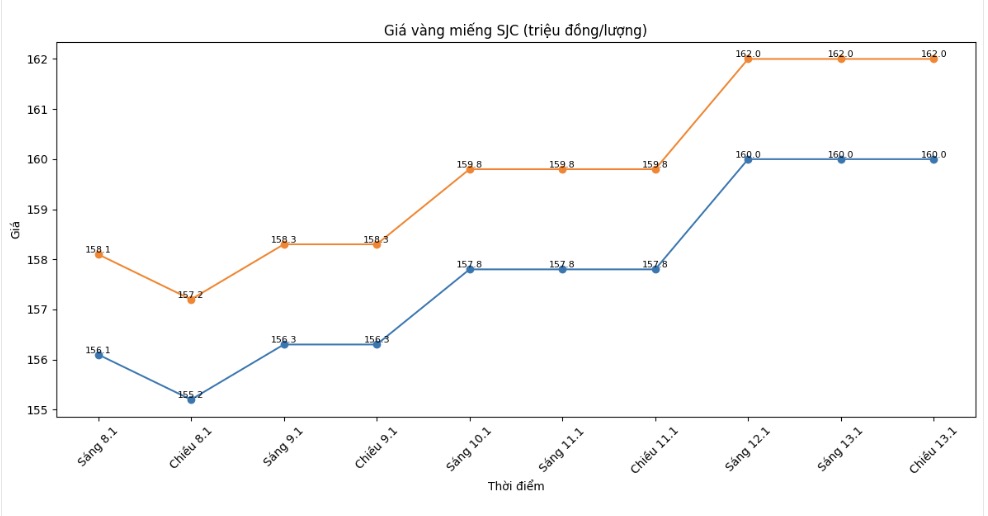

SJC gold bar price

As of 5 pm, SJC gold bar prices were listed by DOJI Group at the threshold of 160-162 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 160-162 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 159.5-162 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

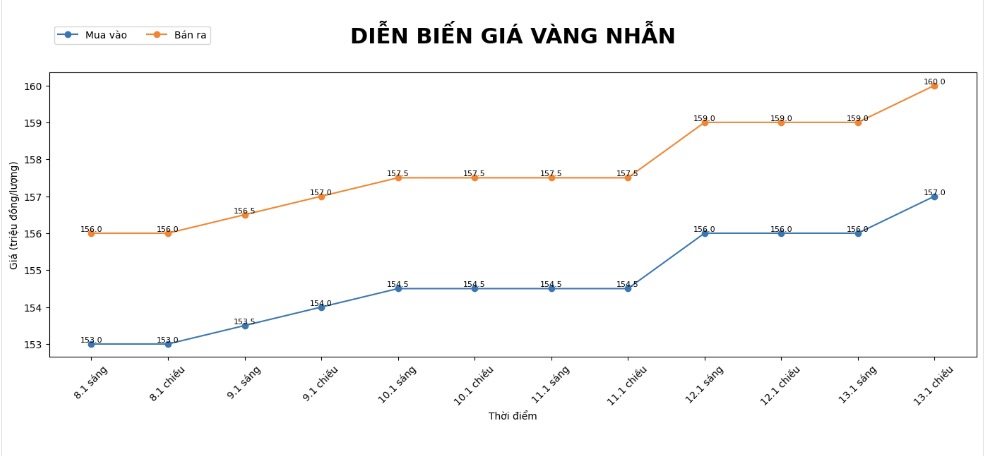

9999 gold ring price

As of 5 pm, DOJI Group listed the price of plain gold rings at 157-160 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 158.6-161.6 million VND/tael (buying - selling), an increase of 600,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 157.3-160.3 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

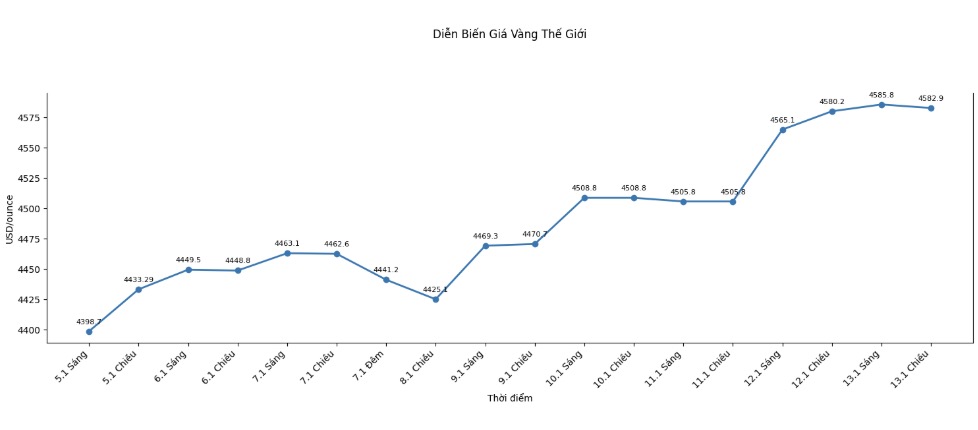

World gold price

World gold prices listed at 5:07 PM were at 4,582.9 USD/ounce, up 2.7 USD compared to the previous day.

Gold price forecast

World gold prices went sideways below a record level of 4,600 USD/ounce after many investors closed short-term profits after the previous strong increase.

Although gold prices have slightly decreased and stabilized after reaching historical peaks, the gold and precious metals market still maintains high prices, reflecting the cautious psychology and the trend of investors looking for safe assets.

Mr. Kyle Rodda - senior analyst at Capital.com - said that some investors took short-term profits, but according to observations, price drops during Asian trading hours were quickly pushed up to buy in the previous session.

Previously in the previous session, gold prices increased by more than 2% and reached a historical high of about 4,629.94 USD/ounce, due to increased demand for value-preserving assets as the market remained volatile.

Some concerns in the global market continue, partly pushing investors to turn to gold - an asset considered safer in a period of increased risk and a low interest rate environment.

Citi Bank recently also increased its price forecast for the next 3 months with a target of 5,000 USD/ounce for gold and 100 USD/ounce for silver, emphasizing strong investment momentum and many positive factors expected to continue to support prices in the first quarter of 2026.

For other precious metals, spot silver prices fell slightly by about 0.1% to 84.86 USD/ounce after hitting a record high of 86.22 USD/ounce in the previous session. Platinum also fell nearly 1.9% to 2,299.20 USD/ounce after once climbing to a previous record peak, and palladium lost nearly 2.6% to 1,793 USD/ounce.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...