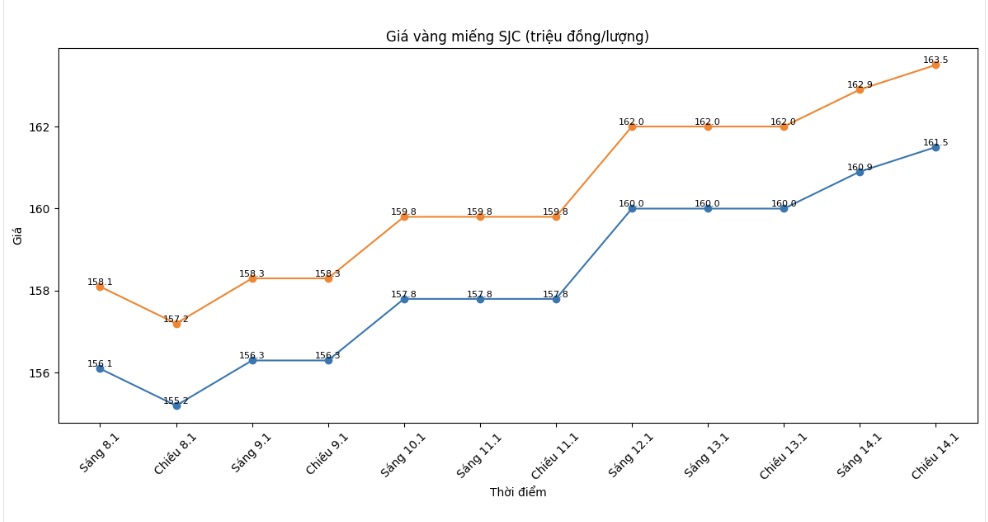

SJC gold bar price

As of 5:00 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 161.5-163.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 161.5-163.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 161-163.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

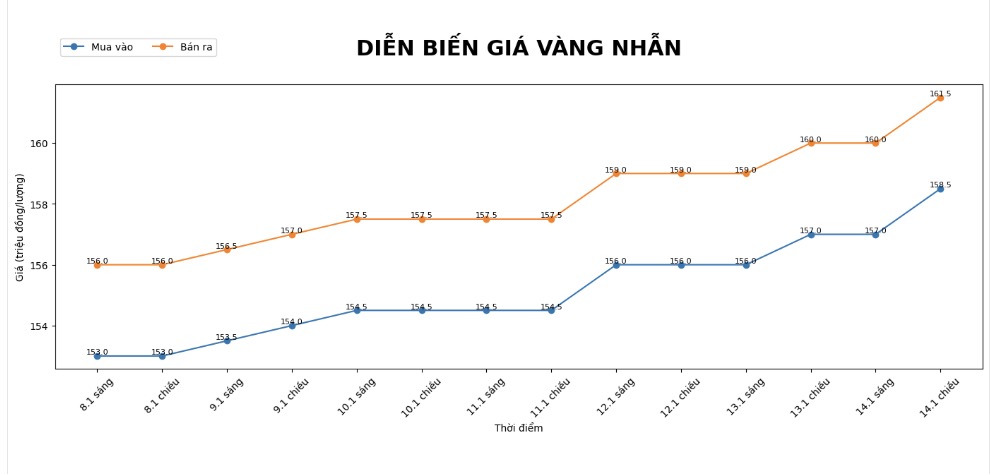

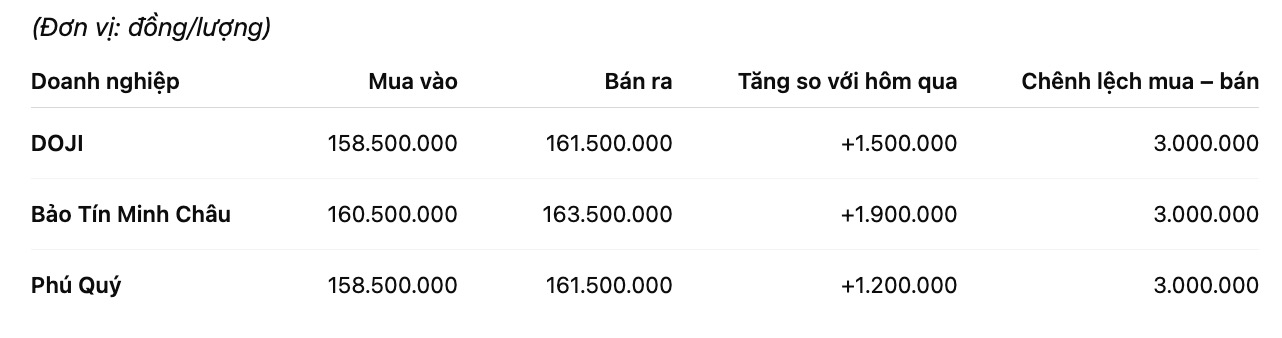

9999 gold ring price

As of 5:00 PM, DOJI Group listed the price of plain gold rings at 158.5-161.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 160.5-163.5 million VND/tael (buying - selling), an increase of 1.9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 158.5-161.5 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

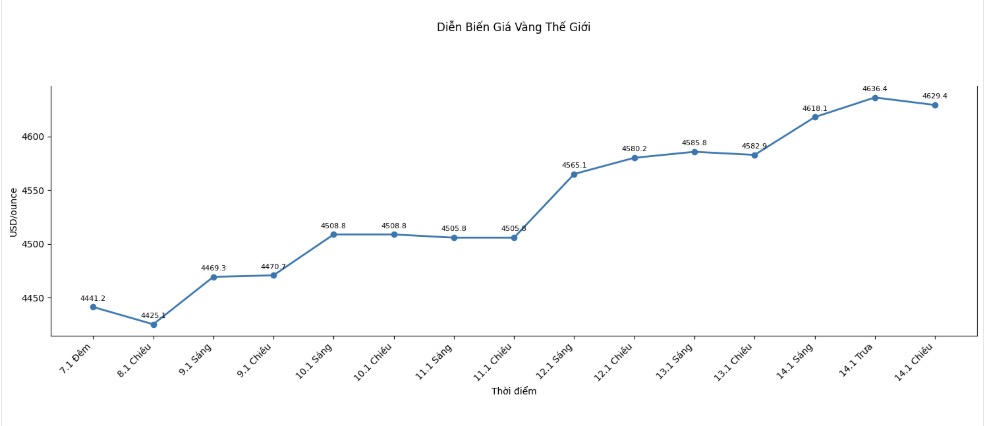

World gold price

World gold prices listed at 5:05 PM were at 4,629.4 USD/ounce, up 46.5 USD compared to the previous day.

Gold price forecast

The developments of the world gold market are showing a particularly sensitive period, when both macroeconomic and geopolitical factors simultaneously create momentum for the precious metal.

In the context of inflation in the US cooling down faster than expected, investors are increasingly betting on the possibility that the US Federal Reserve (Fed) will soon reverse monetary policy, opening a cycle of interest rate cuts from mid-year onwards.

According to Kitco, spot gold prices have continuously approached record highs, reflecting that safe-haven cash flow is returning strongly. Weakening inflation figures have caused real yields to decrease, increasing the attractiveness of gold - an asset that does not generate profits but has the ability to preserve value in a low-interest environment.

In addition, instability related to the Middle East situation as well as controversies surrounding the Fed's independence have weakened confidence in the USD, further supporting the upward trend of precious metals.

Not only gold, the silver market is also witnessing a rare breakthrough. The fact that silver prices exceeded the 90 USD/ounce mark is seen as a signal that investors are expanding their shelter to other metals, in the context that global risks show no signs of cooling down.

From a medium-term perspective, Citigroup made a rather bold assessment when raising the gold price target to 5,000 USD/ounce in the next few quarters. Citi's strategic group believes that three key factors including geopolitical tensions, material supply shortages and concerns about the Fed's monetary policy are creating a solid foundation for a new upward cycle of precious metals.

However, the bank also noted that if global hotspots subside in the second half of the year, shelter demand may decrease and gold will be the metal most clearly under adjustment pressure.

Sharing the same positive view, Mr. Nick Cawley - an analyst at Solomon Global - said that gold and silver still have a lot of room to increase in the first half of 2026.

In an environment where investors are increasingly moving away from the USD to find safe havens, gold adjustments should only be seen as buying opportunities" - Mr. Cawley emphasized. According to this expert, psychological milestones such as 5,000 USD/ounce for gold and 100 USD/ounce for silver may soon be challenged, accompanied by stronger fluctuations in the market.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...