Gold prices rose sharply in Wednesday's trading session, approaching a record high set in the previous session, while silver for the first time in history surpassed the 90 USD/ounce mark.

This increase comes from lower-than-expected US inflation figures, reinforcing expectations that the US Federal Reserve (Fed) will soon cut interest rates, amid rising geopolitical risks.

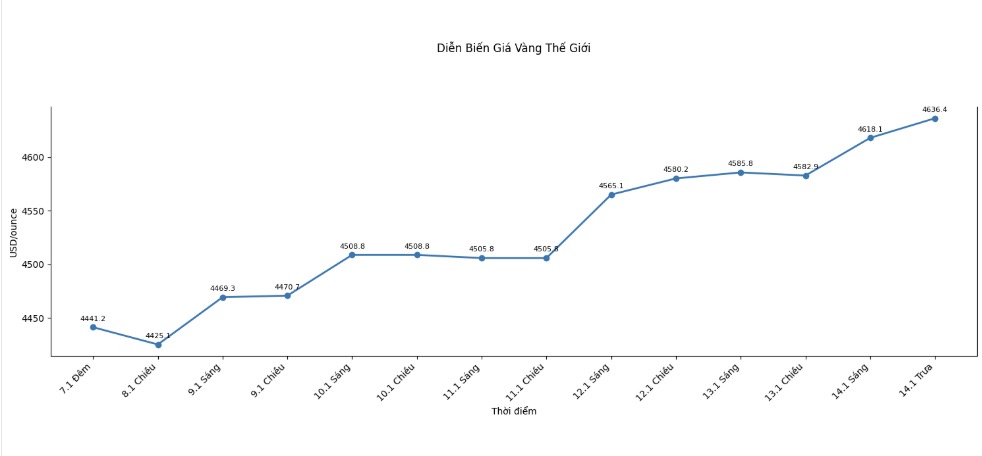

At 4:06 AM (GMT), spot gold prices rose 0.9% to $4,627.95 an ounce, after hitting a record high of $4,634.33 on Tuesday. Gold futures for February on the US exchange also rose 0.8% to $4,635.6 an ounce.

US President Donald Trump welcomed the newly released inflation figures, and continued to call on Fed Chairman Jerome Powell to "significantly cut interest rates".

Meanwhile, global central bank governors and many CEOs of major Wall Street banks simultaneously spoke out in support of Mr. Powell on Tuesday, after information appeared that he was being investigated.

Analysts believe that concerns about the Fed's independence as well as confidence in US assets have contributed to boosting safe haven demand, thereby pushing gold prices up.

Investors currently expect the Fed to have two interest rate cuts, each of 0.25 percentage points this year, with the earliest of which may take place in June.

Non-profit assets such as gold often perform well in low interest rates as well as when geopolitical and economic instability increases.

In another development, Iran is still witnessing the largest wave of protests in many years.

On the other precious metal market, spot platinum prices rose 4.7% to $2,432.8/ounce, the highest level in a week. Previously, this metal set a record of $2,478.50/ounce on December 29. Palladium prices also rose 3.7%, to $1,910.08/ounce.

See more news related to gold prices HERE...