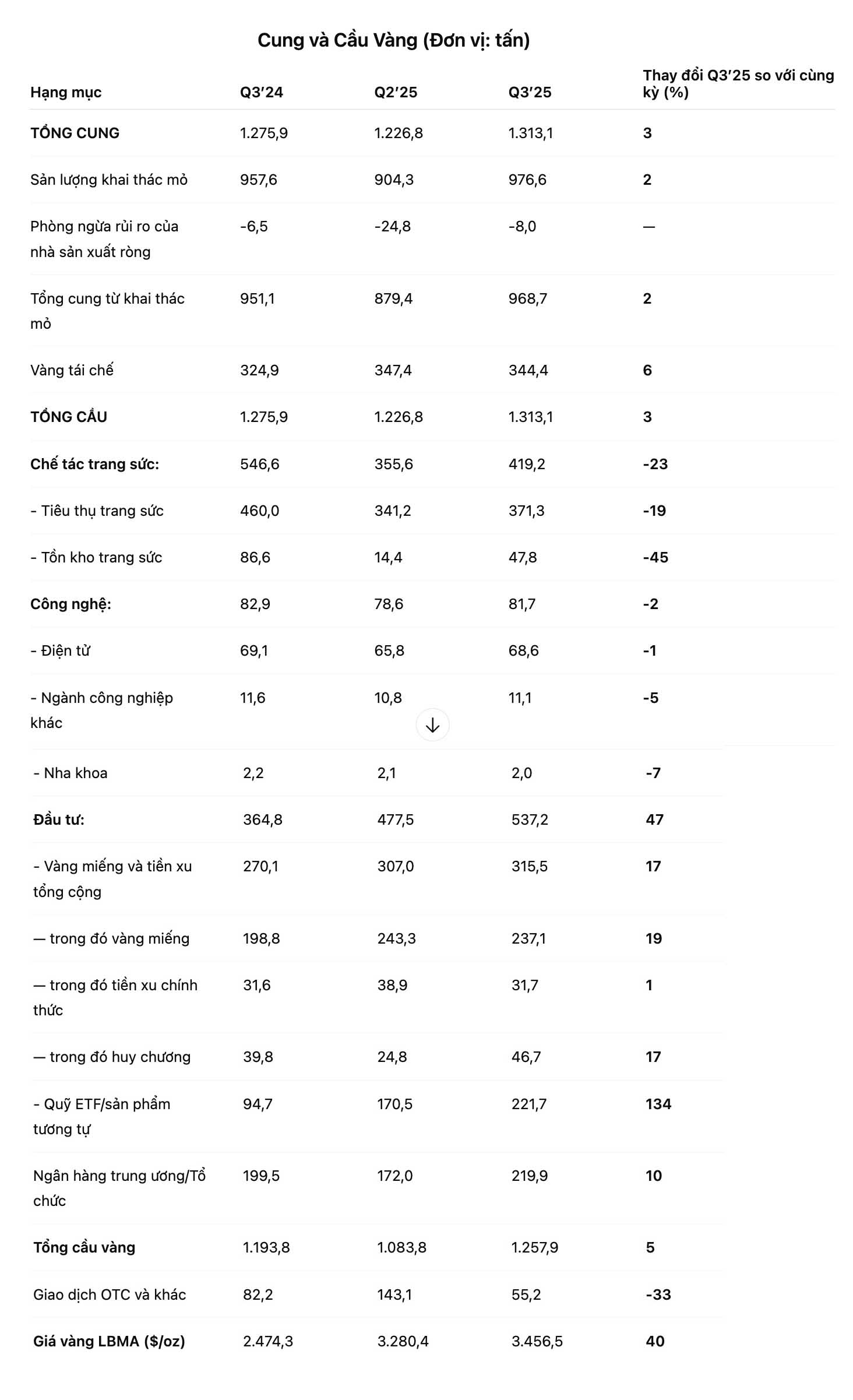

The World Gold Council (WGC) said that global gold demand in the third quarter of 2025 increased by 3% compared to the same period last year, reaching 1,313 tons - the highest level ever recorded - thanks to strong investment demand.

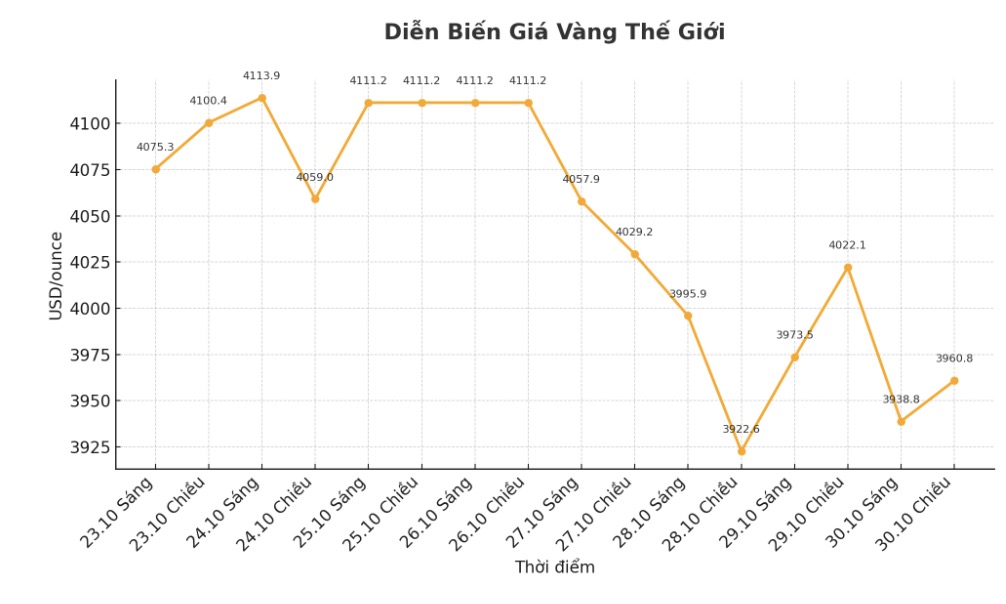

Spot gold prices have increased by 50% since the beginning of the year, reaching a record $4,381/ounce on October 20. The increase was driven by safe-haven demand amid geopolitical tensions, uncertainty over US tariffs, and recent recent buying for the fear of missing (FOMO) mentality.

Ms. Louise Street - senior market analyst at WGC - commented: "The outlook for gold remains positive, as the USD weakens, expectations of lower interest rates and the risk of inflation can continue to boost investment demand.

Our studies show that the market has not yet reached the saturated point."

Demand for gold bars and coins in the third quarter increased by 17%, mainly from India and China, while capital flows into physical gold ETFs skyrocketed by 134%, according to the WGC - the representative organization for global gold mining companies.

These segments have offset the sharp decline in demand for gold jewelry - the sector that accounts for the largest proportion of physical gold demand - down 23% to 419.2 tons due to high prices, making global consumers more cautious about spending.

The central bank, another major demand source, also increased gold purchases by 10% to 219.9 tons in the third quarter, according to the WGC's estimate based on published data and unreported transactions.

In total, central banks bought 634 tonnes of gold between January and September - down from a three-year peak in recent years but still significantly above pre-2022.

In terms of supply, recycled gold increased by 6% and mining output increased by 2% in the third quarter, bringing the total supply of gold in this quarter to a record level.

Gold supply and demand according to WGC data:

See more news related to gold prices HERE...