SJC gold bar price

As of 9:30 am, SJC gold bar prices were listed by DOJI Group at the threshold of 160.9-162.9 million VND/tael (buying - selling), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 160.9-162.9 million VND/tael (buying - selling), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 160.4-162.9 million VND/tael (buying - selling), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

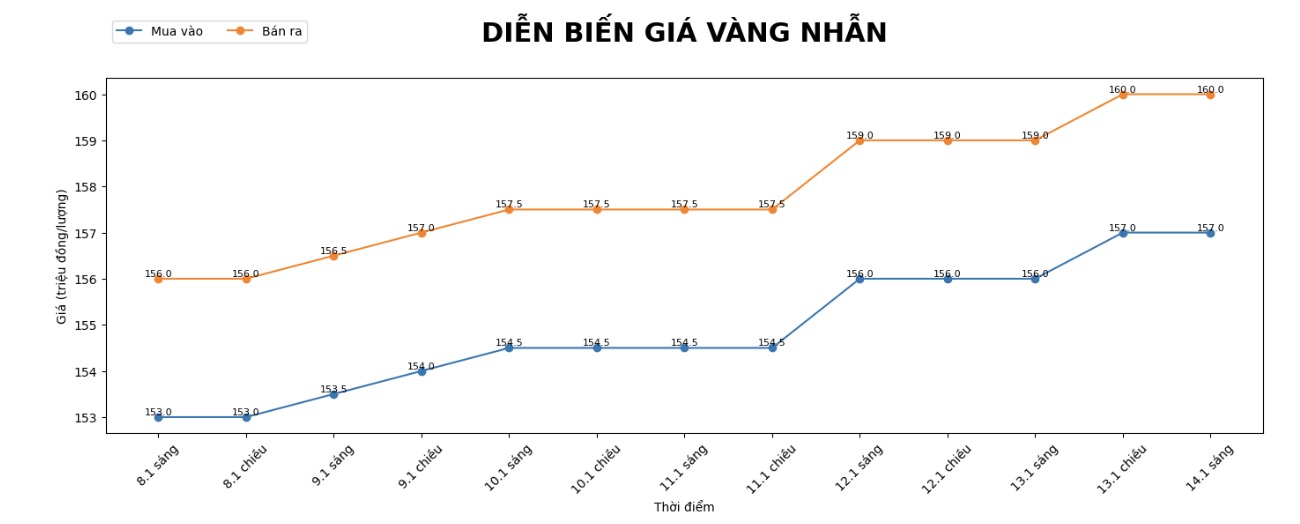

9999 gold ring price

As of 9:30 am, DOJI Group listed the price of gold rings at 157-160 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 159.9-162.9 million VND/tael (buying - selling), an increase of 1.9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 158.2-161.2 million VND/tael (buying - selling), an increase of 900,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

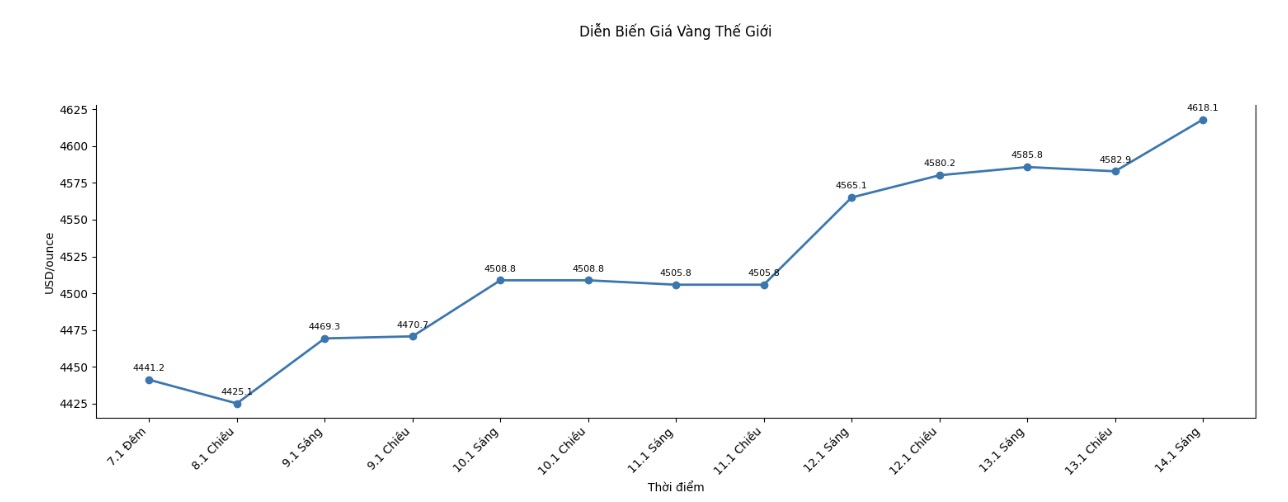

World gold price

At 9:38 am, world gold prices were listed around the threshold of 4,585.8 USD/ounce, up 20.7 USD compared to the previous day.

Gold price forecast

World gold prices continue to remain at historical peaks as safe-haven money continues to flow strongly into precious metals amid global economic and geopolitical instability.

In last night's trading session on the Comex exchange, February gold futures at one point jumped to $4,644/ounce - the highest ever - before slightly adjusting to around $4,613/ounce. Gold's upward momentum took place in parallel with silver's strong breakthrough, as the price of this metal approached the $90/ounce mark.

The main driving force of the market comes from concerns about geopolitical risks and the weakening of the monetary environment in the US. The latest inflation data released shows that the core CPI in December only increased by 0.2% compared to the previous month and 2.6% compared to the same period - lower than forecast.

This development reinforces expectations that the US Federal Reserve (Fed) will continue its monetary easing roadmap this year, thereby increasing the attractiveness of gold – a non-profit asset.

Mr. David Meger - Director of Metal Trading at High Ridge Futures, said that the market is reacting positively to the downward inflation context. "The fairly moderate CPI data has opened up room for the Fed to cut interest rates in the near future, which is supporting gold prices to maintain their upward trend," he said.

From a medium and long-term perspective, gold's prospects are still positively assessed. In a newly released report, Mr. Nick Cawley, a market analyst at Solomon Global, forecasts that gold prices may reach the 5,000 USD/ounce mark in the first half of 2026.

According to him, the combination of geopolitical tensions, loose monetary policy and risk-avoidance is creating a solid foundation for the precious metal. "Any adjustment of gold in this period should also be seen as an opportunity to accumulate more position," Mr. Cawley assessed.

Technically, the gold market is still in a strong upward trend. The nearest resistance levels are determined around the 4,640 – 4,675 USD/ounce range, while the 4,580 – 4,550 USD/ounce area is playing an important supporting role. When macroeconomic factors show no signs of stabilization, gold is likely to continue to play the role of a priority shelter channel for global investors in the coming time.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...