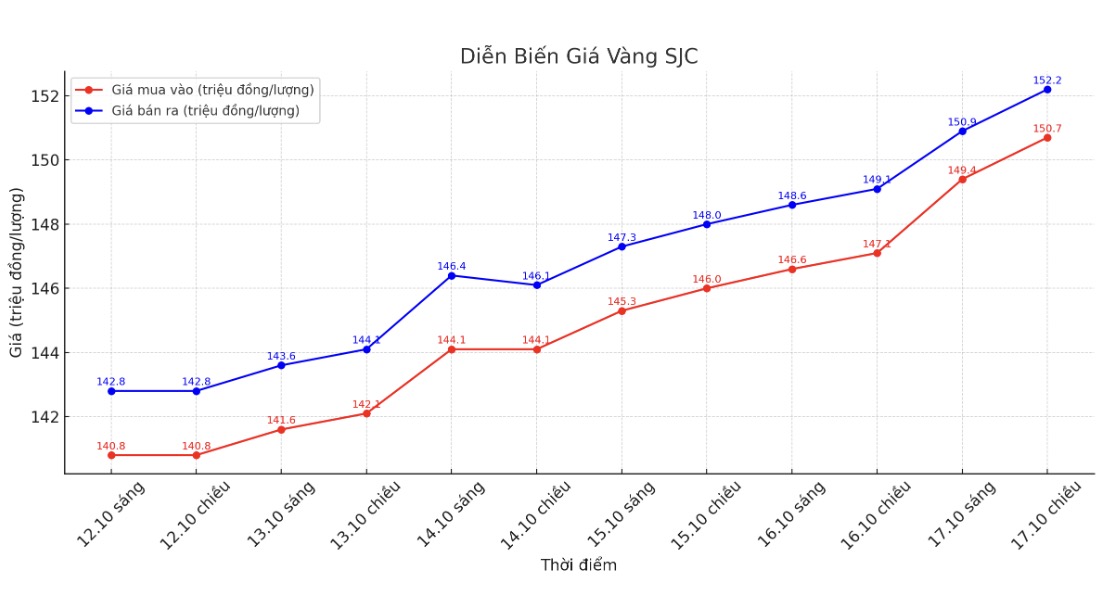

SJC gold bar price

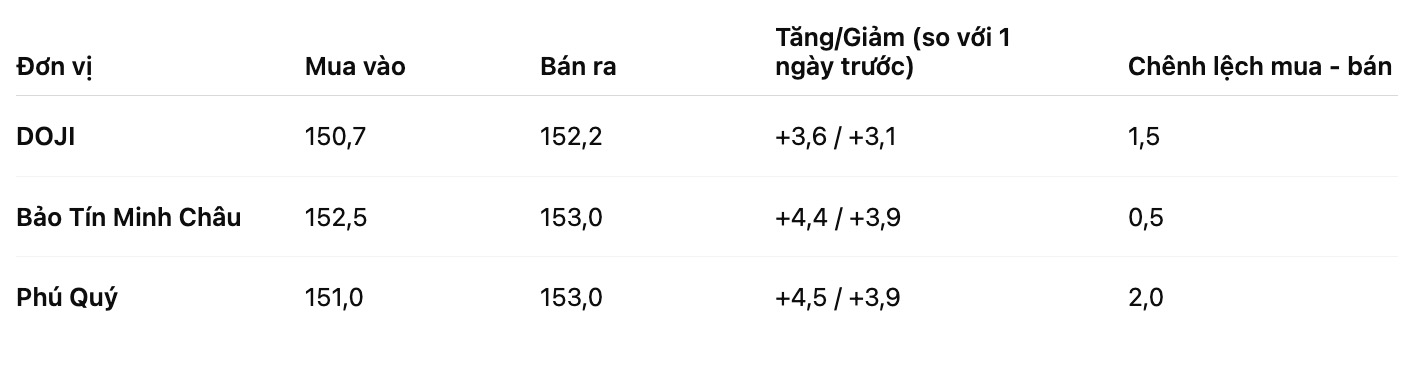

As of 5:45 p.m., DOJI Group listed the price of SJC gold bars at VND150.7-152.2 million/tael (buy - sell), an increase of VND3.6 million/tael for buying and an increase of VND3.1 million/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.5-153 million VND/tael (buy - sell), an increase of 4.4 million VND/tael for buying and an increase of 3.9 million VND/tael for selling. The difference between buying and selling prices is at 500,000 VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151-153 million VND/tael (buy - sell), an increase of 4.5 million VND/tael for buying and an increase of 3.9 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

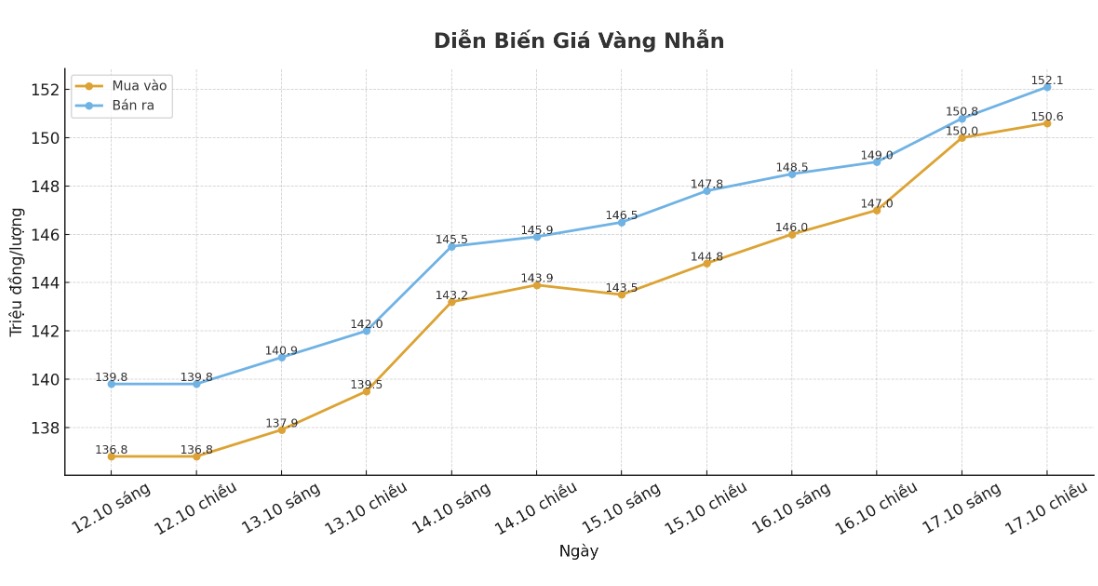

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 150.6-152.1 million VND/tael (buy - sell), an increase of 3.6 million VND/tael for buying and an increase of 3.1 million VND/tael for selling. The difference between buying and selling is 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.5-159.5 million VND/tael (buy - sell), an increase of 5.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), an increase of 3.9 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

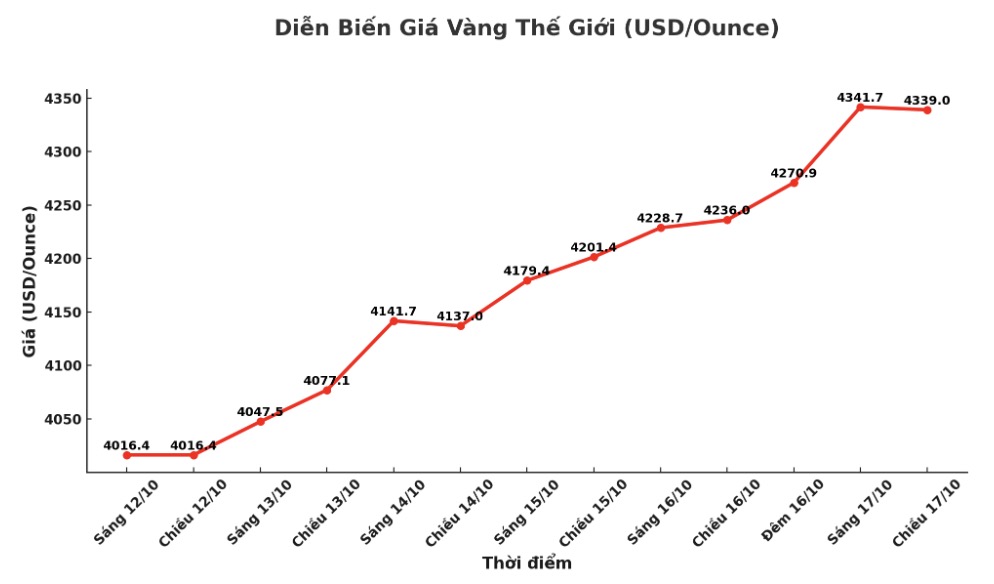

World gold price

The world gold price was listed at 5:35 p.m. at 4,339 USD/ounce, up 103 USD compared to a day ago.

Gold price forecast

Gold prices surpassed the $4,300/ounce mark in the session on October 17, heading for the strongest week of increase since December 2008, when geopolitical and global economic uncertainties and expectations of a Fed cutting interest rates soon prompted cash flow to seek safe-haven metals.

Overall, gold prices rose about 8.1% for the week - the strongest increase since the 2008 financial crisis. Previously, in the session, gold temporarily headed for its largest increase since September 2008, when the collapse of Lehman Brothers fueled the global crisis.

With expectations of interest rate cuts, geopolitical risks and prolonged concerns in the banking sector, the current environment is still very favorable for gold, said Alexander Zumpfe, a precious metals trader at Heraeus Metals Germany. He said that gold prices may temporarily correct in the short term because they are in a state of "overbuy".

Technically, gold's relative strength index (RSI) is currently at 88 - showing that the metal is overbought.

Gold - a traditional asset seen as a hedge against instability and inflation, often benefiting from a low-interest-rate environment - has risen more than 66% since the start of the year. The price increase is driven by geopolitical tensions, expectations of the FED cutting interest rates, central bank purchases, the trend of "de-dollarization" and strong capital flows into ETFs.

I think large and steady capital flows into ETFs are the factor that drives gold prices up, said Michael Haigh, global director for commodity research at Societe Generale.

SPDR Gold Trust - the world's largest gold ETF - said its holdings increased to 1,034.62 tons on October 16, the highest level since July 2022.

In other precious metals, platinum prices fell 3.3% to $1,656.90/ounce, while palladium lost 2.9%, to $1,566.30/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...