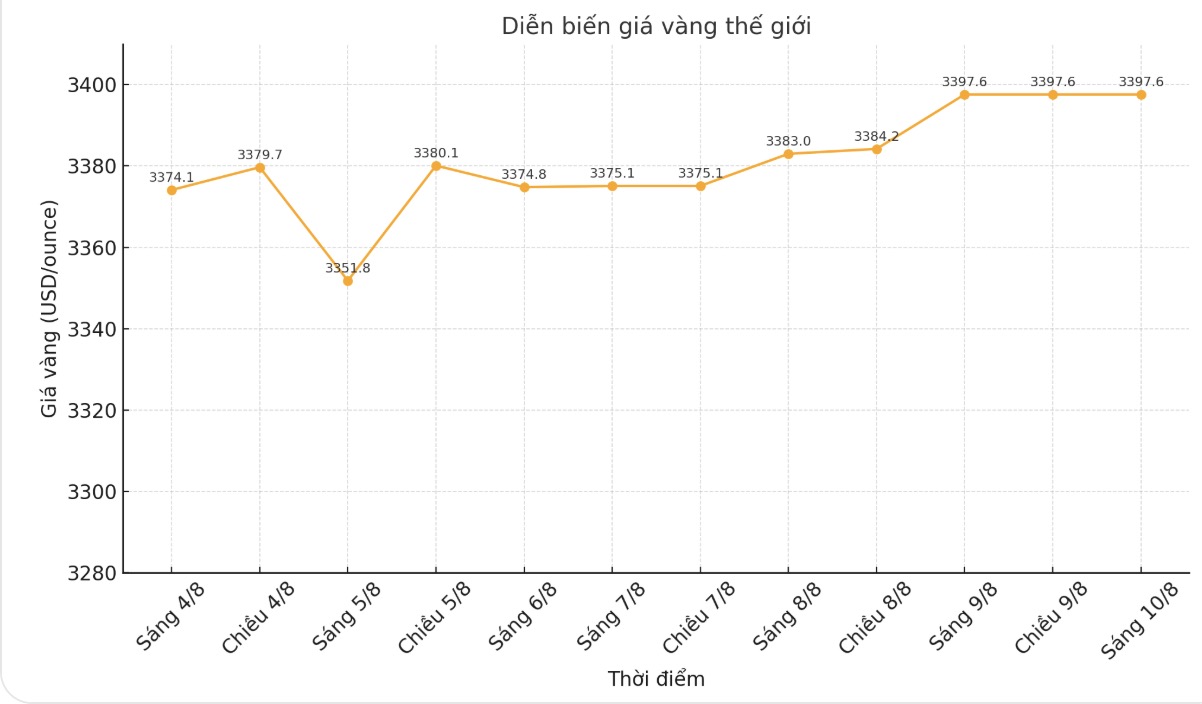

Spot gold opened the week at $3,360.52 an ounce and after quickly falling to the support zone of nearly $3,345 an ounce at around 9:15 p.m. Sunday (EDT), the precious metal began its first rally, hitting $3,383/ounce just 15 minutes after the North American market opened on Monday morning.

After a second failed attempt to hold the $3,380/ounce mark on Monday evening, gold fell sharply to a weekly low of $3,350/ounce at 7:30 a.m. EDT. However, right from this level, gold increased sharply, soaring to 3,390 USD/ounce right before noon in the East.

Once again, buying power was not enough to push prices higher, and by 7am on Wednesday, gold returned to $3,360/ounce. But as the North American market opened, buying power rebounded, pushing prices closer to $3,380 an ounce late in the morning.

On Wednesday evening, buying from Asian and European traders became significant, helping spot gold reach a new weekly peak of $3,396/ounce at 3:45 a.m. (EDT). When news of the US imposing a tax on gold imports from Switzerland appeared late Thursday afternoon, gold prices finally broke the resistance zone of $3,400/ounce.

As rumors spread all night and in the Friday morning session, gold prices fluctuated strongly within a range of 20 USD, continuously testing the resistance zone of 3,400 USD/ounce.

Notably, the White House's announcement that it will not impose a tax will only reduce prices to the support zone of $3,380/ounce, then rebound and anchor close to the $3,400/ounce mark until the end of the week.

Gold price forecast for next week

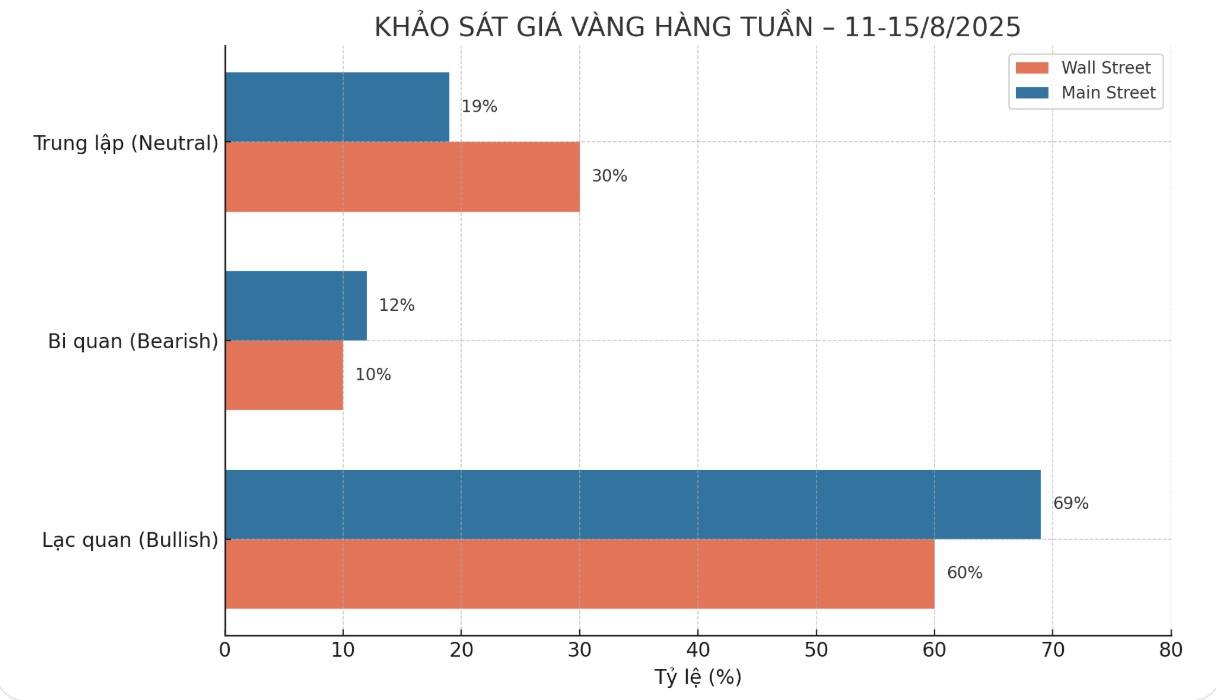

The weekly gold survey of an international financial information platform shows that industry experts have returned to a strong state of optimism, while individual investors still maintain a positive view on the short-term prospects of gold.

This week, 10 analysts participating in a gold survey with Wall Street buyers regained their advantage after fluctuations and solid increases in gold prices during the week.

Six experts (equivalent to 60%) predict gold prices will continue to increase next week; only one (10%) predicts prices to decrease. The remaining three analysts (accounting for 30%) predict that gold prices will move sideways.

Meanwhile, Kitco's online survey received 188 votes, with the majority of Main Street investors remaining optimistic.

129 individual investors (69%) predict gold prices will increase next week; only 23 people (12%) see prices falling. The remaining 36 (19%), forecast prices will continue to accumulate next week.

Economic data to watch next week

Economic news will be bustling again next week, with key indicators of inflation and consumer health on the watch list.

Early Tuesday morning, the Reserve Bank of Australia will have an interest rate decision, with the market predicting a 25 basis point cut, from 3.85% to 3.60%. Traders will then turn their attention to the US CPI report for July, which is expected to show core inflation rising slightly to 0.3% from 0.2% in June.

Wednesday is expected to be quite quiet, highlighted by the statements of FED Governors Goolsbee and Bostic. However, data will be bustling again on Thursday with the US PPI report on core inflation expected to increase by 0.2% after June's zero level along with weekly jobless claims.

The week will end with a deeper look at US consumers, as July retail sales are expected to decline slightly from 0.6% to 0.5%, while core retail sales are expected to decrease from 0.6% to 0.3% compared to June.

Then in the morning, the University of Michigan's preliminary consumer confidence index for August will let the market know what consumers expect in the coming time.

See more news related to gold prices HERE...