Updated SJC gold price

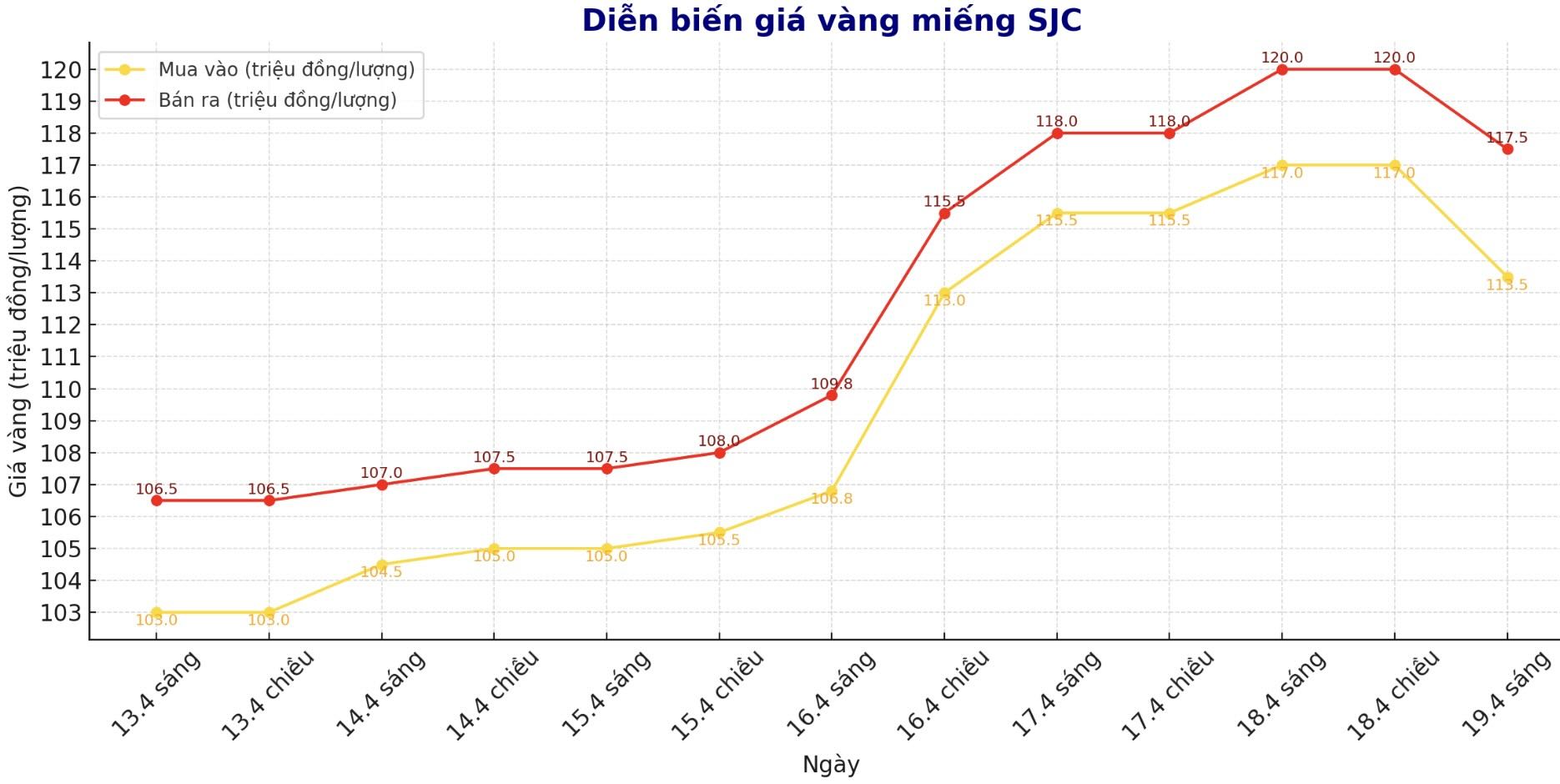

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND113.5-117.5 million/tael (buy - sell), down VND3.5 million/tael for buying and down VND2.5 million/tael for selling. The difference between buying and selling prices is at 4 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117-120 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 113.5-117.5 million VND/tael (buy - sell), down 3.5 million VND/tael for buying and down 2.5 million VND/tael for selling. The difference between buying and selling prices is at 4 million VND/tael.

9999 round gold ring price

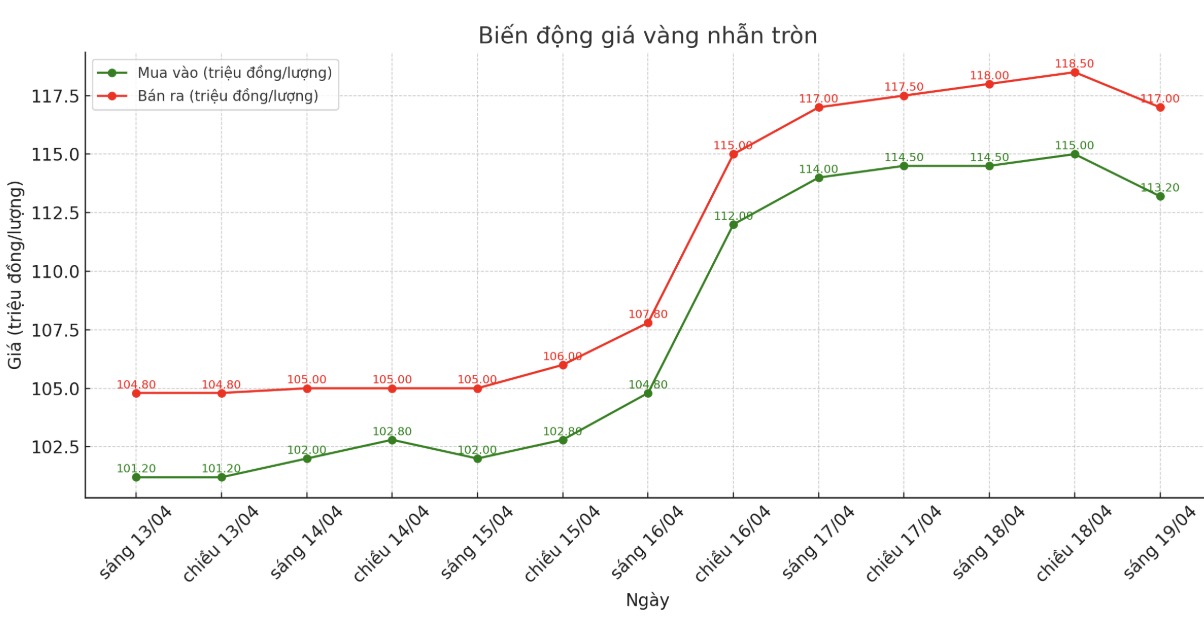

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-118.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 3.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.2-117 million VND/tael (buy - sell), down 3.3 million VND/tael for buying and down 2.5 million VND/tael for selling. The difference between buying and selling is 3.8 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

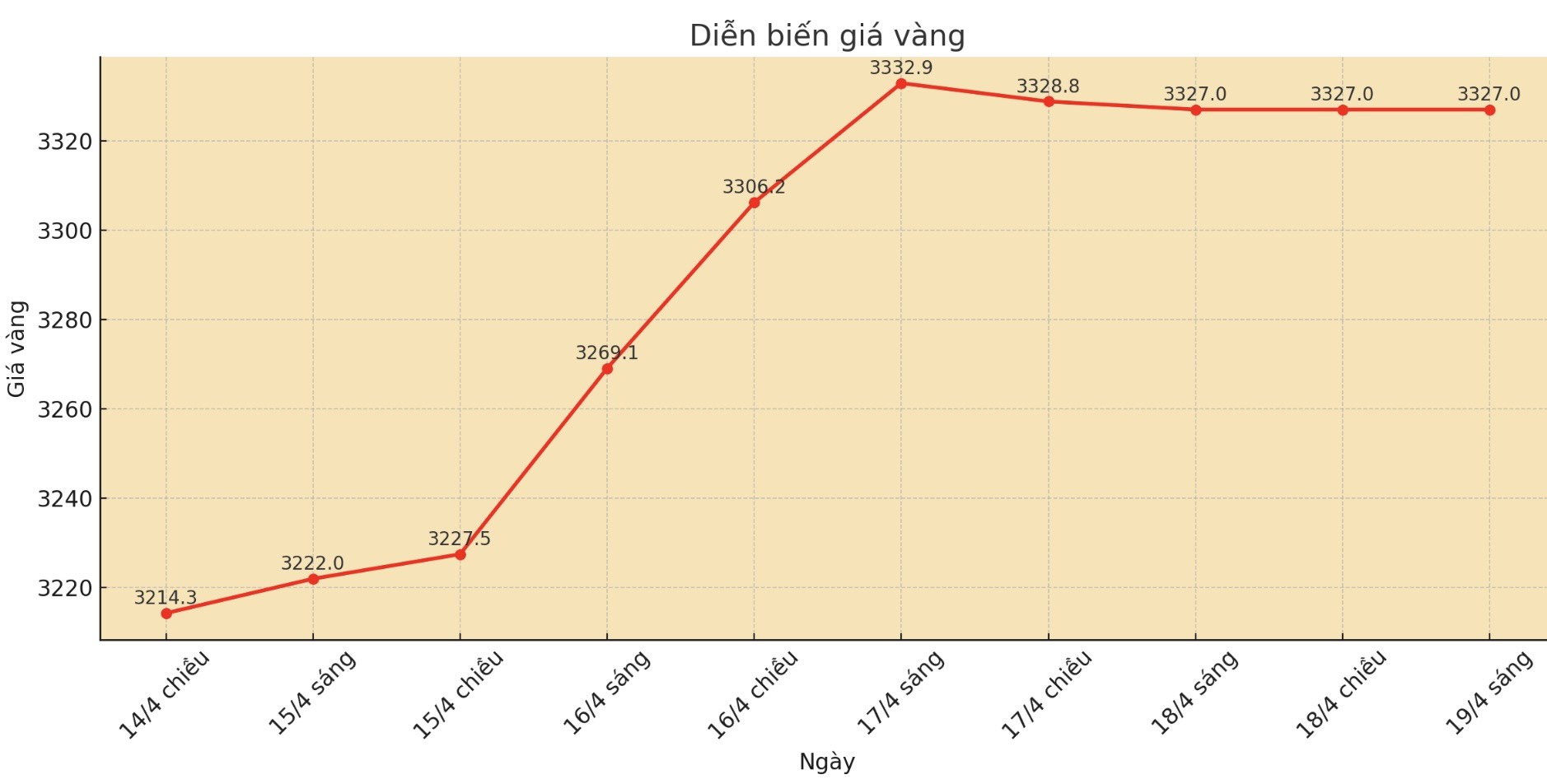

At 9:00 a.m., the world gold price was listed on Kitco around 3,327 USD/ounce.

Gold price forecast

According to Kitco, although gold is in the overbought zone, some experts believe that it will continue to maintain a stable uptrend.

He commented: In just one week, gold has increased by 13% (ie 360 USD). Therefore, it is not surprising if prices adjust slightly. The MacD index is also in the same overbought range as its peak in 2011. Although that does not mean that prices cannot continue to increase, investors should be cautious.

Mr. Christopher Vecchio - Director of futures and foreign exchange contracts at Tastylive.com - said that gold will continue to benefit if the USD continues to weaken. This expert believes that although the USD has not lost its position as a global reserve currency, the unstable trade policy of US President Donald Trump has weakened the US position.

The US is withdrawing from its role as global leader (Pax Americana - an order led by the US) to pursue a policy of My first, he said, leading to many consequences. No currency replaces the USD, but we will need another reserve asset and that is gold.

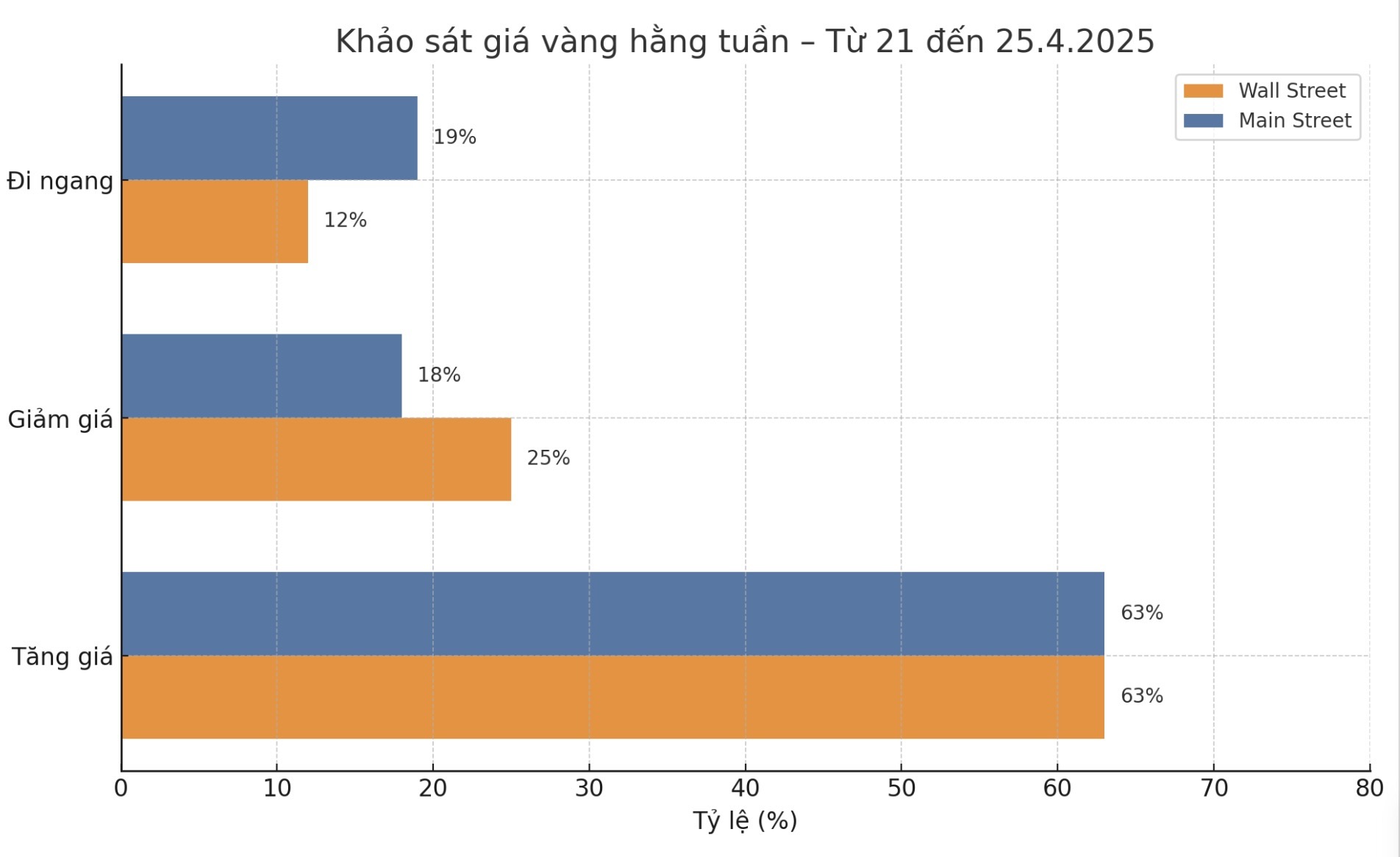

The latest weekly gold survey from Kitco News shows that both Wall Street experts and individual investors are being more cautious as gold prices surpass the $3,300/ounce mark a price zone considered view-high.

This week, 16 analysts participated in the Kitco News survey. Compared to last week when most were optimistic, Wall Street analysts this week have eased their excitement, although most still expect gold prices to continue to rise.

10 people (63%) predict gold prices will increase next week. Meanwhile, four (25%) see prices falling. The remaining two (12%) see gold prices moving sideways around the new peak.

Kitco's online survey also recorded 312 participants from the group of individual investors. Of these, 195 people (63%) see gold prices continuing to rise next week, 57 people (18%) see prices falling, and the remaining 60 people (19%) see prices moving sideways.

Economic data to watch next week

Wednesday: Preliminary manufacturing and service PMI, new home sales in the US

Thursday: Long-term goods orders, weekly jobless claims, US home sales

See more news related to gold prices HERE...