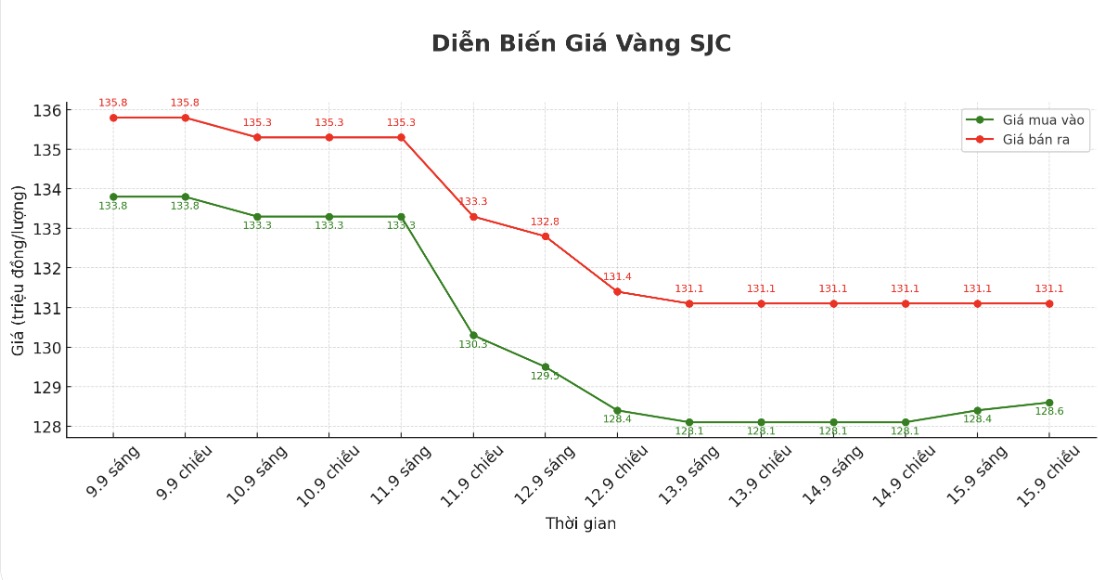

SJC gold bar price

As of 5:30 p.m., DOJI Group listed the price of SJC gold bars at 128.6-131.1 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and unchanged for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.6-131.1 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 127.5-131.1 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3.6 million VND/tael.

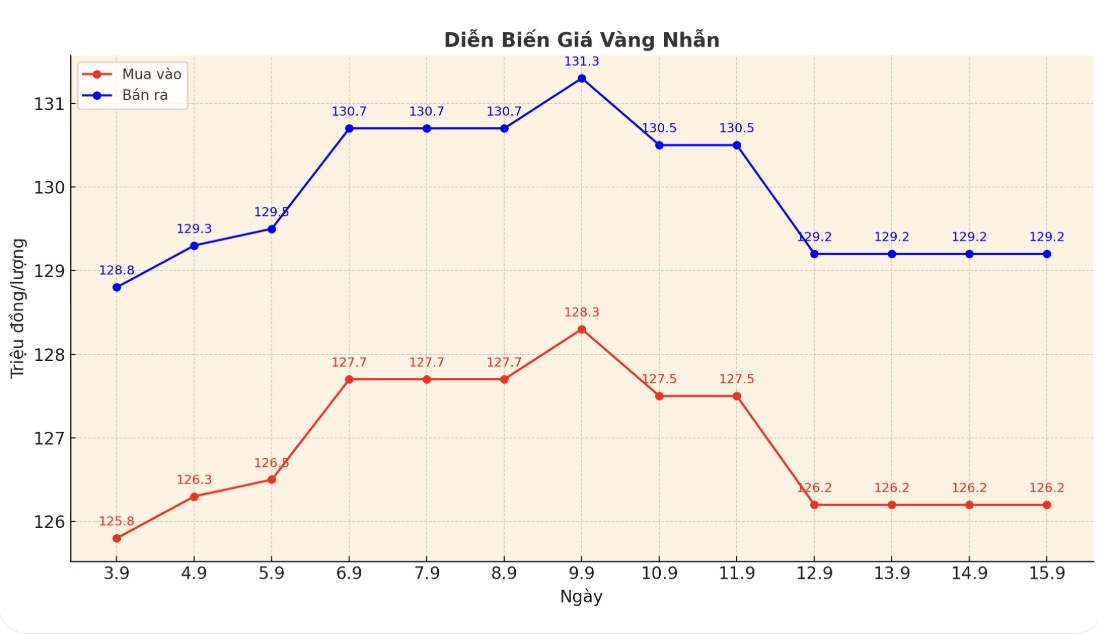

9999 gold ring price

As of 5:30 p.m., DOJI Group listed the price of gold rings at 126.2-129.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 126.8-129.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 125.5-128.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

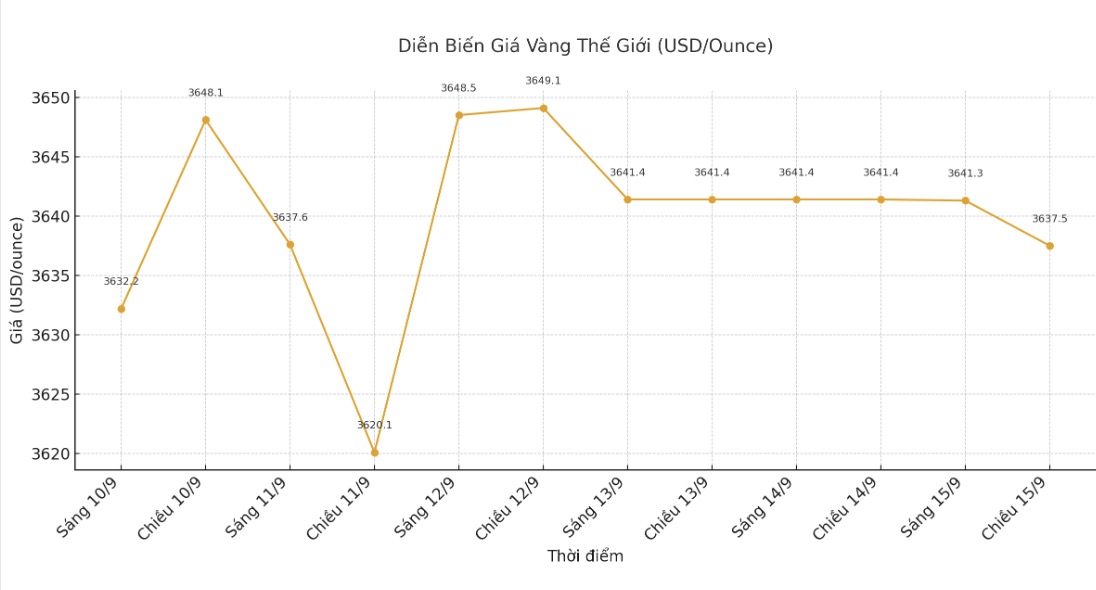

World gold price

The world gold price was listed at 5:00 p.m. at 3,637.5 USD/ounce, down 3.9 USD.

Gold price forecast

World gold prices remained stable in the trading session on Monday as investors awaited the widely predicted interest rate cut by the US Federal Reserve (FED) this week, while profit-taking and stronger USD have limited their increase.

Mr. Tim Waterer - Market Analyst of KCM Trade - said that profit-taking and a stronger USD are putting pressure on gold. The upward outlook remains maintained; however, a period of accumulation or slight adjustment can be seen as positive, supporting golds higher price target in the coming period, he said.

The USD index increased by 0.1%, making gold priced in greenback more expensive for overseas buyers. US inflation data for August was slightly higher than expected on Thursday, but investors predict this will not deter the Fed from cutting interest rates by 0.25 percentage points on Wednesday.

The risk for gold this week is that the Fed may not give a clear signal about when the next interest rate cut will be, Mr. Waterer added.

Gold - a non-yielding safe haven asset is often benefited in a low interest rate environment. The Fed's meeting comes amid many challenges, including legal disputes over the board and US President Donald Trump's efforts to increase the influence on interest rate policy and the broader role of central banks.

While we see the risk for the $4,000/ounce forecast in mid-2026 leaning towards upside, increasing speculative positions also increases the risk of short-term correction, as positions typically return to normal, said Goldman Sachs in a recent report.

Gold prices continue to attract investment flows strongly but are behind platinum and silver in terms of increase. platinum futures ended last week above $1,400/ounce. Although prices have decreased compared to the July peak, they are still near their highest level in 11 years and have increased by more than 54% since the beginning of the year. The increase in platinum has mostly occurred in recent months as investors shifted to lower-value precious metals.

Meanwhile, silver futures have surpassed $42/ounce, hitting a new high in 14 years. Silver prices have increased by nearly 46% since the beginning of the year.

Gold ranked third, at around $3,681 an ounce, up nearly 40% from the beginning of the year. This is not to downplay the role of gold; on the contrary, the widespread price increase in the precious metal market shows a long-term uptrend. Tradition shows that gold leads at the beginning of the uptrend cycle, before being surpassed by silver and platinum - something many investors consider a signal confirming the uptrend.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...