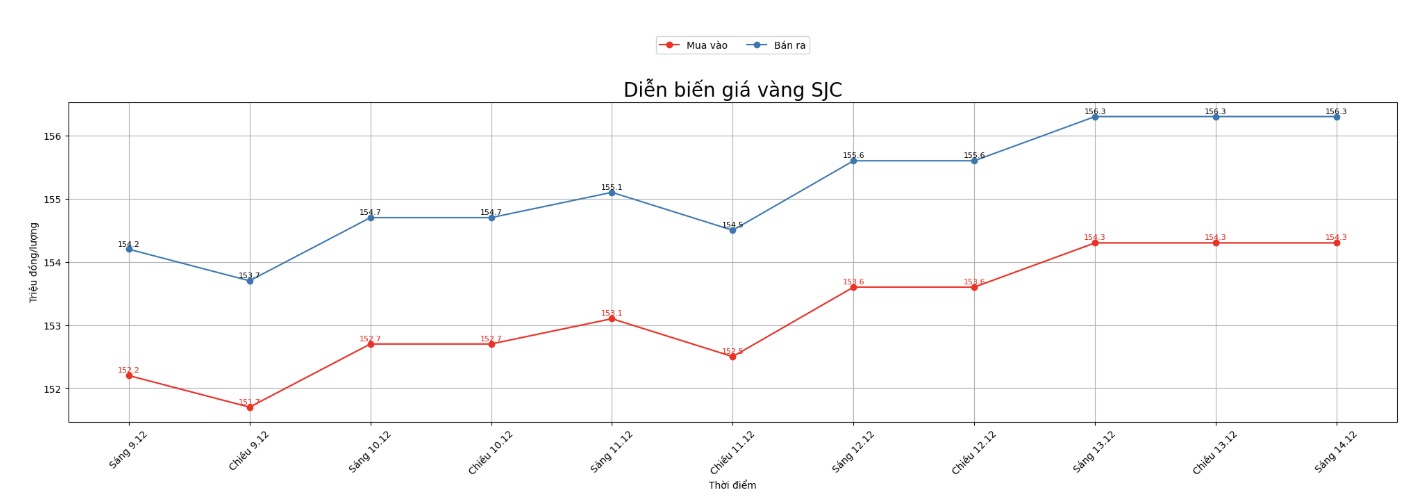

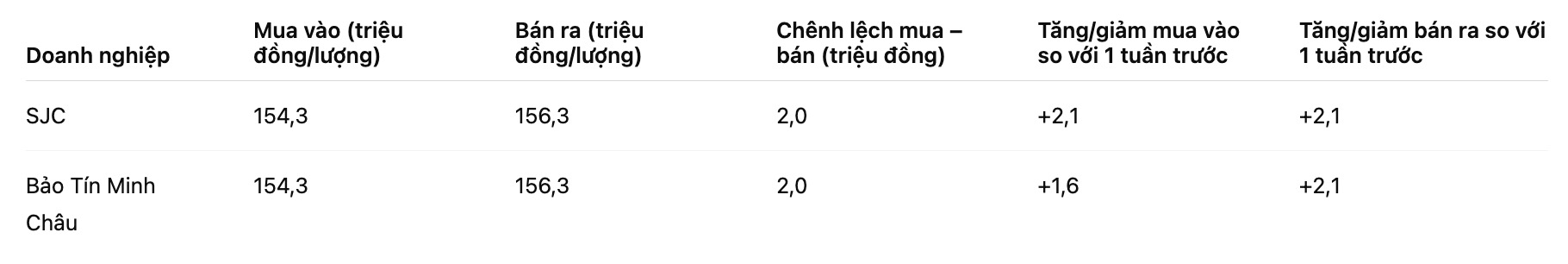

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 154.3-156.3 million VND/tael (buy in - sell out). The difference between buying and selling is at 2 million VND/tael.

Compared to the closing price of the previous trading session (December 7, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 2.1 million VND/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 154.3-156.3 million VND/tael (buy in - sell out). The difference between buying and selling is at 2 million VND/tael.

Compared to a week ago, the price of SJC gold bars was increased by 1.6 million VND/tael for buying and 2.1 million VND/tael for selling.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau in the session of December 7 and selling it in today's session (December 14), buyers will make a profit of VND100,000/tael.

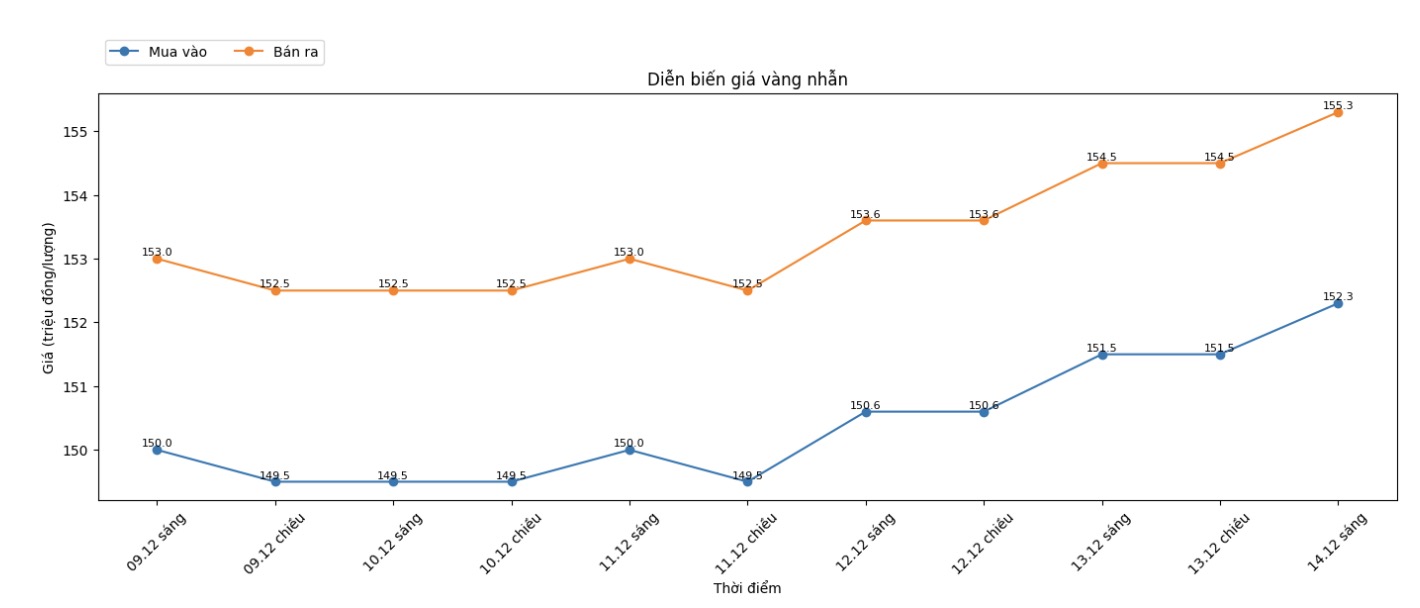

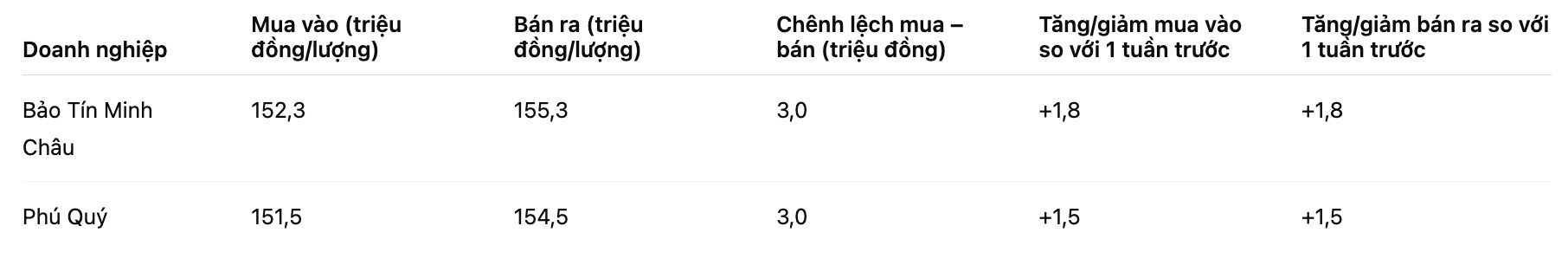

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 152.3-155.3 million VND/tael (buy - sell); increased by 1.8 million VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of December 7 and selling in today's session (December 14), buyers at Bao Tin Minh Chau will lose 1.2 million VND/tael. Meanwhile, the loss when buying in Phu Quy was 1.5 million VND/tael.

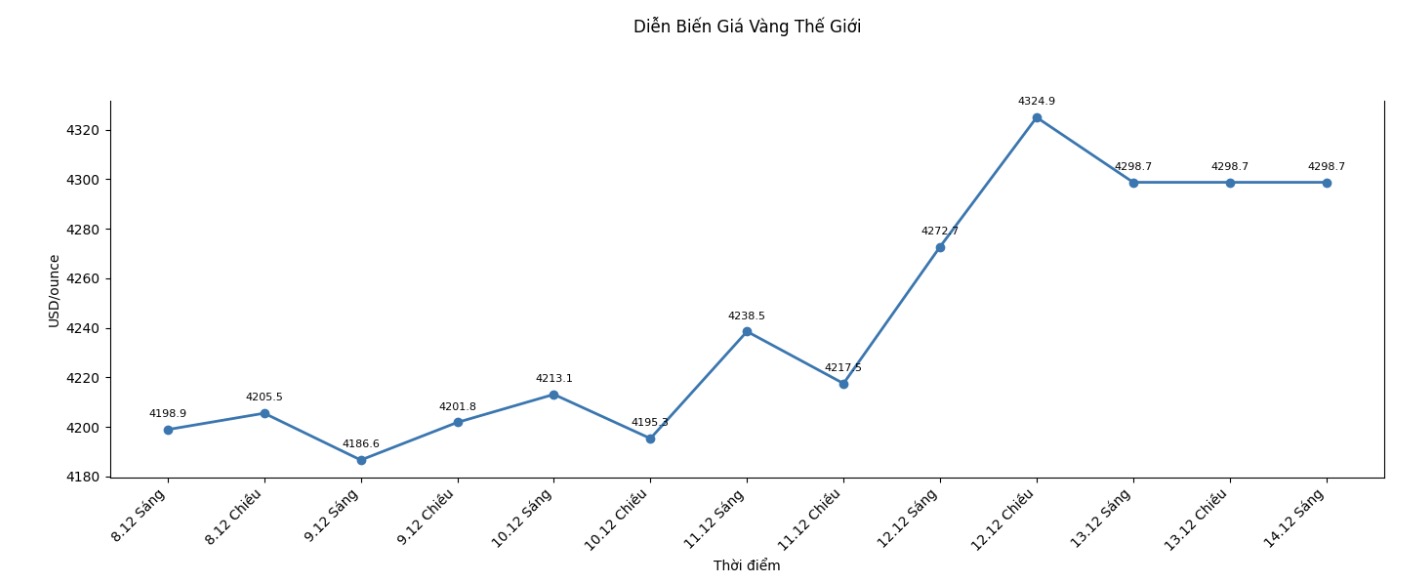

World gold price

At the end of the trading session of the week, the world gold price was listed at 4,298.7 USD/ounce, down 101.4 USD compared to a week ago.

Gold price forecast

Mr. Lukman Otunuga - Senior Market Analyst at FXTM - said that gold's upward momentum is still very solid, with the goal of moving towards higher price levels.

A clear breakout in this zone could pave the way for prices to $4,400 and beyond. Conversely, if weaken below $4,300, prices could sell off again to $4,240/ounce and $4,200/ounce, he said. As the market is pricing in at least two Fed rate cuts next year, buyers have foundation to expect. A widely weakening USD and central bank demand could continue to support deep gold's rally into 2026".

Although gold is attracting new buying momentum, analysts also warn that entering the holiday season could increase volatility. thin liquidity in the last full trading week of 2025 could distort technical signals and lead to strong price fluctuations.

Mr. Aaron Hill - Director of Market Analysis at FP Markets - said he expects gold to trade in a wide range of 4,250 - 4,380 USD/ounce.

Smooth liquidity will make the market bustle - just need a quiet night, you can wake up and see that the price has shifted by $60 compared to when you go to bed - but the general trend is still going up.

I will monitor the $4,255 an ounce mark as a key boundary. If it breaks through this level, prices could quickly slide to $4,200/ounce in a low-volume environment. But as long as that mark remains, I still consider each correction as an opportunity," he said.

In addition to the possibility of fluctuations, the US Department of Labor will release October and November employment data next week, along with November inflation data.

According to consensus forecasts, economists believe that the US economy only created about 50,000 more jobs last month, showing that the labor market continued to cool down. Meanwhile, the Consumer Price Index (CPI) is forecast to increase back above 3%.

Commodity analysts believe that the current data context is still beneficial for gold, as weak economic activity increases the pressure for the Fed to soon start the interest rate cut cycle.

See more news related to gold prices HERE...