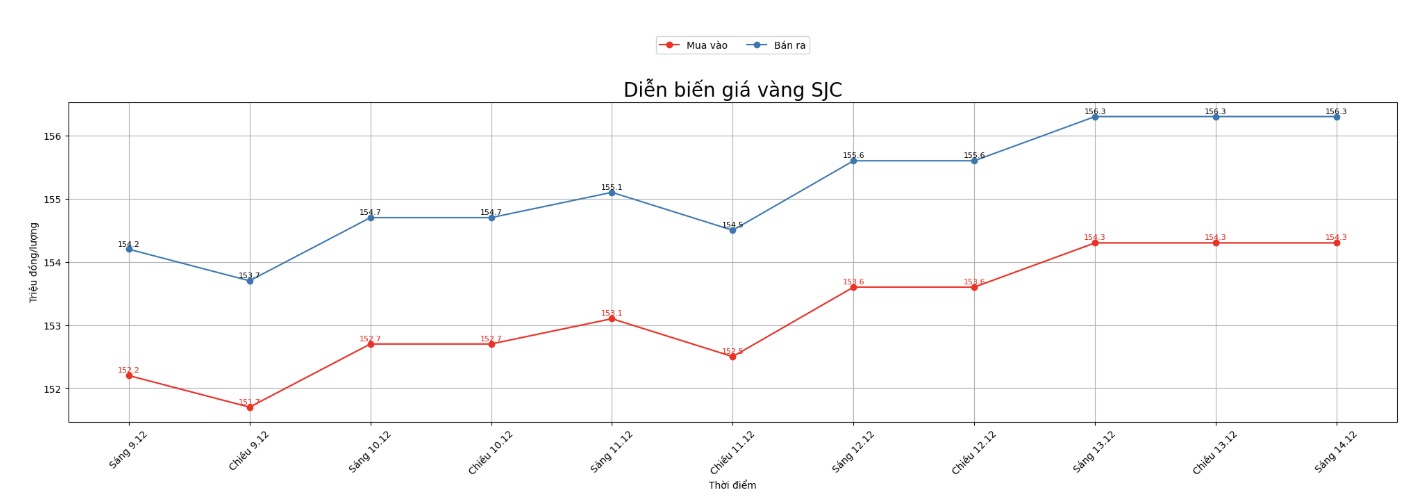

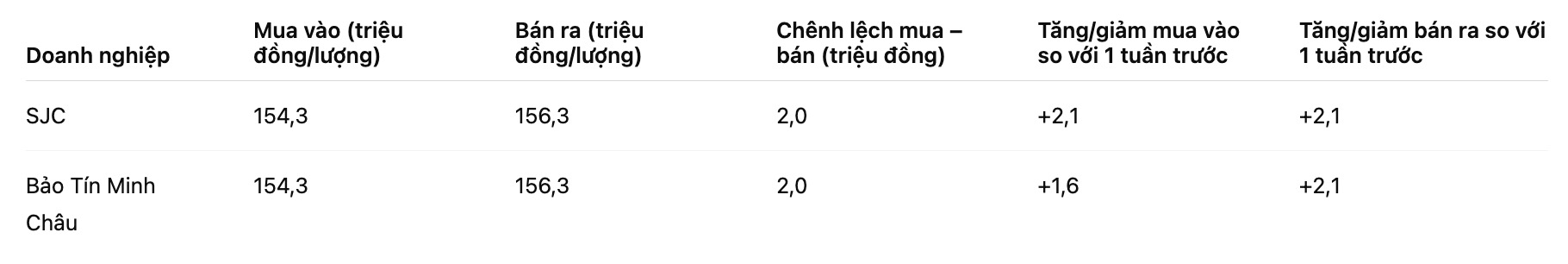

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 154.3-156.3 million VND/tael (buy in - sell out). The difference between buying and selling is at 2 million VND/tael.

Compared to the closing price of the previous trading session (December 7, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 2.1 million VND/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 154.3-156.3 million VND/tael (buy in - sell out). The difference between buying and selling is at 2 million VND/tael.

Compared to a week ago, the price of SJC gold bars was increased by 1.6 million VND/tael for buying and 2.1 million VND/tael for selling.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau in the session of December 7 and selling it in today's session (December 14), buyers will make a profit of VND100,000/tael.

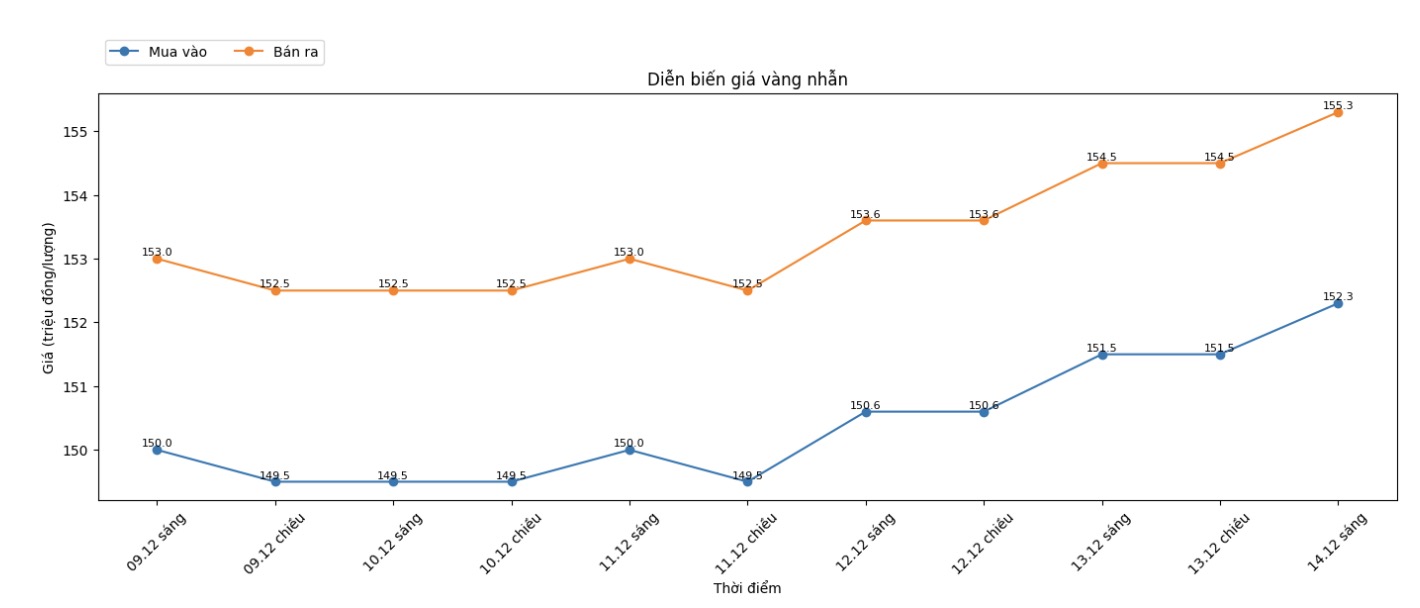

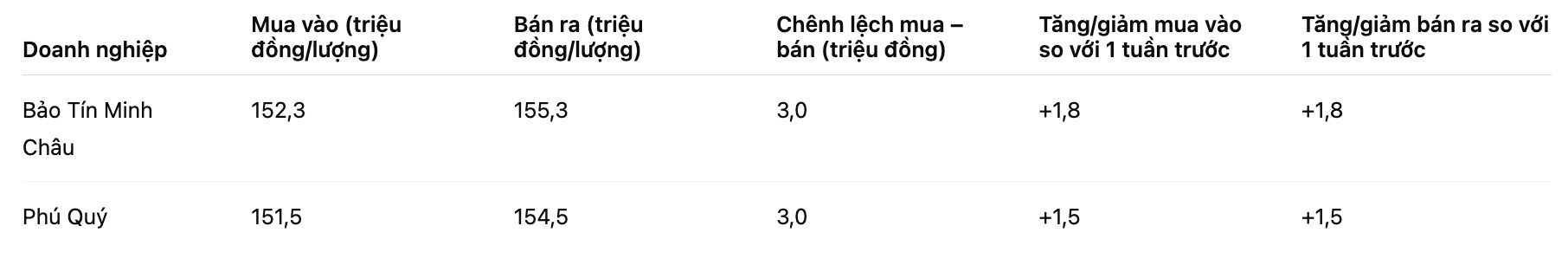

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 152.3-155.3 million VND/tael (buy - sell); increased by 1.8 million VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of December 7 and selling in today's session (December 14), buyers at Bao Tin Minh Chau will lose 1.2 million VND/tael. Meanwhile, the loss when buying in Phu Quy was 1.5 million VND/tael.

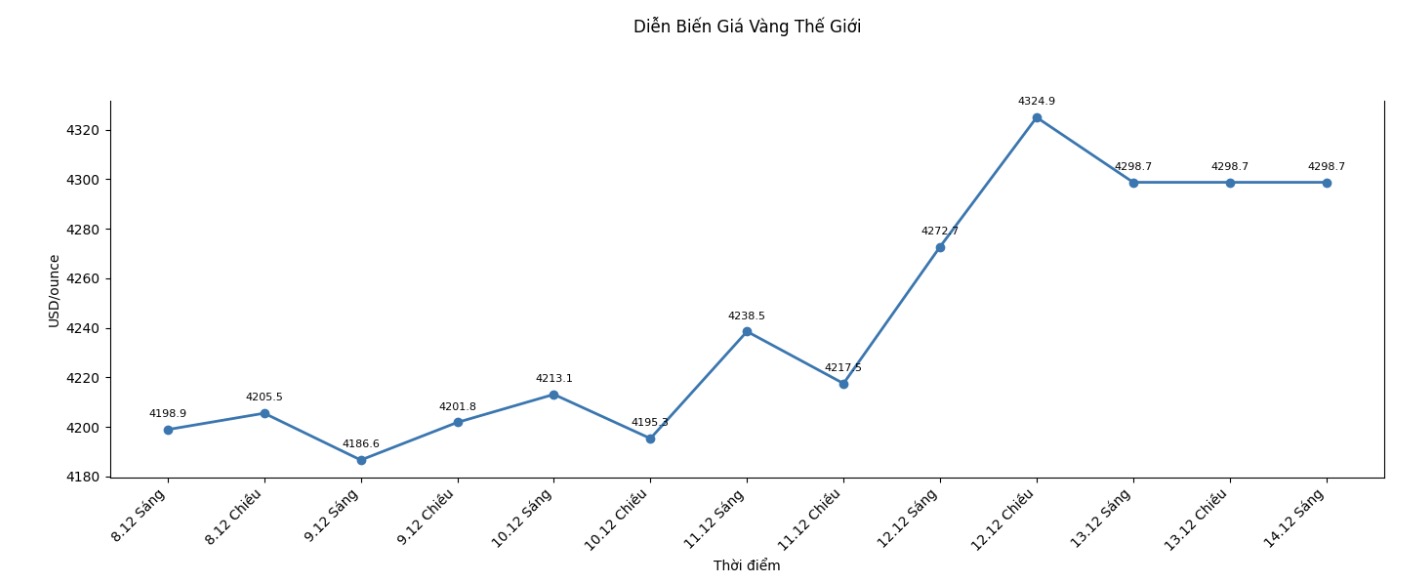

World gold price

At the end of the trading session of the week, the world gold price was listed at 4,298.7 USD/ounce, down 101.4 USD compared to a week ago.

Gold price forecast

Neils Christensen - an analyst at Kitco News - said that since the beginning of the year, gold prices have set nearly 50 new historical peaks, currently trading around 4,300 USD/ounce before the weekend break. Gold has gained more than 65% this year, recording its strongest annual gain since 1979.

It is difficult to imagine which scenario could cause the precious metal bubble to "bleep up". Will interest rates increase again next year? Will globalization make a strong comeback? Will government spending be tightened?

Neils Christensen said these are all questions the unit has asked analysts during the year-end series. So far, the answer is almost consistent: difficult to achieve.

Many experts predict that the US Federal Reserve (Fed) will continue to cut interest rates even if inflation remains persistent. This means real yields will continue to fall, reducing the opportunity cost of gold - a non-interest-bearing asset.

At the same time, economic and geopolitical instability is expected to continue to hold back GDP growth next year. Although a new AI economy could help the stock market maintain positive support through 2026, the growing risks in the stock market make gold an attractive portfolio diversification tool.

Although demand for gold has reached an unprecedented level this year, this precious metal still accounts for only a very small proportion of total global financial assets. That shows that there is still a lot of room for capital to continue moving into the gold market.

So what do all these factors mean for precious metals? Despite the lack of absolute consensus, many analysts still believe that the price of 5,000 USD/ounce for gold is a completely feasible target for next year. Meanwhile, silver prices may increase to 75 80-85 USD/ounce, and some even predict that silver could reach 100 USD.

Mr. Lukman Otunuga - Senior Market Analyst at FXTM - said that gold's upward momentum is still very solid, with the goal of moving towards higher price levels.

A clear breakout in this zone could pave the way for prices to $4,400 and beyond. Conversely, if weakened below $4,300, prices could sell off again to $4,240 and $4,200, he said. As the market is pricing at least two rate cuts by the Fed next year, buyers have room to expect. A widely weakening USD and central bank demand could continue to support deep gold's rally into 2026".

See more news related to gold prices HERE...