Update SJC gold price

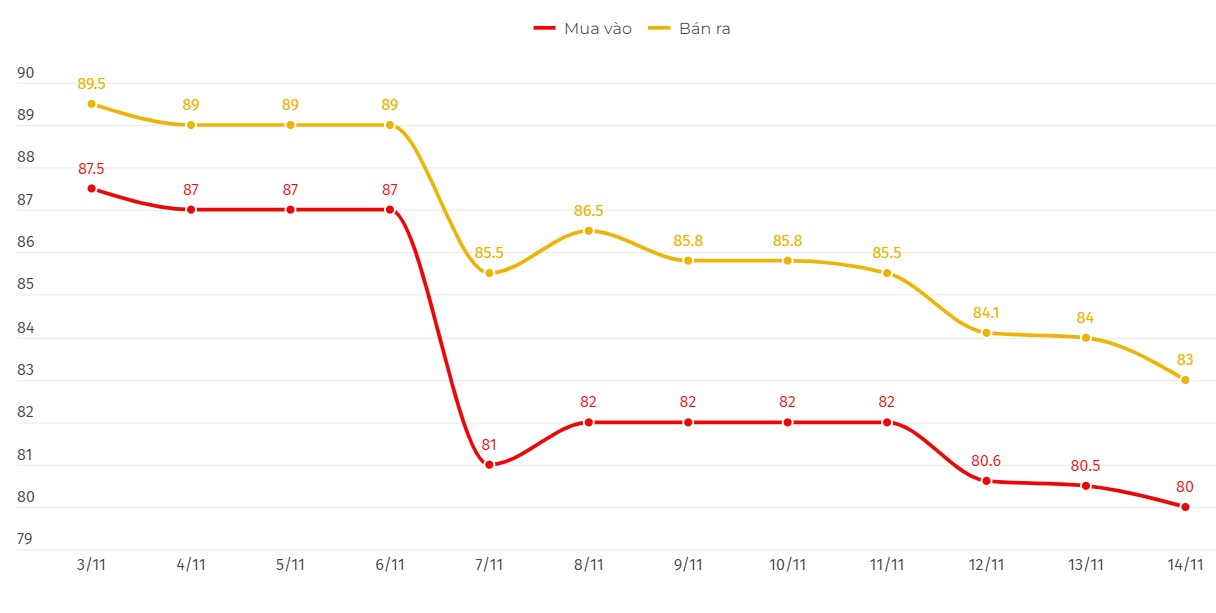

As of 9:30 a.m., the price of SJC gold bars was listed by DOJI Group at 80-83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at DOJI decreased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 80-83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC decreased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 80-83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at Bao Tin Minh Chau decreased by 700,000 VND/tael for buying and decreased by 500,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 3.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

Price of round gold ring 9999

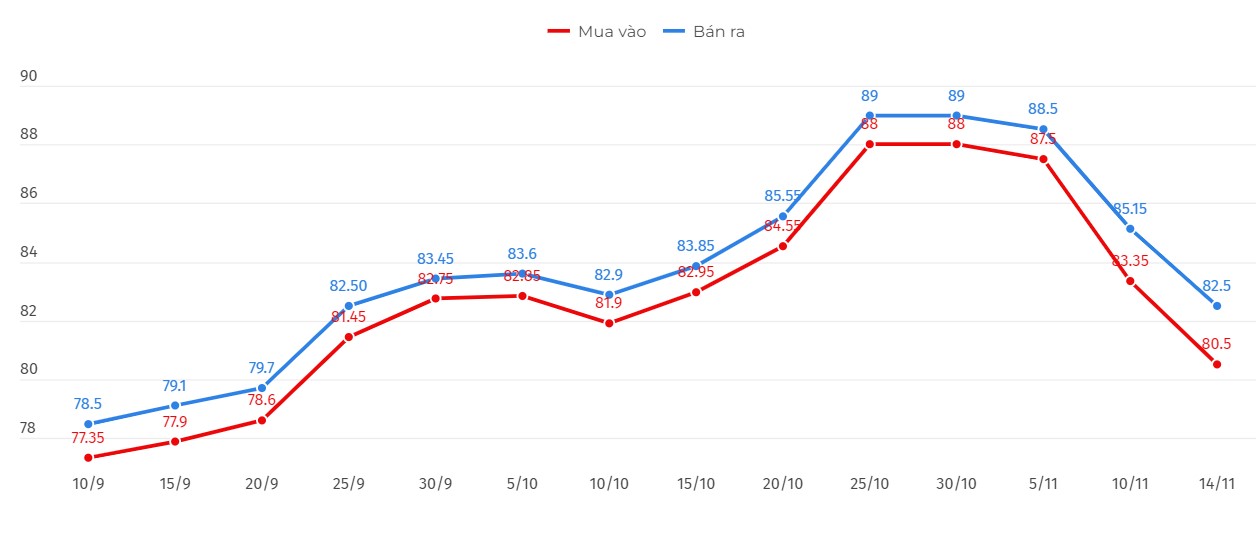

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 80.5-82.5 million VND/tael (buy - sell); down 900,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 80.52-82.67 million VND/tael (buy - sell), keeping the buying price unchanged and decreasing 450,000 VND/tael for selling price compared to early this morning.

World gold price

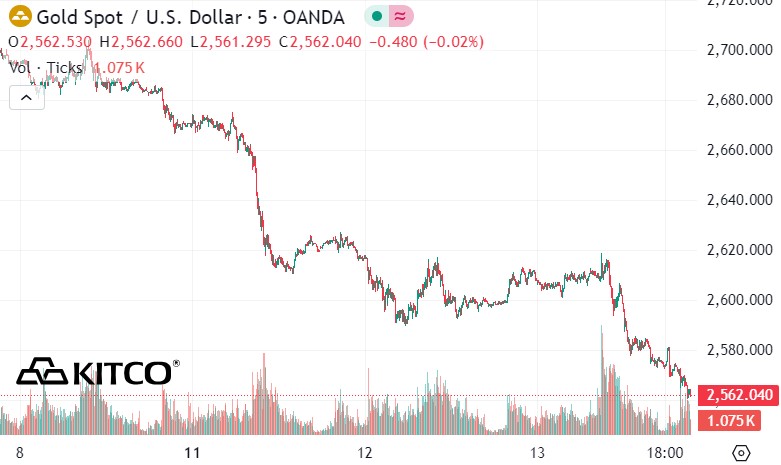

As of 9:30 a.m., the world gold price listed on Kitco was at 2,562 USD/ounce, down 45.7 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell due to pressure from the strong increase of the USD. Recorded at 9:30 a.m. on November 14, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 106.535 points (up 0.14%).

Despite the sharp decline, gold still has medium- and long-term support as there are many supporting factors, according to Axel Rudolph, senior technical analyst at IG in London.

Rudolph analyzed the stability of gold's long-term uptrend. The first major factor he looked at was government buying.

“Central bank gold purchases have reached historic levels, with nearly 400 tonnes purchased in the first half of 2022 alone – the fastest pace in 55 years. By July 2024, global gold purchases reached their highest level in nearly 14 years,” he said.

The surge is “a significant shift,” Rudolph said, as central banks have shifted “from net sellers to active buyers” over the past decade. Major institutions in Russia, China, India, Poland and Hungary have significantly increased their gold reserves.

"The main driver behind this trend is diversification. Central banks are looking to reduce their exposure to currencies and bonds. With global debt at record levels, gold acts as an important hedge against market risks. Central bank purchases have created sustained upward pressure on gold prices, contributing to a record high of nearly $2,800 an ounce just a few weeks ago," the expert analyzed.

From a technical perspective, Rudolph said that $2,600 an ounce could be attractive to investors. However, he warned that "a continued decline and a weekly close below the September 18 low of $2,546.86 an ounce could lead to a deeper correction."

"According to the technical chart, the next resistance level for gold is $2,700 and the support level is $2,500/ounce," said Jim Wyckoff, market analyst at Kitco Metals.

Today, the US will release the Producer Price Index (PPI) and the number of weekly unemployment claims. Tomorrow, officials will continue to announce retail sales. Speeches by the Chairman of the US Federal Reserve (FED) - Mr. Jerome Powell and other officials will also be noted.

See more news related to gold prices HERE...