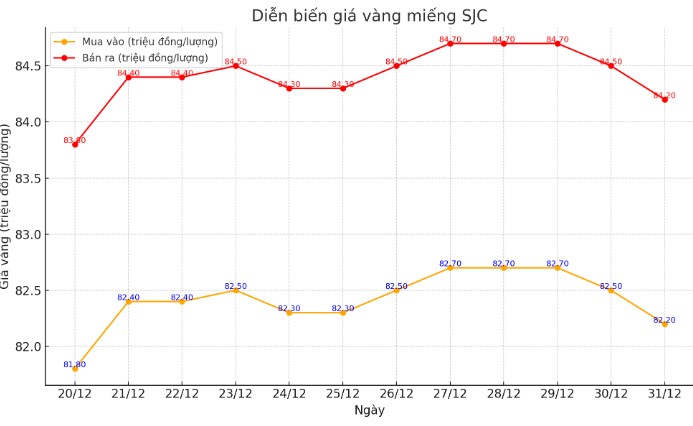

Update SJC gold price

As of 8:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.2-84.2 million/tael (buy - sell), down VND300,000/tael.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.2-84.2 million VND/tael (buy - sell), down 300,000 VND/tael.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.2-84.2 million VND/tael (buy - sell), down 300,000 VND/tael.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

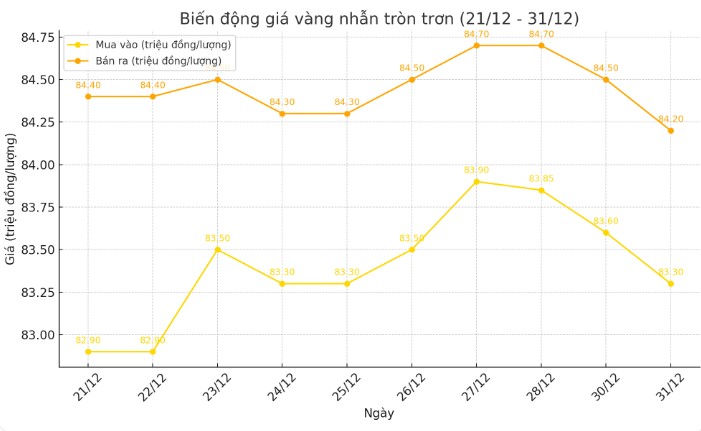

Price of round gold ring 9999

As of 7:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.30-84.20 million VND/tael (buy - sell); down 300,000 VND/tael for both buying and selling compared to the close of yesterday's trading session.

Saigon Jewelry Company SJC listed the price of SJC 9999 gold rings at 82.2-84 million VND/tael (buy - sell).

World gold price

As of 8:20 p.m., the world gold price listed on Kitco was at 2,606.8 USD/ounce, down 14.1 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices fell amid an increase in the USD index. Recorded at 20:30 on December 31, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.035 points (up 0.08%).

Despite the decline, gold prices have risen about 26% since the beginning of the year, supported by strong demand from central banks, geopolitical tensions and loose monetary policies from major banks around the world.

Tim Waterer, senior market analyst at KCM Trade, said that the outlook for US interest rates will continue to be a key driver of gold prices in 2025. US President-elect Donald Trump’s trade policies and the US Federal Reserve’s interest rate trajectory are expected to play a key role in shaping the global inflation picture.

After three strong interest rate cuts in September, November and December 2024, the Fed signaled at its recent meeting that there would be fewer rate cuts in 2025. In addition, other major central banks have also shown caution in setting monetary policy plans for the new year.

“Gold is likely to remain supported in 2025 as rising geopolitical risks, trade tensions and central bank buying offset headwinds from a strong US dollar and the Fed’s slow pace of monetary policy easing,” said Aneeka Gupta, director of macroeconomic research at WisdomTree.

Gold has long been seen as a hedge against inflation and uncertainty, especially in times of global economic challenges. However, higher interest rates could reduce the appeal of the precious metal, which does not offer a fixed yield. As 2025 approaches, gold prices will continue to reflect the volatility of major economic and geopolitical factors.

See more news related to gold prices HERE...