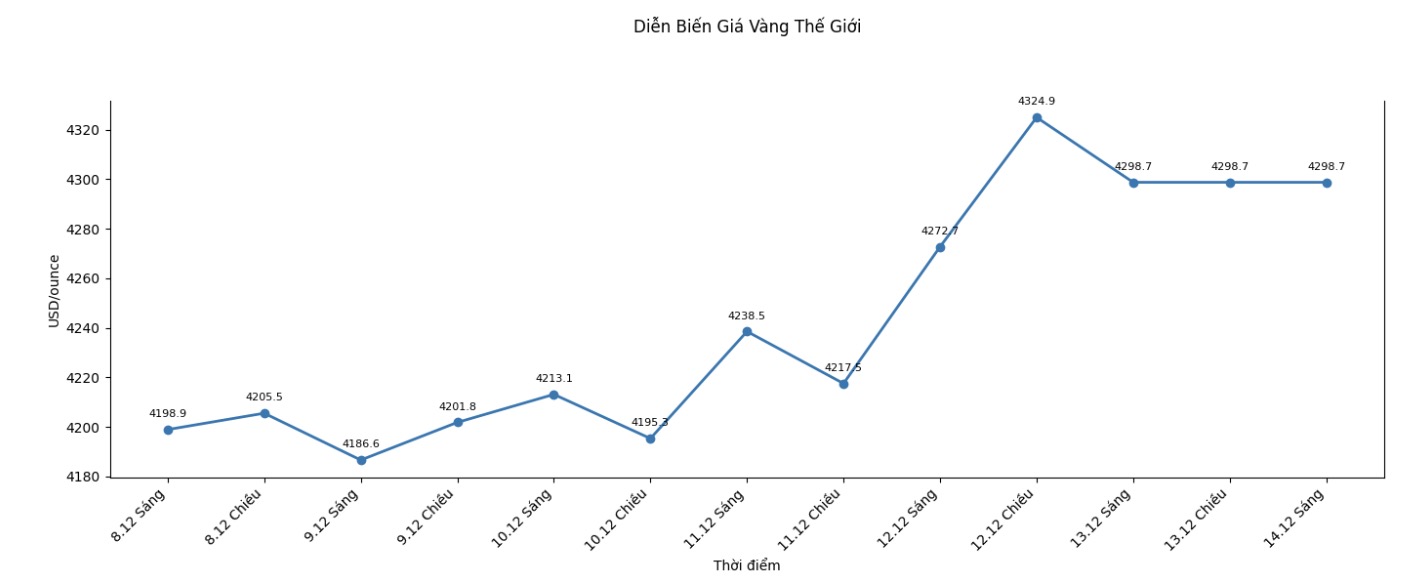

Since the beginning of the year, gold prices have set nearly 50 new historical peaks, currently trading around 4,300 USD/ounce before the weekend break. Gold has gained more than 65% this year, recording its strongest annual gain since 1979.

The biggest question many investors are asking is whether the rally in gold and silver can hold on.

However, the increase in gold is still "inferior" to silver. Although the gray metal has edged up from a peak of over $64.66 an ounce, silver has still risen more than 6% for the week and is trading at a record price range. Since the beginning of the year, silver prices have increased by 115%.

With such a strong increase, it is not surprising that some analysts have begun to warn that this increase may not be sustainable.

Last week, the Bank for International payments (BIS) attracted a lot of attention when it released a report saying that both gold and the stock market are in the "bubble zone".

That may be true, but according to some experts, even if the gold market is in a bubble state, it does not mean that the bubble will break next year. An increasingly popular view among precious metals investors is that gold and silver may be highly valued, but they are not holding enough.

It is difficult to imagine which scenario could cause the precious metal bubble to "bleep up". Will interest rates increase again next year? Will globalization make a strong comeback? Will government spending be tightened?

Neils Christensen - an analyst at Kitco News said that these are all questions that the unit has asked analysts during the year-end series. So far, the answer is almost consistent: difficult to achieve.

Many experts predict that the US Federal Reserve (Fed) will continue to cut interest rates even if inflation remains persistent. This means real yields will continue to fall, reducing the opportunity cost of gold - a non-interest-bearing asset.

At the same time, economic and geopolitical instability is expected to continue to hold back GDP growth next year. Although a new AI economy could help the stock market maintain positive support through 2026, the growing risks in the stock market make gold an attractive portfolio diversification tool.

Although demand for gold has reached an unprecedented level this year, this precious metal still accounts for only a very small proportion of total global financial assets. That shows that there is still a lot of room for capital to continue moving into the gold market.

So what do all these factors mean for precious metals? Despite the lack of absolute consensus, many analysts still believe that the price of 5,000 USD/ounce for gold is a completely feasible target for next year. Meanwhile, silver prices may increase to 75 80-85 USD/ounce, and some even predict that silver could reach 100 USD.

See more news related to gold prices HERE...