According to the US Bureau of Labor Statistics, the consumer price index (CPI) increased 0.2% last month after an increase of 0.3% in June. This inflation data is in line with forecasts.

Full-term inflation rose 2.7% year-on-year, slightly below the forecast of 2.8%.

Meanwhile, core inflation - excluding food and energy prices - fluctuated by 0.3% in July (equal to the increase in June and in line with the forecast). However, core annual inflation rose 3.1%, slightly above the forecast of 3.0%.

Some economic experts believe that the annual increase in core CPI is an initial sign that high prices are gradually eating deep into the economy, not beneficial to consumption.

The report points to widespread increases in many groups of indicators, including healthcare, airfares, entertainment, household appliances and household appliances, and used cars and trucks.

Housing costs increased by 0.2% in the month, which is the main factor that pushes inflation up overall. On the positive side, the decrease in energy prices helped reduce pressure on consumers; the energy index decreased by 1.1% in July due to the decrease in gasoline prices by 2.2% in the month. The energy index fell 1.6% over the past year, but the food index rose 2.9% over the same period.

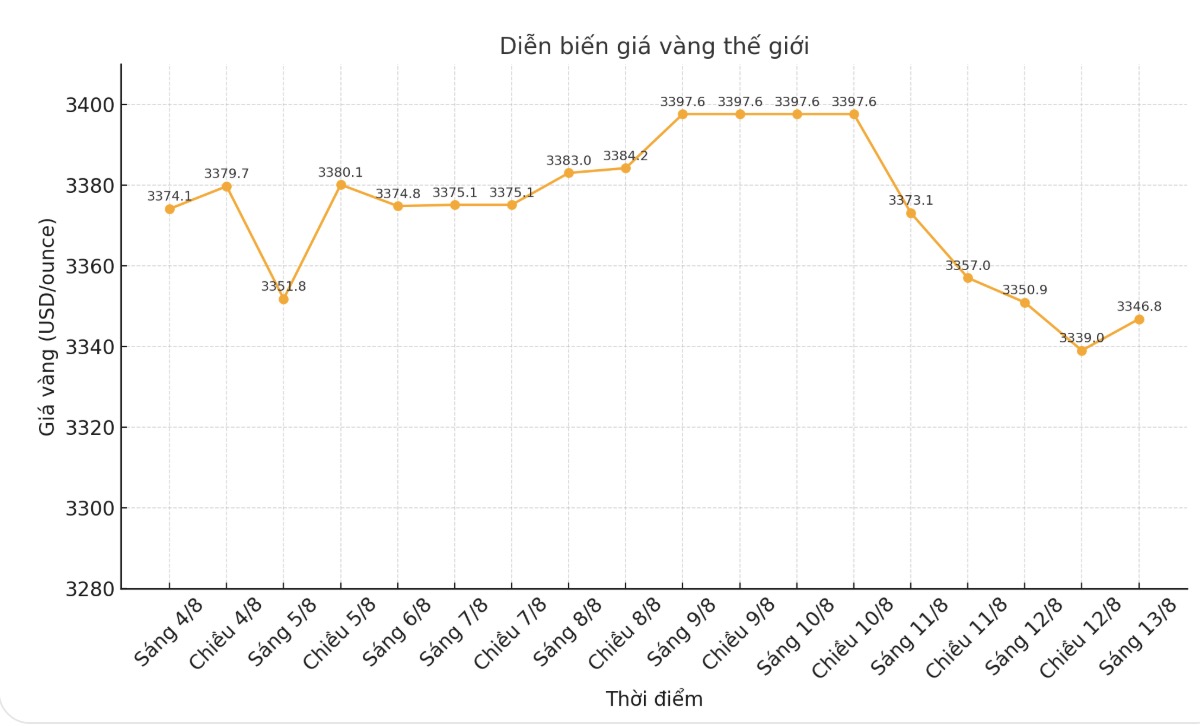

The gold market is recording a good increase after releasing inflation data, moving to the uptrend zone for the day. Spot gold prices recorded at 0:30 on August 13 (Vietnam time) increased slightly to 3,346.8 USD/ounce.

Typically, high inflation is considered a negative for gold because it could force the US Federal Reserve (FED) to maintain a tight monetary policy. However, the market still expects the Fed to cut interest rates in September, as weak labor market data continues to overwhelm concerns about rising consumer prices.

Analysts say this is a favorable environment for gold: high inflation combined with low interest rates will sharply reduce real yields, thereby reducing the opportunity cost of holding gold - a non-yielding asset.

Larry Tentarelli - Chief Technical Strategist of Blue chip Daily Trend Report - said that although inflation increased overall last month lower than expected, it was still at a high level, putting the FED in a difficult position.

While some data do not form a trend, two consecutive months of 12-month inflation increases will make it difficult for the Fed to justify the interest rate cut at the meeting on September 17.

We do not expect a rate cut in September unless the job market falls sharply in the next 45 days. If the Fed is forced to choose between supporting the labor market and curbing inflation, we believe it will prioritize protecting the labor market, he said.

Jeffrey Roach - Chief Economist of LPL Financial commented that although core inflation increases, this will not prevent the FED from cutting interest rates.

Investors must accept the fact that inflation is higher than the FED's target in the context of slowing growth, setting a "stagflation-lite" scenario. Despite rising core inflation, we still expect the Fed to cut interest rates next month, as it focuses more on a weakening labor market, the expert said.