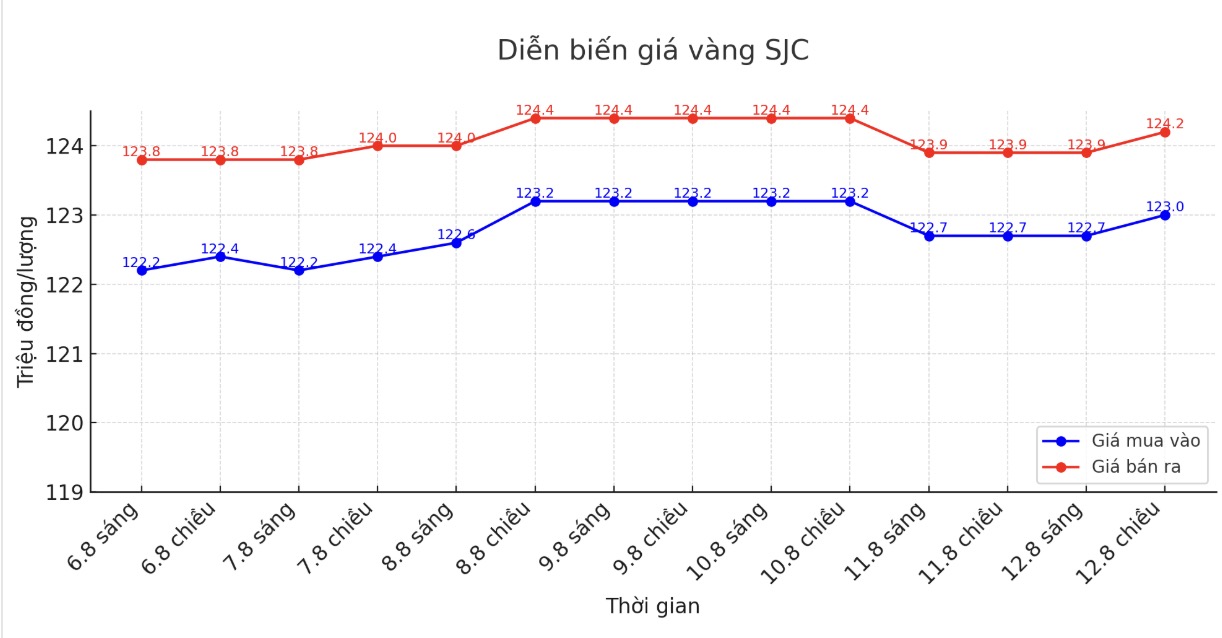

SJC gold bar price

As of 5:40 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND123.2 million/tael (buy in - sell out), an increase of VND300,000/tael for both buying and selling. The difference between buying and selling prices is at 1.2 million VND/tael.

DOJI Group listed at 122.7-123.9 million VND/tael (buy - sell), unchanged. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123-124.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 1.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.2-124.2 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

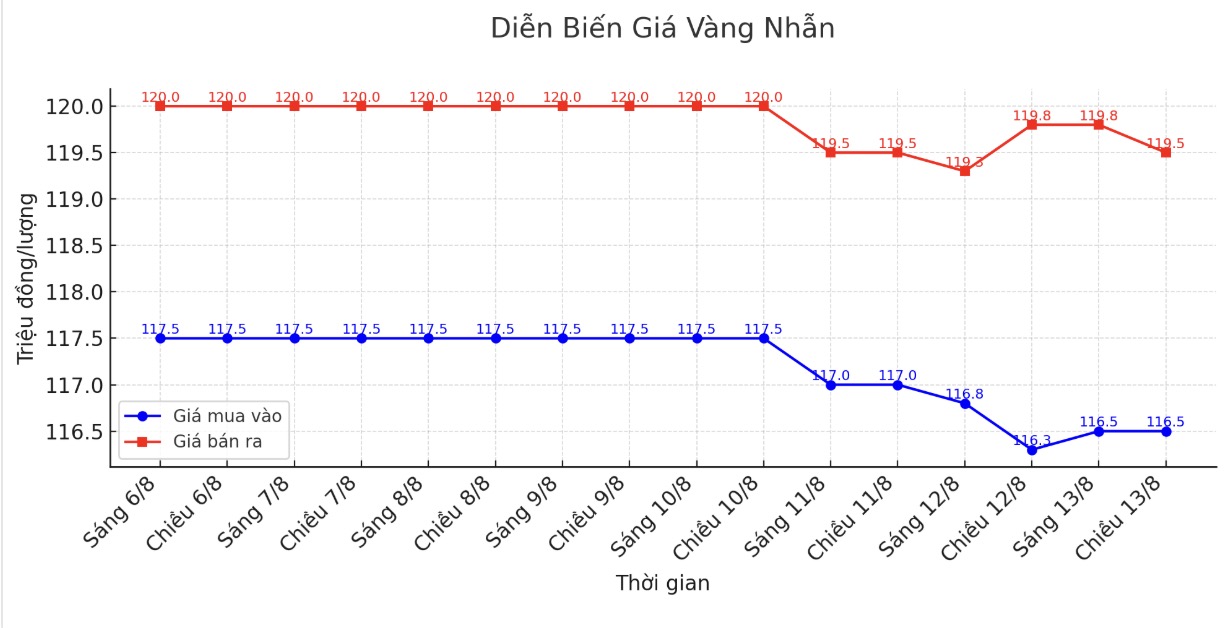

9999 gold ring price

As of 5:40 p.m., DOJI Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 300,000 VND/tael. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 to 3.5 million VND/tael, posing a potential risk of loss for investors.

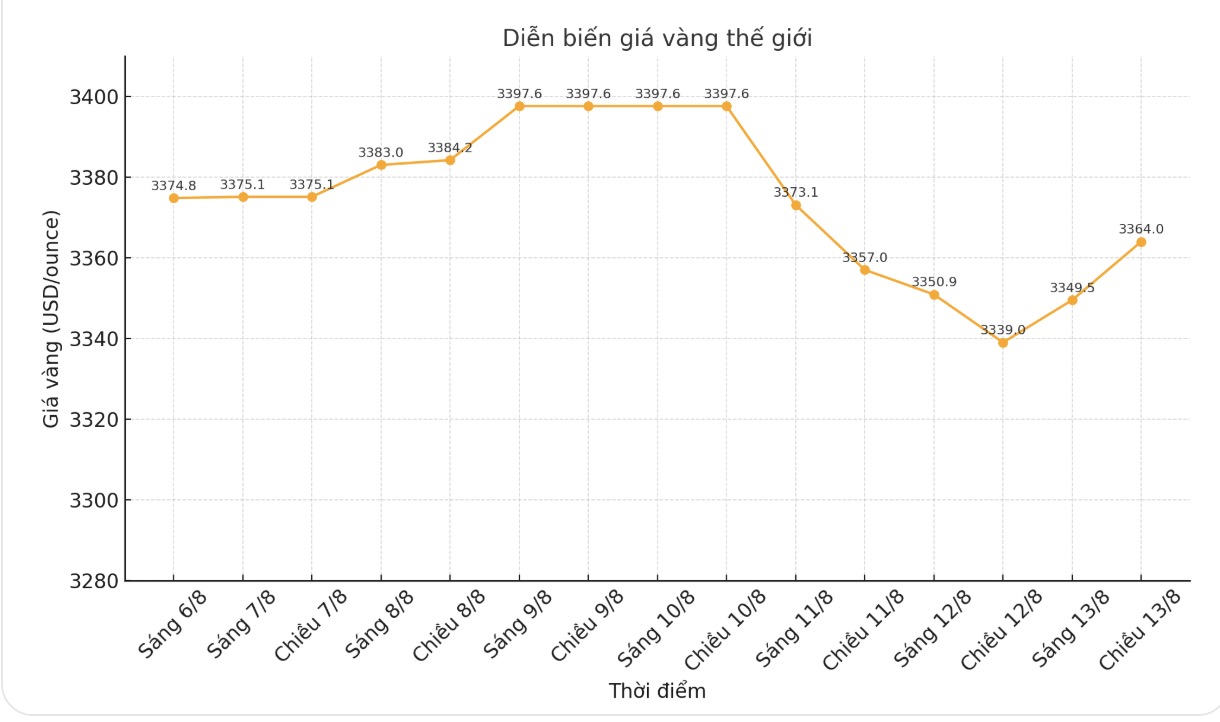

World gold price

The world gold price was listed at 5:30 p.m. at 3,364 USD/ounce, up 25 USD.

Gold price forecast

Gold prices increased as expectations of the US Federal Reserve (FED) cutting interest rates in September increased after moderate inflation data, while the weak USD boosted demand for this precious metal.

Investors are starting to debate whether the Fed will implement a 50 basis point cut at its September meeting, following the comments of US Treasury Secretary Bessent yesterday, focusing on the upcoming weak US economic data supporting this view, said UBS commodity analyst Giovanni Staunovo.

The market is now pricing in a more than 90% chance of a Fed rate cut next month, after July's slight inflation showed a limited impact of US import taxes on consumer prices, and it is expected that there will be at least one more rate cut before the end of the year.

Gold - a non-profit asset, is often considered a safe haven in the context of economic instability or geopolitics that often benefits in a low interest rate environment.

The USD (.DXY) hit a two-week low, making gold priced in greenback cheaper for overseas buyers.

Mr. Tim Waterer - Head of Market Analysis at financial services company KCM Trade - commented that the weakness of the USD has created conditions for a slight recovery in gold prices, with this precious metal fluctuating around 3,350 USD/ounce ahead of the meeting between the heads of the two countries Russia and the US on August 15.

The analyst added that if the meeting fails to resolve the issue and the conflict in Ukraine continues, gold may once again move towards the $3,400/ounce mark. Gold is often considered a safe investment channel in the context of many political and financial uncertainties.

European and Ukrainian leaders held online talks with US President Donald Trump on Wednesday, ahead of his summit with Russian President Vladimir Putin, to highlight the risks of bargaining Ukraine's interests for a ceasefire.

Meanwhile, the US and China have extended the tariff ceasefire by 90 days to avoid imposing three-digit tariffs on each other's goods.

Economic data to watch this week

Wednesday: Speeches by Barkin, Bostic and Goolsbee (FED).

Thursday: US PPI July, US jobless claims.

Friday: US retail sales in July, New York Empire State Production Index, Michigan Consumer Confidence Index (preliminary estimate).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...