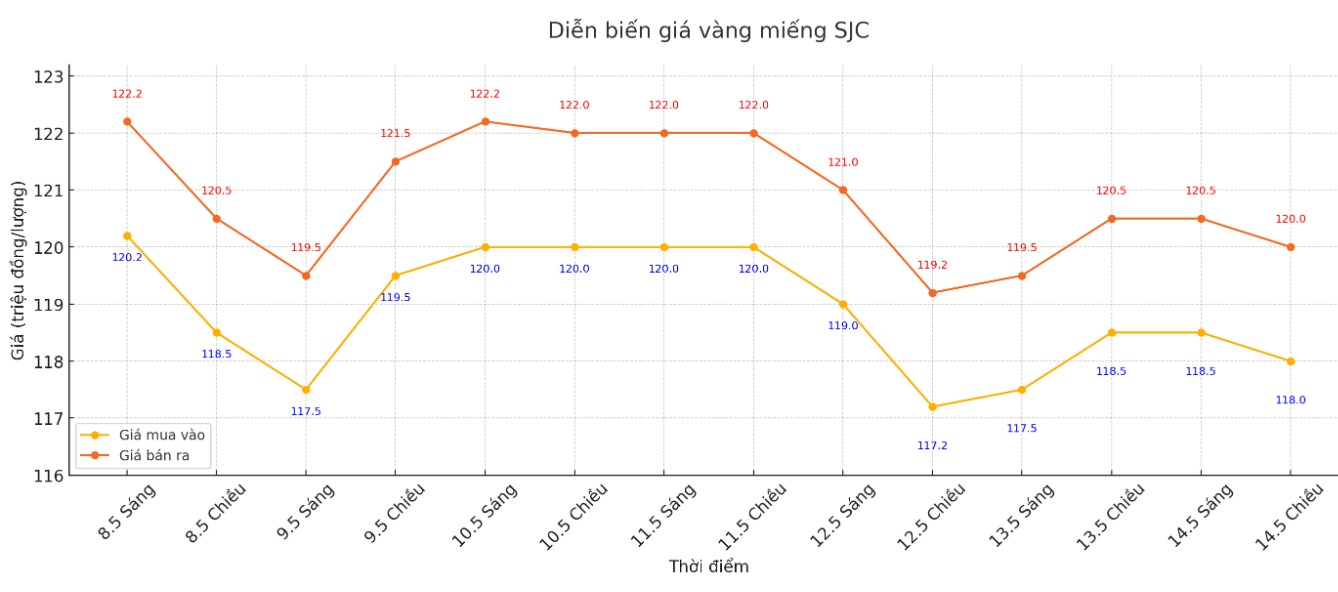

Updated SJC gold price

As of 5:50 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND118-120 million/tael (buy in - sell out), down VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118-120 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118-120 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

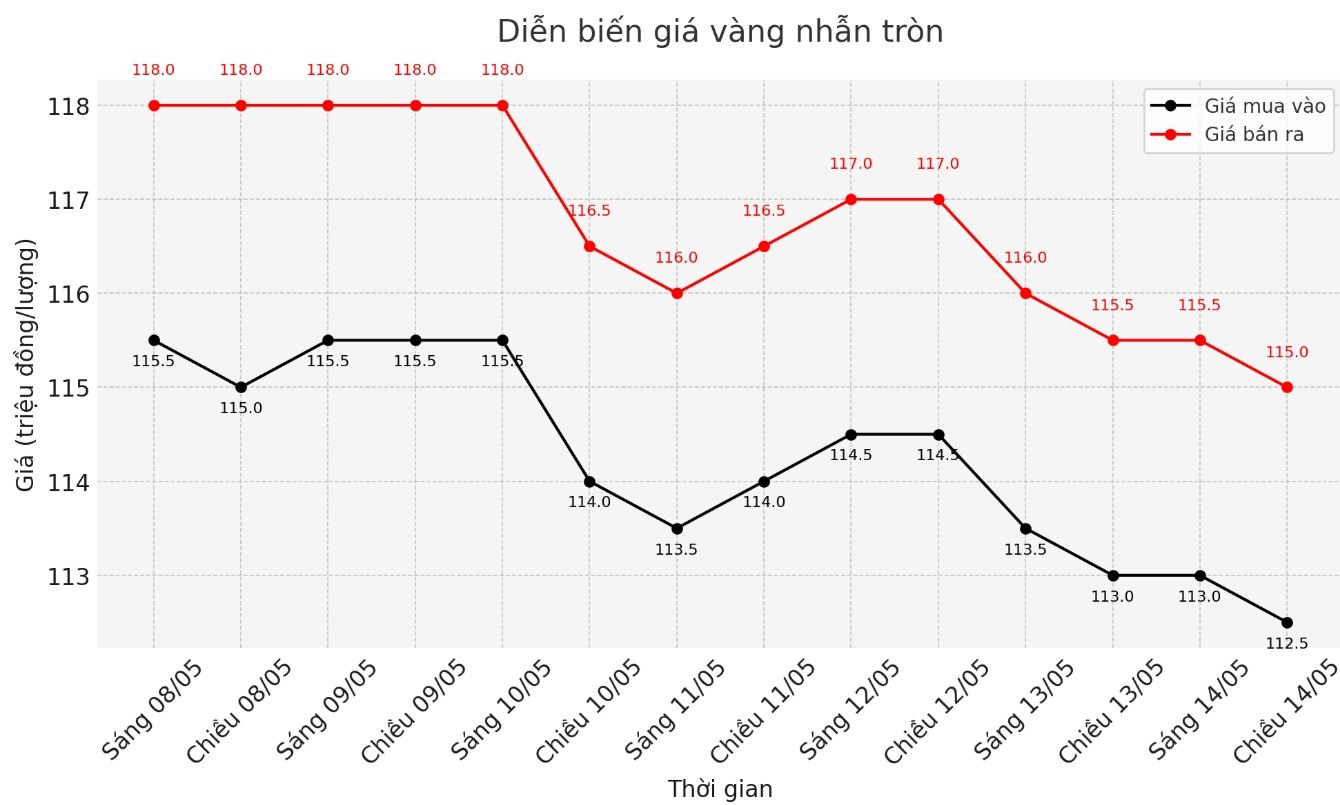

9999 round gold ring price

As of 5:50 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-115 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.5-116.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

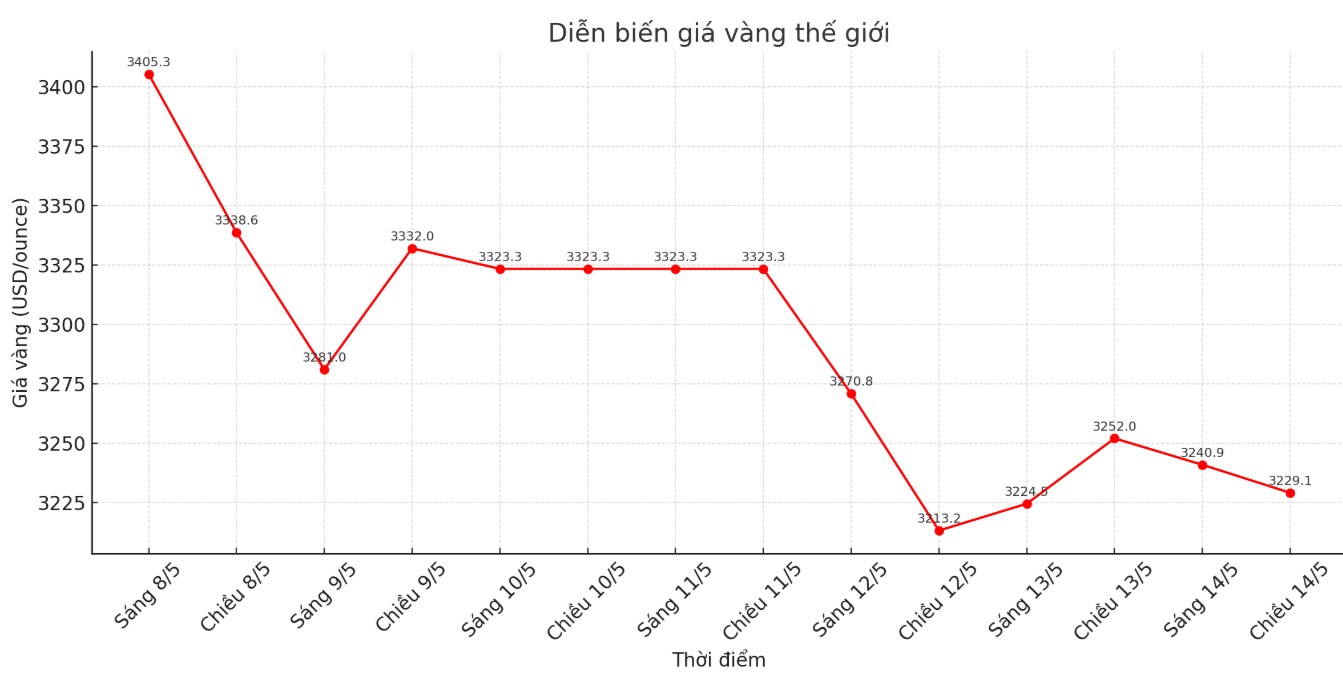

World gold price

At 5:52 p.m., the world gold price listed on Kitco was around 3,229.1 USD/ounce, down 22.9 USD/ounce.

Gold price forecast

According to Kitco, gold prices fell as tensions in US-China trade relations eased, reducing safe-haven demand. At the same time, investors are waiting for new inflation data to assess the possibility of policy adjustments from the US Federal Reserve (FED).

Marcus Waterman - Director of Market Strategy at Capital Heights Investments - commented: "Inflation data shows that we are continuing on a path of inflation reduction, although the pace is slower than the Fed wants. This keeps gold a hedge in its portfolio despite recent fluctuations.

The inflation report released today has weakened the USD, after hitting a one-month high on Monday. The previous increase in the greenback came from the news that the US and China agreed to reduce tariffs on each other, contributing to removing trade barriers.

However, the outlook for the 9-day deal is still unclear, causing investors to remain cautious and continue to favor gold as a safe haven. The USD index fell sharply by 0.81% to 100.93.

Market sentiment on the possibility of a Fed rate cut has also changed significantly. According to CME's FedWatch tool, the probability of the Fed cutting interest rates by 0.25% at the June meeting is now down to just 8.2%, down sharply from 30.5% last week.

Although the easing of tensions between the US and China has helped improve market sentiment, questions about the viability of the deal could maintain golds appeal as a safe haven asset, said Quasar Elizundia, senior analyst at Pepperstone.

Whether the Fed decides to cut interest rates in the coming time or not is still an important factor affecting the gold price outlook in 2025.

See more news related to gold prices HERE...