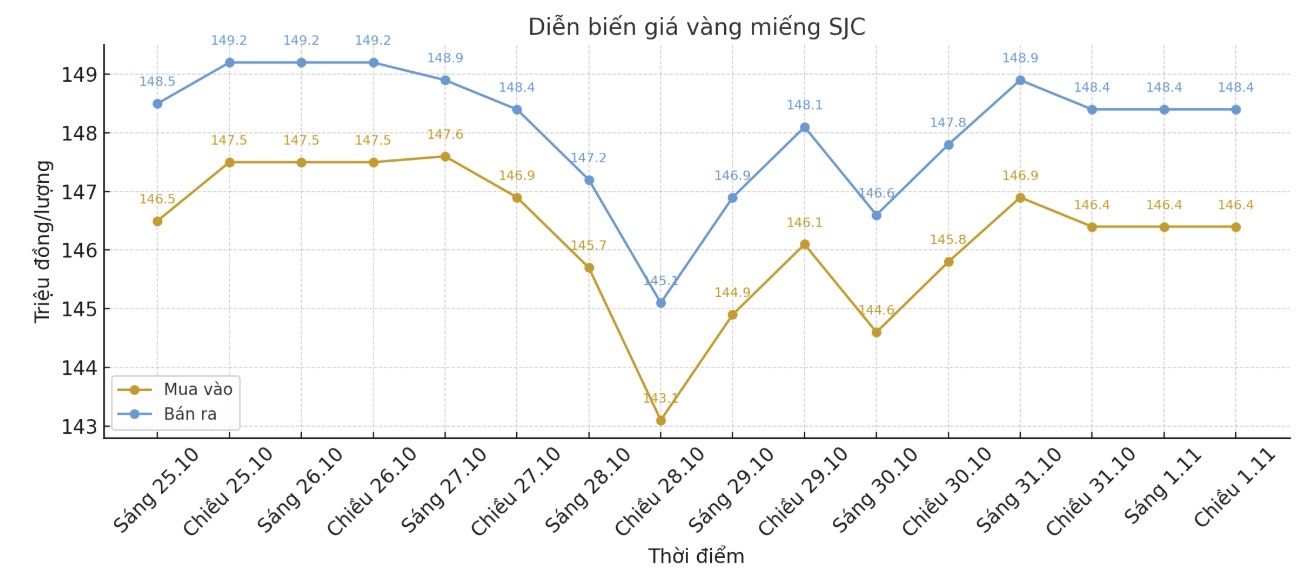

SJC gold bar price

As of 5:11 p.m., DOJI Group listed the price of SJC gold bars at 146.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.9-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

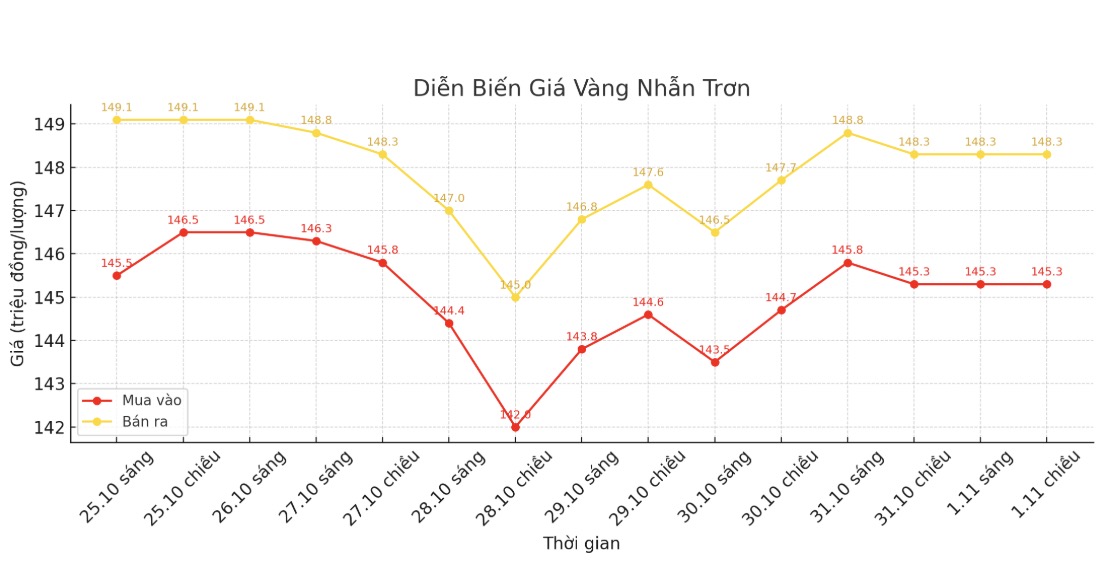

9999 gold ring price

As of 5:11 p.m., DOJI Group listed the price of gold rings at 145.3-148.3 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.2-149.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

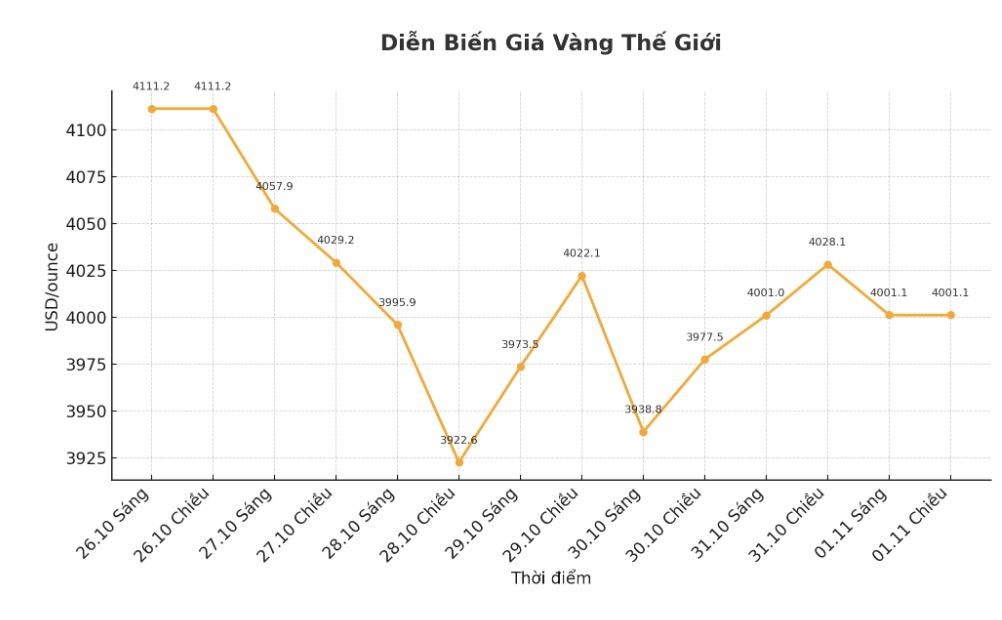

World gold price

The world gold price was listed at 5:12 p.m. at 4,001.1 USD/ounce, down 27 USD compared to a day ago.

Gold price forecast

Despite continued selling pressure, gold prices are stabilizing around $4,000 an ounce as the market awaits further clear signals about US monetary policy.

Philip Streible - chief strategist at Blue Line Futures commented that gold still has room for increase in the short term, but needs to surpass the threshold of 4,175 USD/ounce to regain a clear uptrend.

Weaker data next week could reflect a weakening labor market, forcing the Fed to continue policy easing despite Powells caution. This could create a driver for gold prices," Streible said.

Meanwhile, Ole Hansen - Director of Commodity Strategy at Saxo Bank - said that the current selling pressure does not change the long-term outlook for gold. However, he predicted that prices will continue to accumulate sideways.

The previous accumulation period lasted four months, so if prices set a new record before the end of the year, it would be surprising.

Mr. Powell is cautious because the situation is unpredictable, while the US-China trade deal has not actually solved the core problem. Therefore, patience is the right strategy at this time" - he commented.

Aaron Hill - an analyst at FP Markets - believes that the gold market will witness strong fluctuations as investors seek a balance between opposing factors.

Gold prices held around $4,000 an ounce as the Fed hinted that it may not cut interest rates in December, along with a US-China tax deal that reduced safe-haven demand. However, the VIX volatility index is still high above 16, causing the defence cash flow to flow slightly into gold.

I am still optimistic in the long term - buying when prices fall below $3,950/ounce is reasonable" - this expert said.

Lukman Otunuga - senior analyst at FXTM, noted that political instability in the US - when the US government cannot pass the new budget - could continue to support gold prices.

Technically, gold prices have fallen about 8% from historical peaks, but still rose 4% for the month. The resistance level is close to $4,050 and supporting around $4,000/ounce; breaking one of these two milestones will shape the upcoming trend," he said.

If the US government is not reopened next week, it will be the longest closure in history. The situation has lasted for a month and is at risk of affecting economic activity, especially if the budget for the SNAP food subsidy program expires, affecting 1/8 of the US population.

Schedule for releasing important economic data next week

Monday: Manufacturing ISM index.

Wednesday: ADP Employment Report, ISM survey for the service sector.

Thursday: Bank of England (BoE) monetary policy meeting.

Friday: Preliminary survey of consumer confidence - University of Michigan.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...