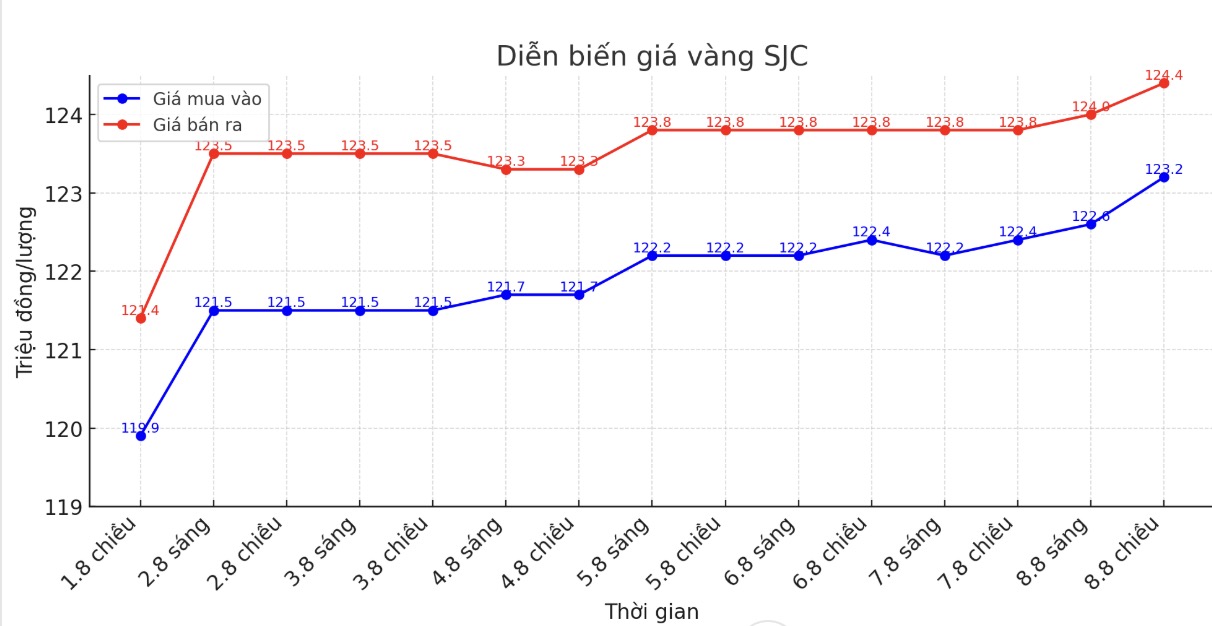

SJC gold bar price

As of 6:40 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 123.2-124.4 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1.2 million VND/tael.

DOJI Group listed at 123.2-124.4 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123.2-124.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and an increase of 400,000 VND/tael for selling. The difference between buying and selling prices is at 1.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.2-124.4 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.2 million VND/tael.

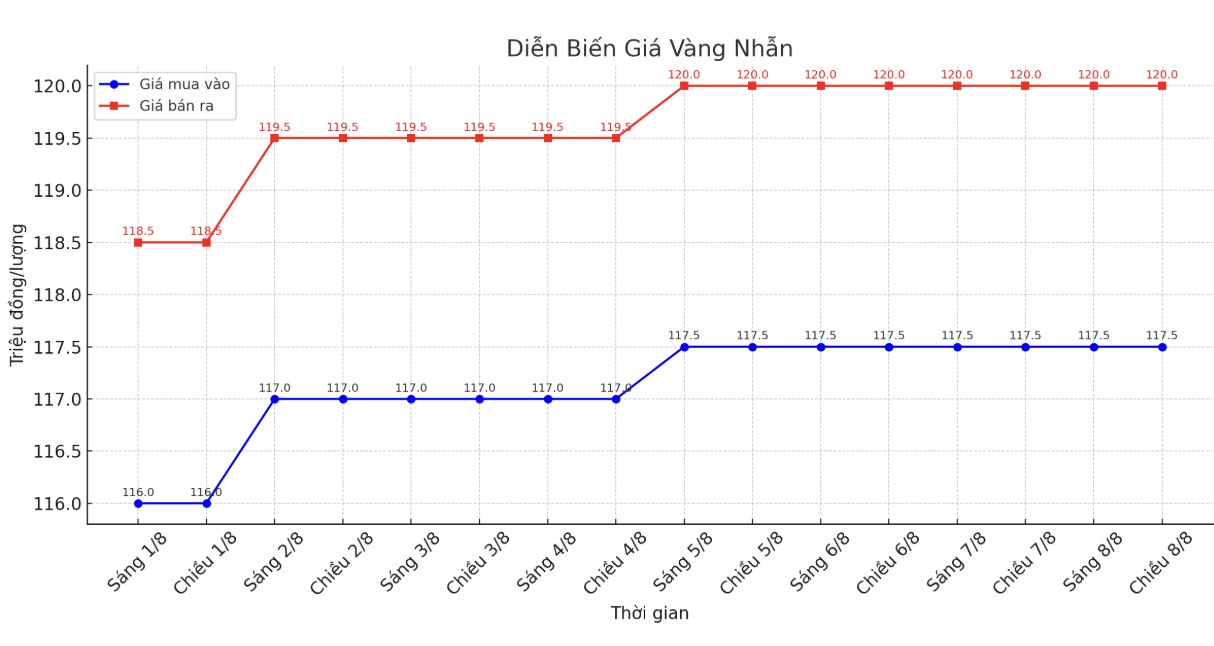

9999 gold ring price

As of 6:40 a.m., DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

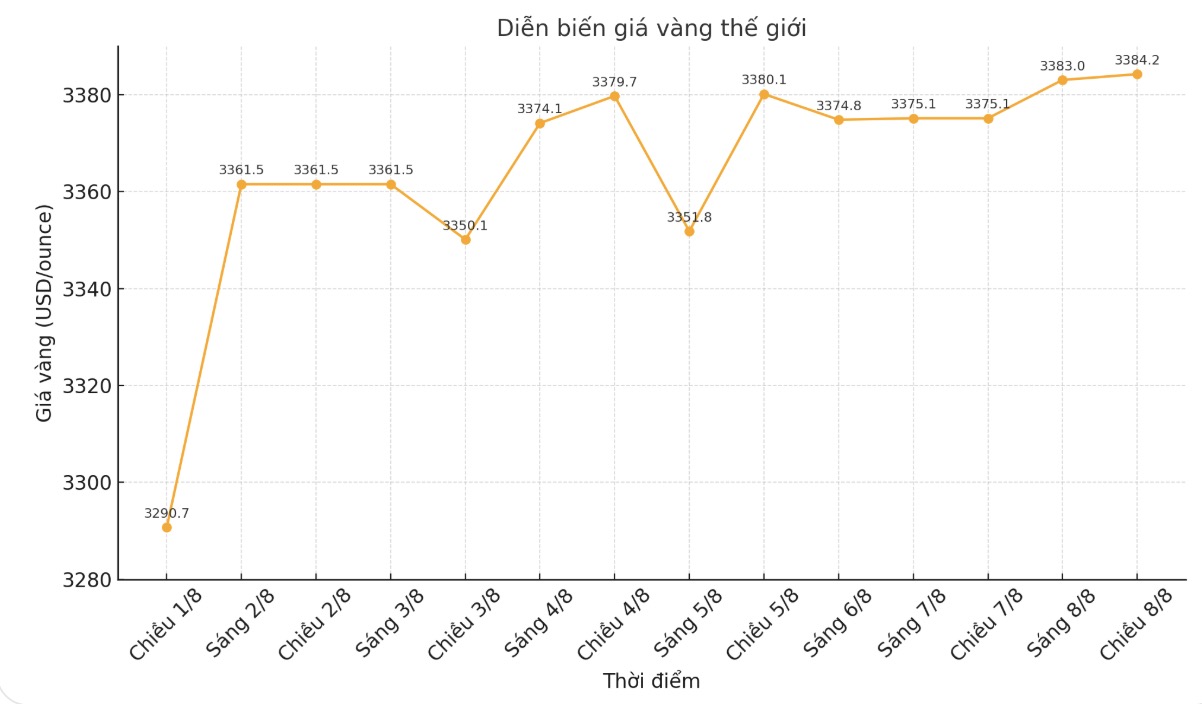

World gold price

The world gold price was listed at 6:40 p.m. at 3,397.6 USD/ounce.

Gold price forecast

Gold prices increased after the news of the US imposing import tariffs on 1kg and 100 ounce gold bars - a move that is expected to shake the global gold market and deal another heavy blow to Switzerland, the world's largest gold refining center.

According to the ruling letter dated July 31 of the US Customs and Border Protection Agency (CBP) reached by the Financial Times, the above types of gold bars will be classified as taxable customs codes, instead of codes exempted under the comprehensive tax policy of US President Donald Trump. The verdict is a US document used to clarify trade policy.

This decision is in complete contrast to the previous expectations of the gold industry that 1kg and 100 ounce gold bars will be classified as tax-free. Currently, 1kg gold bars are the most popular trading on the comex exchange - the world's largest gold futures market - and account for the majority of Switzerland's gold exports to the US.

On Friday afternoon, the White House called the Financial Times article dis plagiarized and reassured the market that gold was not subject to tariffs. However, after a quick and short sell-off, the precious metal still maintained its upward momentum throughout the week.

The weekly gold survey of an international financial information platform shows that industry experts have returned to a solid optimistic stance, while individual traders continue to maintain a new positive view on gold's short-term prospects.

Eugenia Mykuliak - founder and CEO of B2PRIME Group - said that the new tax rates on gold are only the latest factor supporting gold prices to enter the fall.

Tax rates increase uncertainty and push investors to seek safe-haven assets such as gold. As US inflation rises and job growth slows, the risk of recession increases, which also supports gold. The market is now strongly pricing in the possibility of the Fed cutting interest rates in September, a context that often reduces the opportunity cost of holding non-yielding assets such as gold, she said.

Precious metals analyst Jim Wyckoff said that gold prices are expected to continue to increase next week: " Maintain the uptrend as the charts for positive signals and buyers have regained momentum this week".

Economic data to watch next week

Tuesday: RBA interest rate decision, US CPI in July, speeches by Barkin and Schmid (FED).

Wednesday: Speeches by Barkin, Bostic and Goolsbee (FED).

Thursday: US PPI July, US jobless claims.

Friday: US retail sales in July, New York Empire State Production Index, Michigan Consumer Confidence Index (preliminary estimate).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...