Gold price movements last week

Although gold prices have had adjustments in the week, the upward trend is still maintained stably in the first full trading week of 2026. In the context of a very optimistic market, gold prices have now approached the historical peaks set last month.

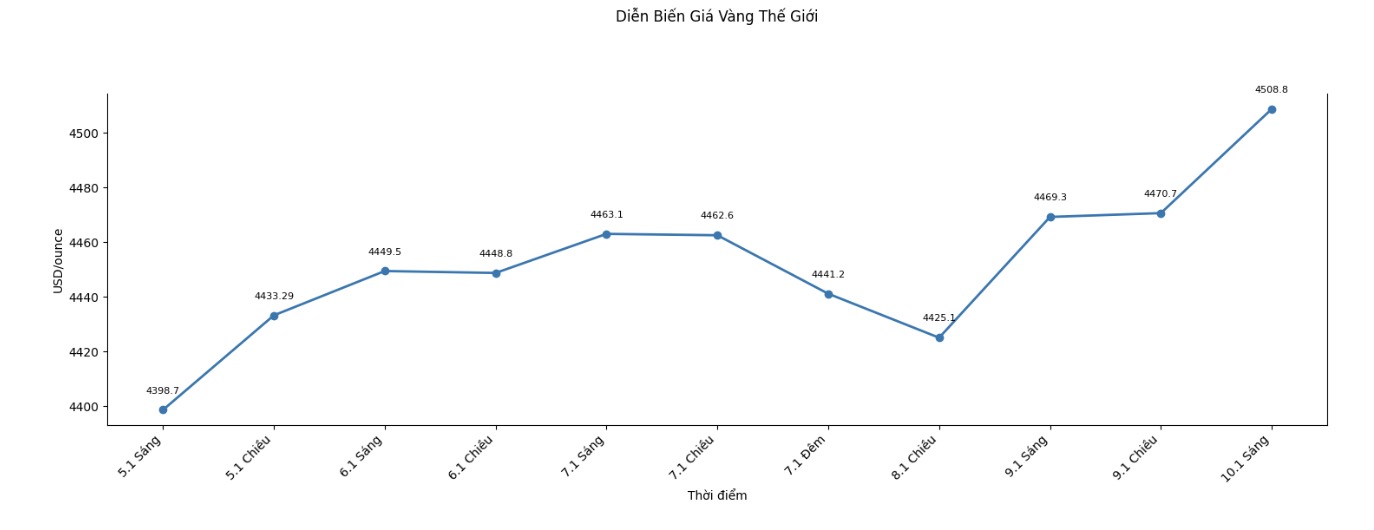

Spot gold opened the week at 4,370 USD/ounce and quickly regained the 4,400 USD/ounce mark just two hours after the Sunday evening trading session began.

Gold prices soon approached 4,440 USD/ounce in the morning session, then had a quick correction to check the support zone of 4,400 USD/ounce right before 8:15 am Monday (New York time - ET). After that, the price quickly set a short-term peak around 4,450 USD/ounce.

On Monday evening, the Asian market continued the upward momentum of North America, pushing spot gold prices up to $4,470/ounce right after midnight. When the North American market opened on Tuesday morning, gold was quickly pushed up to nearly $4,490/ounce, and by about 6:00 PM on the same day, this precious metal reached a peak of nearly $4,500/ounce.

After that, gold recorded the first significant correction of the week, when the price retreated to 4,444 USD/ounce just before 2:00 AM and continued to fall to 4,426 USD/ounce just half an hour after the North American market opened on Wednesday morning. However, although it could not exceed 4,470 USD/ounce on Wednesday and early Thursday morning, the declines did not get closer to the support zone of 4,400 USD/ounce.

By Thursday afternoon, as the North American market approached closing time, spot gold prices finally surpassed the 4,470 USD/ounce mark. Although only increasing by about 8 USD, a new price level was set; throughout the night, gold did not fall below 4,465 USD as the market waited for the December non-agricultural jobs report.

The jobs data released is true to the forecast, but that is enough to strengthen the slight slope towards the possibility that the US Federal Reserve (Fed) will cut interest rates. Thanks to that, gold prices quickly broke through the 4,500 USD/ounce mark at around 10:15 AM. After a short correction to the support zone of 4,485 USD/ounce, the market continued to fluctuate around the 4,500 USD/ounce mark when entering the weekend holiday.

Gold price forecast for next week

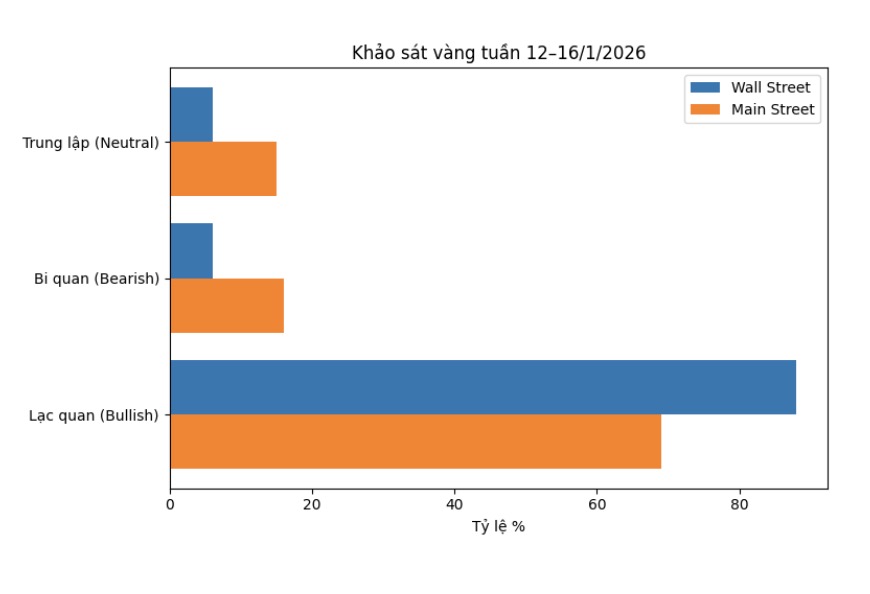

The latest weekly gold survey with Wall Street experts shows that Wall Street has almost reached absolute consensus on the prospect of gold price increases in the short term, while individual investors also maintain a majority of optimistic views.

This week, 16 experts participated in Kitco News' gold survey, in which Wall Street experts expressed an overwhelming view that gold prices will continue to rise in the near future. 14 people, equivalent to 88%, predicted gold prices would rise next week.

Only one expert, accounting for 6%, believes that prices will fall, while another predicts gold will remain unchanged next week.

Meanwhile, an online survey with individual investors recorded a total of 268 votes, with optimistic sentiment continuing to maintain at a high level.

There are 184 investors, equivalent to 69%, expecting gold prices to rise next week, while 44 people, accounting for 16%, predict this precious metal will weaken. The remaining 40 people, accounting for 15% of the total, believe that gold prices will accumulate and remain unchanged next week.

Economic data to be monitored next week

Next week's economic data release schedule will focus on important figures on inflation and housing markets, along with regional US manufacturing surveys.

On Tuesday, the market will receive the US consumer price index (CPI) report in December, along with new home sales data for September and October. On Wednesday, the US will announce the producer price index (PPI) for October and November, along with retail sales in November and used housing data in December.

The economic data week will close on Thursday morning with a report on weekly unemployment claims, along with surveys of manufacturing activity in the Empire State region and the Philadelphia Federal Reserve (Philly Fed).

See more news related to gold prices HERE...