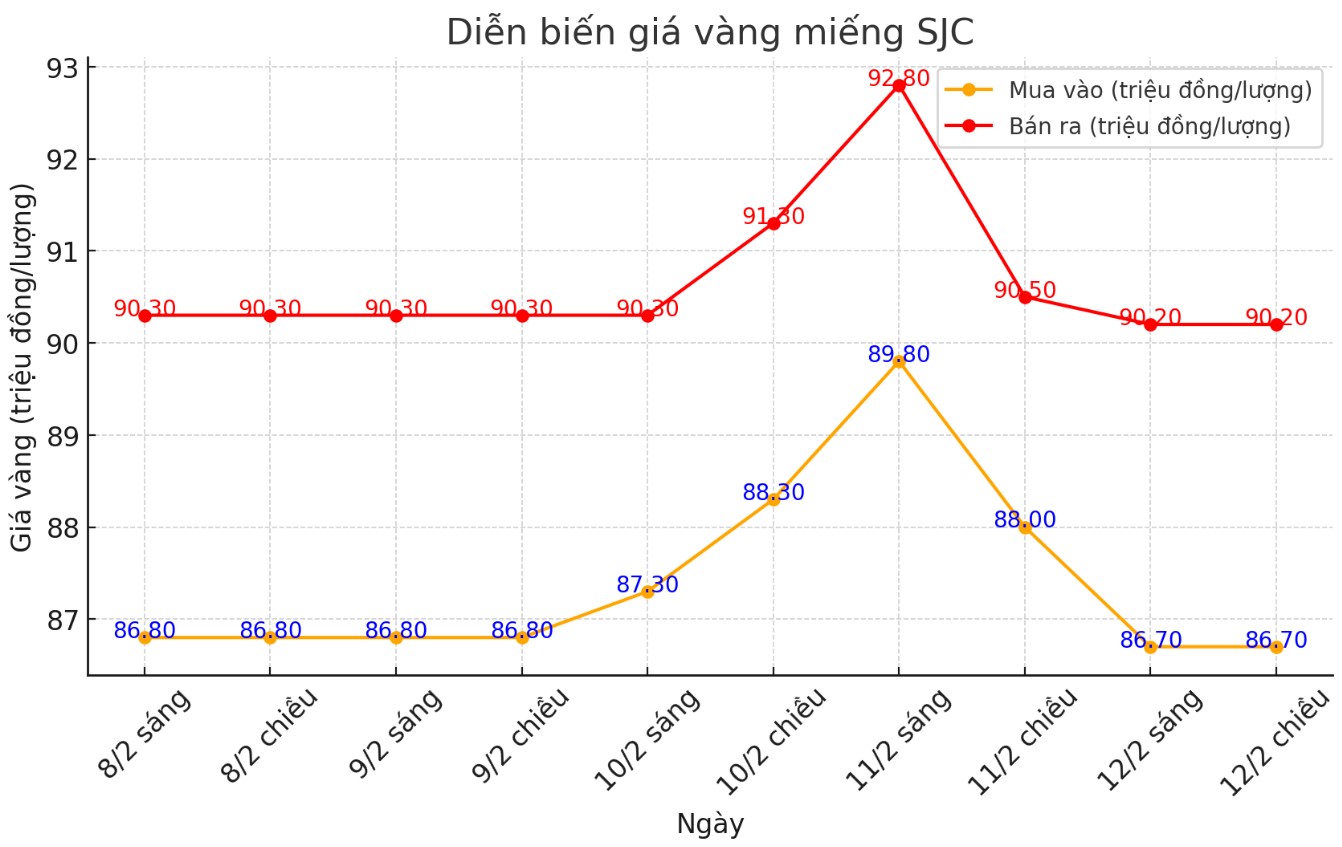

Update SJC gold price

As of 5:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 86.7-90.2 million VND/tael (buy - sell), down 1.3 million VND/tael for buying and down 300,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 86.7-90.2 million VND/tael (buy - sell). The difference between buying and selling is 3.5 million VND/tael.

DOJI Group listed the price of SJC gold bars at 86.7-90.2 million VND/tael (buy - sell), down 1.3 million VND/tael for buying and down 300,000 VND/tael for selling. The difference in buying and selling prices of SJC gold listed by DOJI is 3.5 million VND/tael.

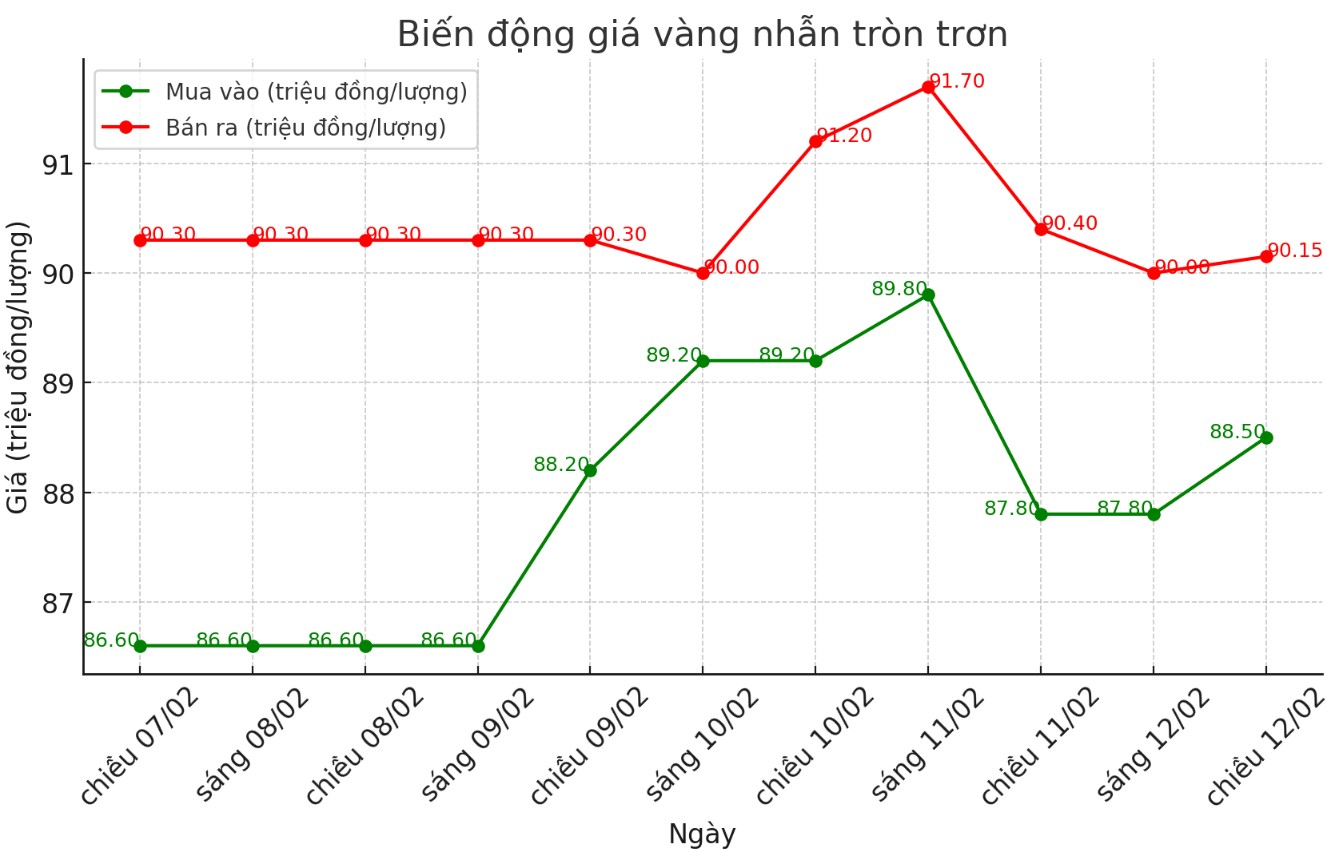

Price of round gold ring 9999

As of 5:45 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88.5-90.15 million VND/tael (buy - sell); up 700,000 VND/tael for buying and down 250,000 VND/tael for selling. The difference between buying and selling is listed at 1.65 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 88.3-90.15 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 300,000 VND/tael for selling. The difference between buying and selling is 1.85 million VND/tael.

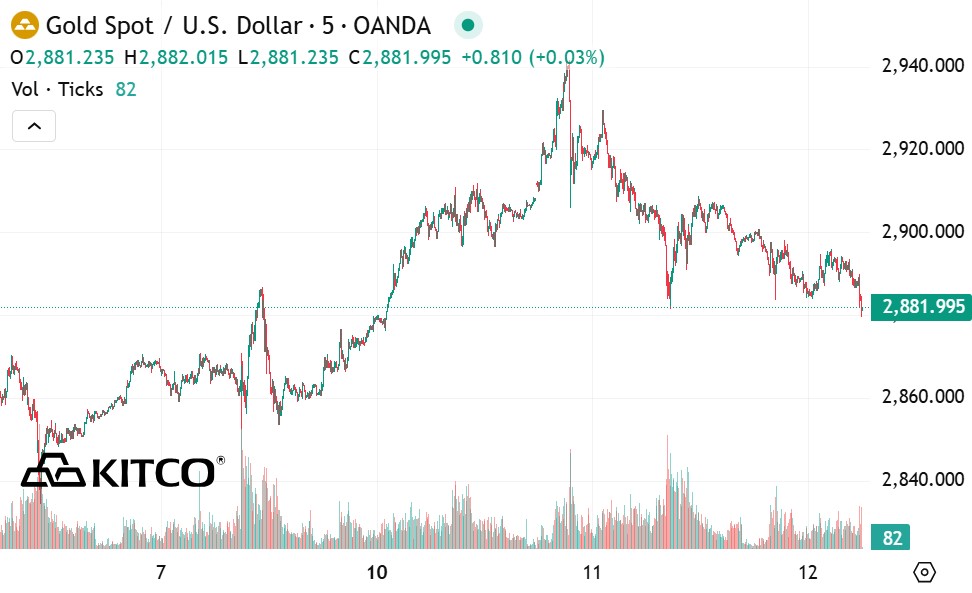

World gold price

As of 5:45 p.m., the world gold price listed on Kitco was at 2,881.9 USD/ounce, down 21.1 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices fell as the USD rose. Recorded at 5:45 p.m. on February 12, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.860 points (up 0.03%).

The pullback from record highs also reflects profit-taking after a sharp rally since mid-December, when gold rose about $370, or 14.25%. The pullback suggests investors are taking advantage of the opportunity to lock in profits while reassessing the outlook for monetary policy and trade risks.

Gold prices fell from historic levels as investors assessed the congressional testimony of Federal Reserve Chairman Jerome Powell and new trade policy statements from US President Donald Trump, according to Kitco.

In his opening remarks, Mr. Powell stressed that the Fed remains cautious about cutting interest rates, citing a strong economy and inflation that has consistently exceeded the Fed's 2% target.

After three interest rate cuts in 2024, the Fed is still maintaining its monetary policy and analysts say it is likely to continue this stance at the Federal Open Market Committee (FOMC) meeting on March 19.

Investors are closely watching Powell’s two-day testimony for clues on upcoming monetary policy, especially with consumer price index (CPI) data due out. If inflation is higher than expected, market expectations for two rate cuts this year could be challenged.

The pullback from record highs also reflects profit-taking after a sharp rally since mid-December, when gold rose about $370, or 14.25%. The pullback suggests investors are taking advantage of the opportunity to lock in profits while reassessing the outlook for monetary policy and trade risks.

Despite the decline in gold, several factors are supporting the precious metal. First, there is a wave of buying as gold prices have fallen sharply. In addition, the rise in the value of the euro could put additional pressure on the already overvalued US dollar. Although this impact may take time to materialize and may not be too strong, experts at the World Gold Council (WGC) believe it is an important factor.

“The Bank of Japan (BoJ) sees domestic demand as meeting its target, and the possibility of another rate hike this year remains on the table. This could create a counter-trend view to market expectations of a weaker US dollar,” the WGC said.

In another development, China has allowed insurance companies to invest in gold, opening up a new cash flow channel that could reach up to 27.4 billion USD. This move is expected to support the increase in gold prices.

See more news related to gold prices HERE...