The precious metals market is entering a period of stagnation after recent strong fluctuations and in the context of quite quiet world economic information.

December gold futures on the CME increased by 5 USD to 4,021.4 USD/ounce, while December silver futures decreased by 0.026 USD to 48.595 USD/ounce.

In the international market, global stock exchanges last night had mixed to moderate positive movements, while US stock indexes are expected to open up firmly in the New York session.

In the remarkable international developments, Chinese President Xi Jinping emphasized the importance of maintaining a stable and smooth global supply chain, calling on countries to cooperate more closely to strengthen the trade and production system.

Speaking at the APEC Summit in Gyeongju (South Korea), he said that it is necessary to strengthen the spirit of cooperation and multilateralism to promote sustainable growth in the region.

Also on the same day, according to Bloomberg, defense ministers of some major economies had their first face-to-face meeting in Kuala Lumpur, in a move seen as contributing to strengthening international dialogue and cooperation in the context of the global move towards more stability and balance.

In China, manufacturing activity continued to weaken, with the Official Manufacturing PMI in October falling to 49 points the lowest level in six months and marking the longest downward trend in more than nine years. A level below 50 points shows that the manufacturing sector is in a narrowing phase, raising expectations that Beijing will launch new economic stimulus measures.

In the US, President Donald Trump called on Republicans in the Senate to remove the filibuster rule to end the nearly month-long federal government shutdown.

Under current regulations, most Senate bills require at least 60 votes to pass, and both parties have long been cautious about adjusting this rule to maintain power balance when not holding a majority. In the current budget discussion, the two sides have not yet reached an agreement on the provisions for spending and health support, causing the temporary approval of the bill to continue to be at a standstill.

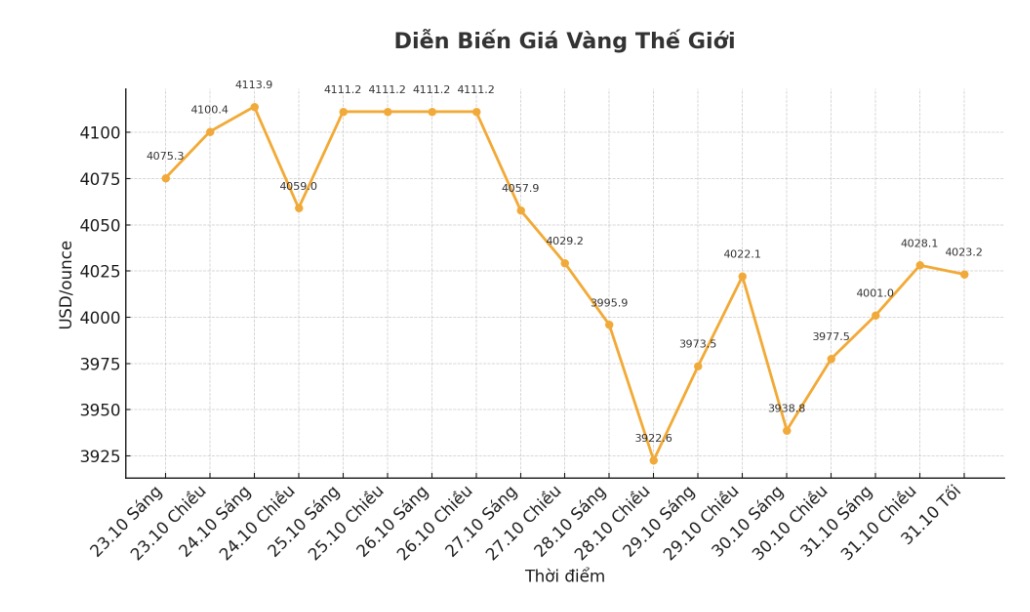

Technically, experts say buyers are aiming to close above the strong resistance level of 4,100 USD/ounce, while sellers are aiming to pull prices below the support zone of 3,800 USD/ounce.

The immediate resistance level was at 4,059.9 USD/ounce and then 4,100 USD/ounce, while the most recent support was at 4,000 USD/ounce, followed by 3,950 USD/ounce.

For silver, bulls are aiming to close above $50 an ounce, while sellers are aiming to break the $45 support. The resistance is currently determined at 49 USD/ounce and 49.225 USD/ounce; supported at 48 USD/ounce and 47.5 USD/ounce.

In other markets, the USD index is almost flat, crude oil prices have decreased slightly around 60.25 USD/barrel, while the yield on the 10-year US Treasury note remains at 4.10%.

The world gold market currently operates mainly through two mechanisms: the spot delivery market - where prices are established for immediate transactions and deliveries, and the futures market - where prices are set for future delivery time. In the context of liquidity and year-end position, December gold futures are currently the most actively traded on the CME exchange.