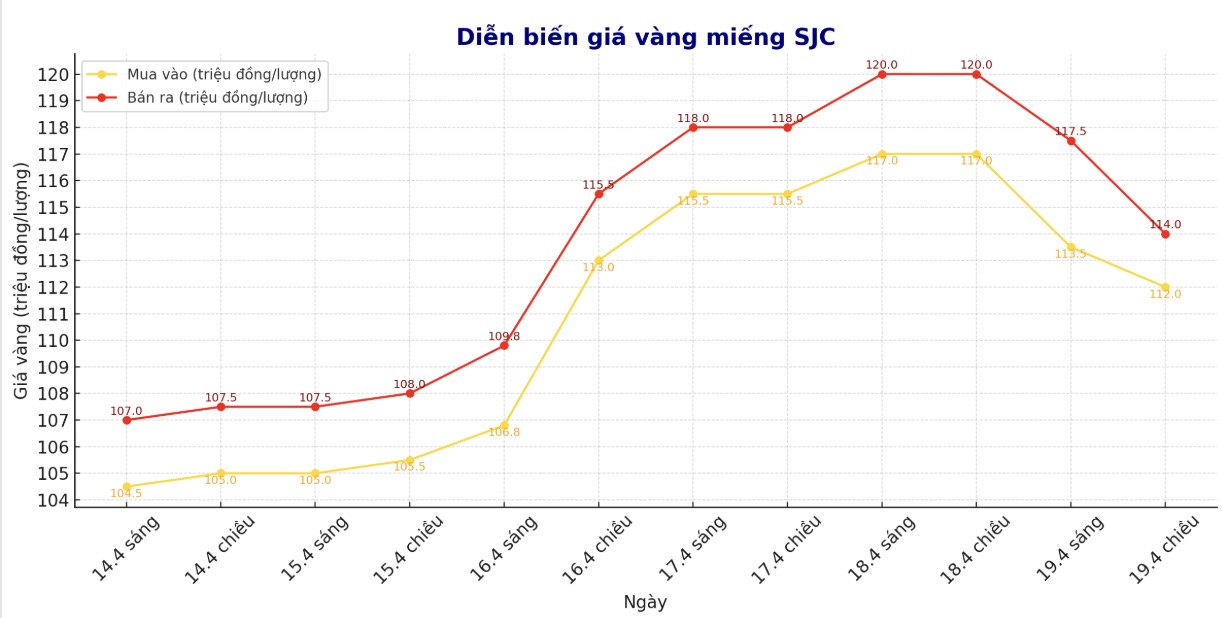

Updated SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND112-114 million/tael (buy - sell); down VND5 million/tael for buying and down VND6 million/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND112-114 million/tael (buy - sell); down VND5 million/tael for buying and down VND6 million/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 112-114 million VND/tael (buy - sell); down 5 million VND/tael for buying and down 6 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

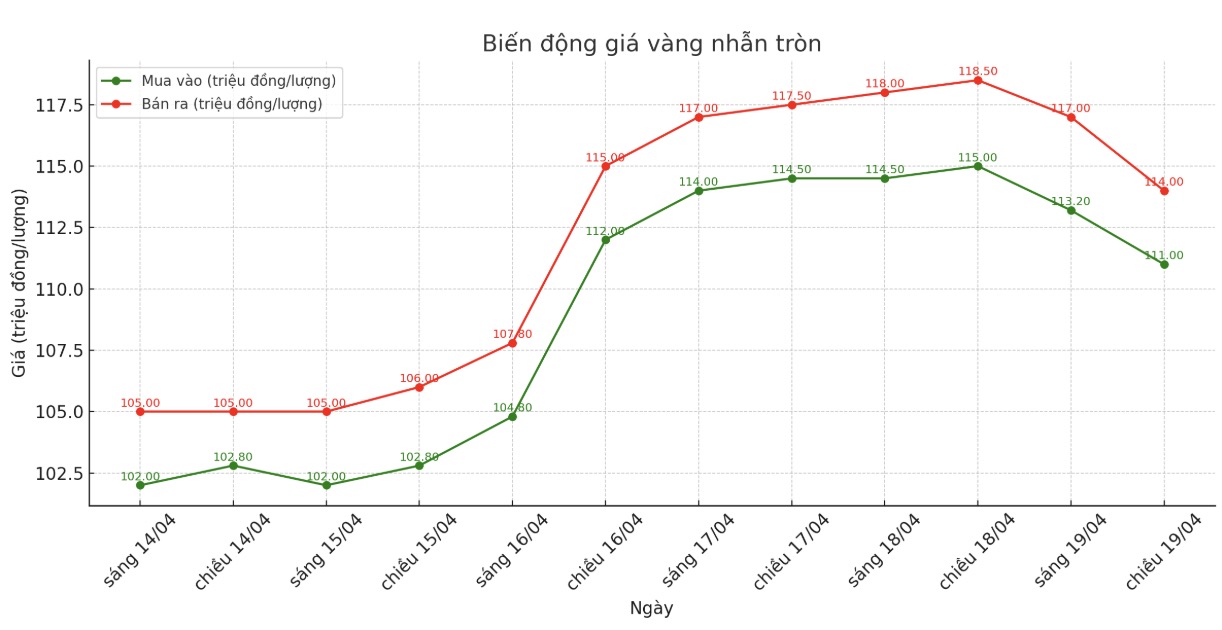

9999 round gold ring price

As of 5:00 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 109.5-113.5 million VND/tael (buy - sell); down 5.5 million VND/tael for buying and down 5 million VND/tael for selling. The difference between buying and selling prices is at 4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 111-114 million VND/tael (buy - sell); down 5.5 million VND/tael for both buying and selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

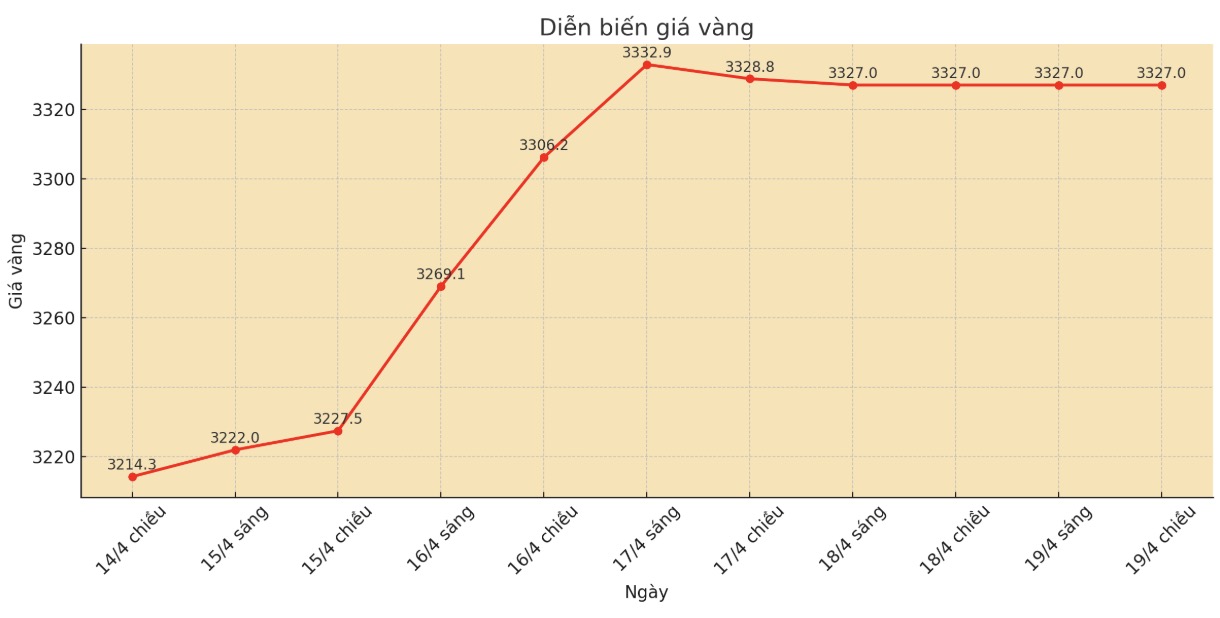

World gold price

As of 5:00 p.m., the world gold price was listed at 3,327 USD/ounce.

Gold price forecast

The latest weekly gold survey from Kitco News shows that both Wall Street experts and individual investors are being more cautious as gold prices surpass the $3,300/ounce mark a price zone considered view-high.

This week, 16 analysts participated in the Kitco News survey. Compared to last week when most were optimistic, Wall Street analysts this week have eased their excitement, although most still expect gold prices to continue to rise.

10 people (63%) predict gold prices will increase next week. Meanwhile, four (25%) see prices falling. The remaining two (12%) see gold prices moving sideways around the new peak.

Kitco's online survey also recorded 312 participants from the group of individual investors. Of these, 195 people (63%) see gold prices continuing to rise next week, 57 people (18%) see prices falling, and the remaining 60 people (19%) see prices moving sideways.

Gold has had an extremely impressive week, and I still dont see a reason to change my bullish view, said James Stanley, senior market strategist at Forex.com.

He added that gold prices have increased too much, making buying more difficult at the moment, but there is still no clear sign that this increase has ended.

Sean Lusk - Co-Director of commercial risk prevention at Walsh Trading said the market is still in a state of "running away for shelter", and gold is benefiting from that fear.

On Thursday, investors take a little profit, thats normal before the long weekend, but well have to see what they do after this slight decline, he said.

Lusk said there is currently a lot of money flowing into gold. Speculators are buying, TV experts are also advising buying, and central banks continue to hoard gold, he said. We have achieved a 25% increase for the year at $3,301/ounce. The next target is around $3,434/ounce.

On the other hand, Rich Checkan - President and COO of Asset Strategies International predicted: " Prices will decrease. I fully expect a profit-taking after gold surpassed $3,300/ounce on Wednesday. This is the time to adjust and build a support zone around this new high.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...