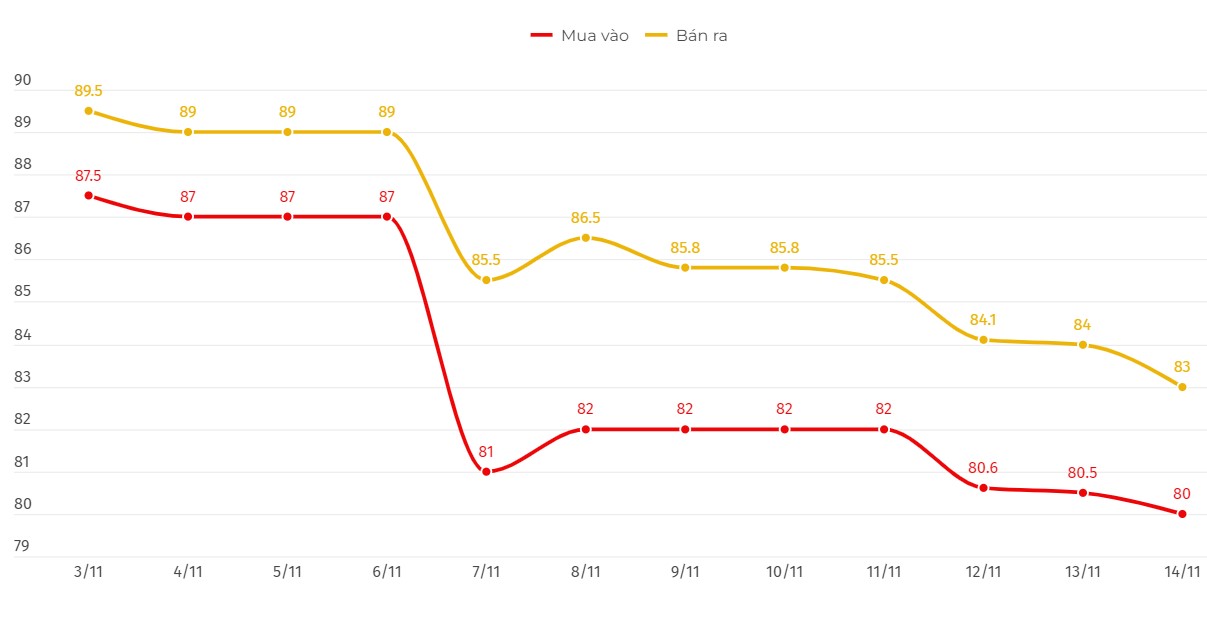

Update SJC gold price

As of 5:25 p.m., the price of SJC gold bars listed by DOJI Group was at 80-83.5 million VND/tael (buy - sell).

Compared to the close of the previous trading session, gold price at DOJI decreased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 80-83.5 million VND/tael (buy - sell).

Compared to the closing price of the previous trading session, the gold price at Saigon Jewelry Company SJC decreased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 80-83.5 million VND/tael (buy - sell).

Compared to the previous trading session, gold price at Bao Tin Minh Chau decreased by 700,000 VND/tael for buying and 500,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 3.5 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 3.5 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

Price of round gold ring 9999

As of 5:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 79.8-82.1 million VND/tael (buy - sell), down 1.3 million VND/tael for buying and down 1.1 million VND/tael for selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 80.12-82.22 million VND/tael (buy - sell); down 1.06 million VND/tael for buying and down 960,000 VND/tael for selling.

World gold price

As of 5:25 p.m., the world gold price listed on Kitco was at 2,542.4 USD/ounce, down sharply by 66.2 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices plummeted amid a surge in the USD index. Recorded at 5:25 p.m. on November 14, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 106.922 points (up 0.51%).

Mr. Kyle Rodda - financial market analyst of online trading platform Capital.com - said that at this time, gold prices are being dominated by fluctuations in the US dollar and bond yields.

According to him, although the recently released October inflation data shows that the US Federal Reserve (FED) may cut interest rates slightly next month, inflation is expected to increase next year, thereby causing the FED to cut interest rates less.

Data released on November 13 showed that U.S. consumer prices rose as expected in October and that the pace of disinflation has slowed in recent months. Gold is seen as a hedge against inflation, but higher interest rates will reduce the appeal of the non-yielding asset.

Meanwhile, Fed officials remain cautious about future rate cuts, given the potential risks to inflation. St. Louis Fed President Alberto Musalem predicts a gradual decline in inflation, but Dallas Fed President Lorie Logan warns that too much monetary easing could spark a resurgence of inflation.

The recent pullback has some people questioning the precious metal’s ability to continue its rally, but gold still has medium- and long-term support because of a number of supporting factors, said Axel Rudolph, senior technical analyst at IG in London.

The expert said that gold supply remains constrained, which will also support the market. “Despite rising prices, gold production has remained relatively stable over the past decade, creating a significant supply-demand imbalance,” he said. “A number of factors limit output, including declining ore grades, a dearth of large new mine discoveries, and rising political risks in key producing regions. Environmental concerns also limit mining expansion.”

From a technical perspective, Rudolph said that $2,600 an ounce could be attractive to investors. However, he warned that "a continued decline and a weekly close below the September 18 low of $2,546.86 an ounce could lead to a deeper correction."

Investors are now awaiting the US Producer Price Index (PPI) and weekly jobless claims data, scheduled for release on November 14, as well as a speech on the same day by FED Chairman Jerome Powell.

See more news related to gold prices HERE...