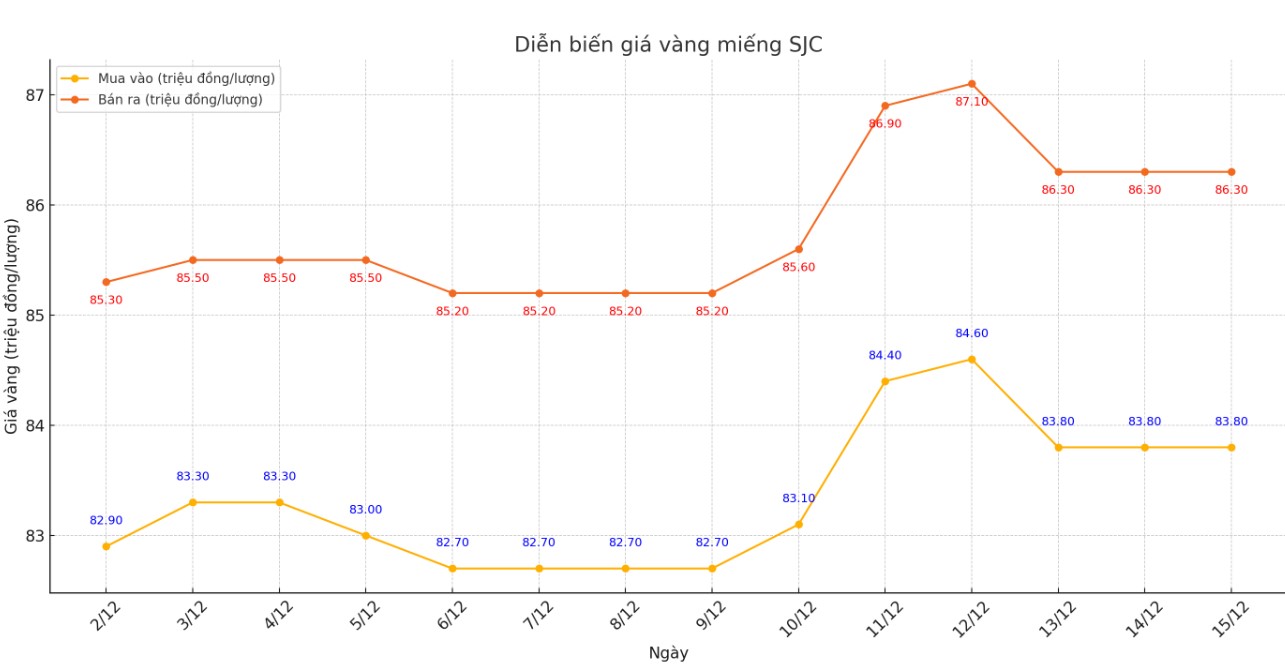

Update SJC gold price

As of 6:00 p.m., DOJI Group listed gold bar prices at 83.8-86.3 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at DOJI increased by 1.1 million VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83.8-86.3 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at Saigon Jewelry Company increased by VND 1.1 million/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

If you buy SJC gold at DOJI Group on December 8 and sell it today (December 15), you will lose 1.4 million VND/tael. Similarly, those who buy gold at Saigon Jewelry Company SJC will also lose 1.4 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say this difference is very high, causing investors to face the risk of losing money when investing in the short term.

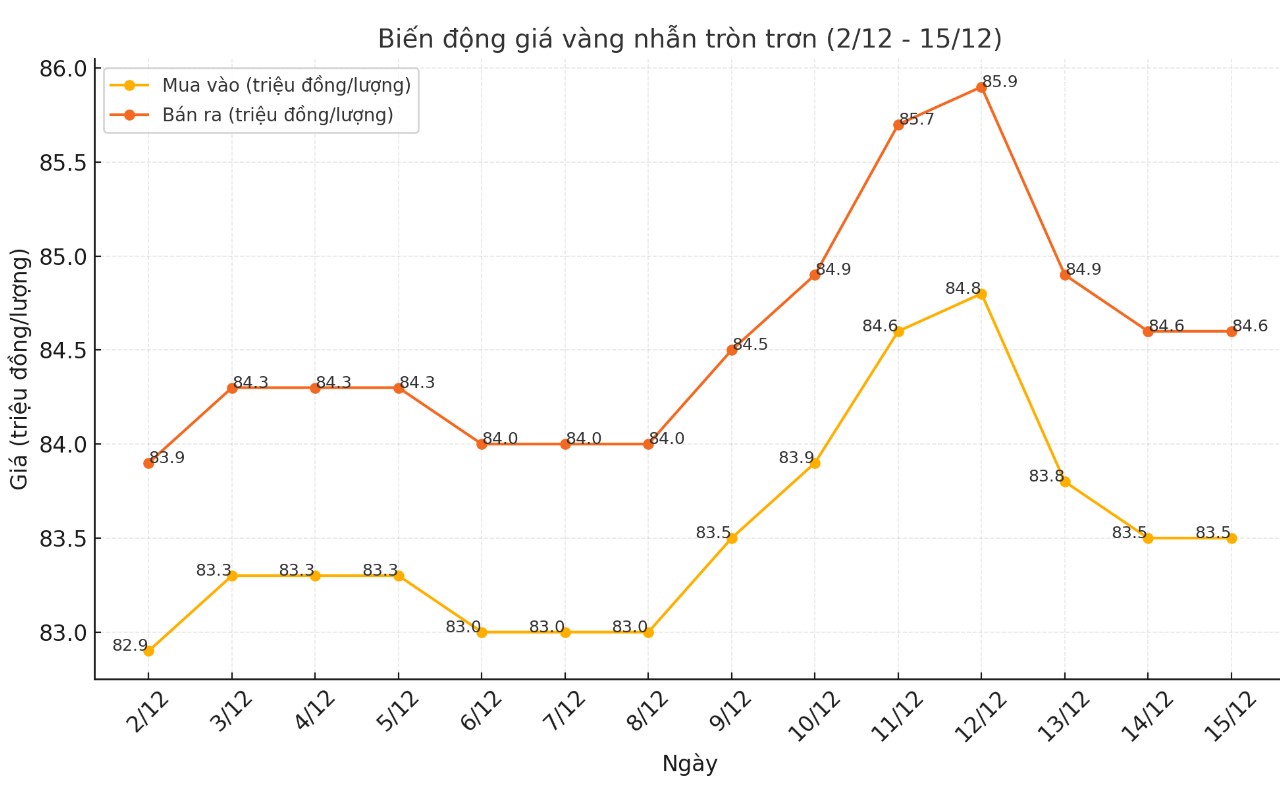

9999 round gold ring price

As of 7:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.5-84.6 million VND/tael (buy - sell); an increase of 500,000 VND/tael for buying and an increase of 600,000 VND/tael for selling compared to the closing price of last week's trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.63-85.38 million VND/tael (buy - sell); an increase of 650,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling compared to the closing price of last week's trading session.

After a week of decline, if you buy gold rings in the session of December 8 and sell them today (December 15), the loss that investors will have to accept when buying at DOJI and Bao Tin Minh Chau is VND500,000/tael and VND400,000/tael, respectively.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

At the close of the weekly trading session, the world gold price listed on Kitco was at 2,648.6 USD/ounce, up 15.3 USD/ounce compared to the close of the previous week's trading session.

Gold Price Forecast

World gold prices are falling sharply as the USD index increases. Recorded at 9:00 a.m. on December 15, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.680 points (up 0.04%).

Gold prices started the week on a strong note, but high inflation data and a stronger US dollar dragged the precious metal lower towards the end of the week.

Gold markets were under pressure after the US Department of Labor announced that the Producer Price Index (PPI) increased by 0.4% in November, higher than the 0.3% in October. Over the past 12 months, wholesale inflation increased by 3.0%, exceeding the forecast of 2.5% and the upwardly revised 2.6% in October.

The rise in wholesale inflation suggests the threat to consumer prices remains high, which could make the US Federal Reserve (FED) hesitant to raise interest rates.

In a recent report, analysts at Wells Fargo forecast just one rate cut by the Fed next year. Similarly, Bank of America forecasts just two rate cuts by 2025.

Naeem Aslam, Chief Investment Officer at Zaye Capital Markets, recommends that gold investors prepare for the possibility of gold prices weakening next week as the Fed adjusts its expectations for interest rate cuts.

“We are going to see a hawkish rate cut given the recent inflation data, which means further downward pressure on gold prices next week,” he said. However, trading volumes may be lower as many traders head off for the holidays.

Lukman Otunuga, Chief Market Analyst at FXTM, is neutral on gold, saying the precious metal is caught in a tug-of-war. He said that despite the Fed's hawkish stance, gold still has strong upside momentum.

“The precious metal is under pressure from rising US government bond yields ahead of the Fed’s final policy meeting. However, the weekly trend remains solid with a gain of nearly 30% year-to-date,” he said.

See more news related to gold prices HERE...