"Shocked" on the morning of April 19, domestic gold prices turned to decrease sharply

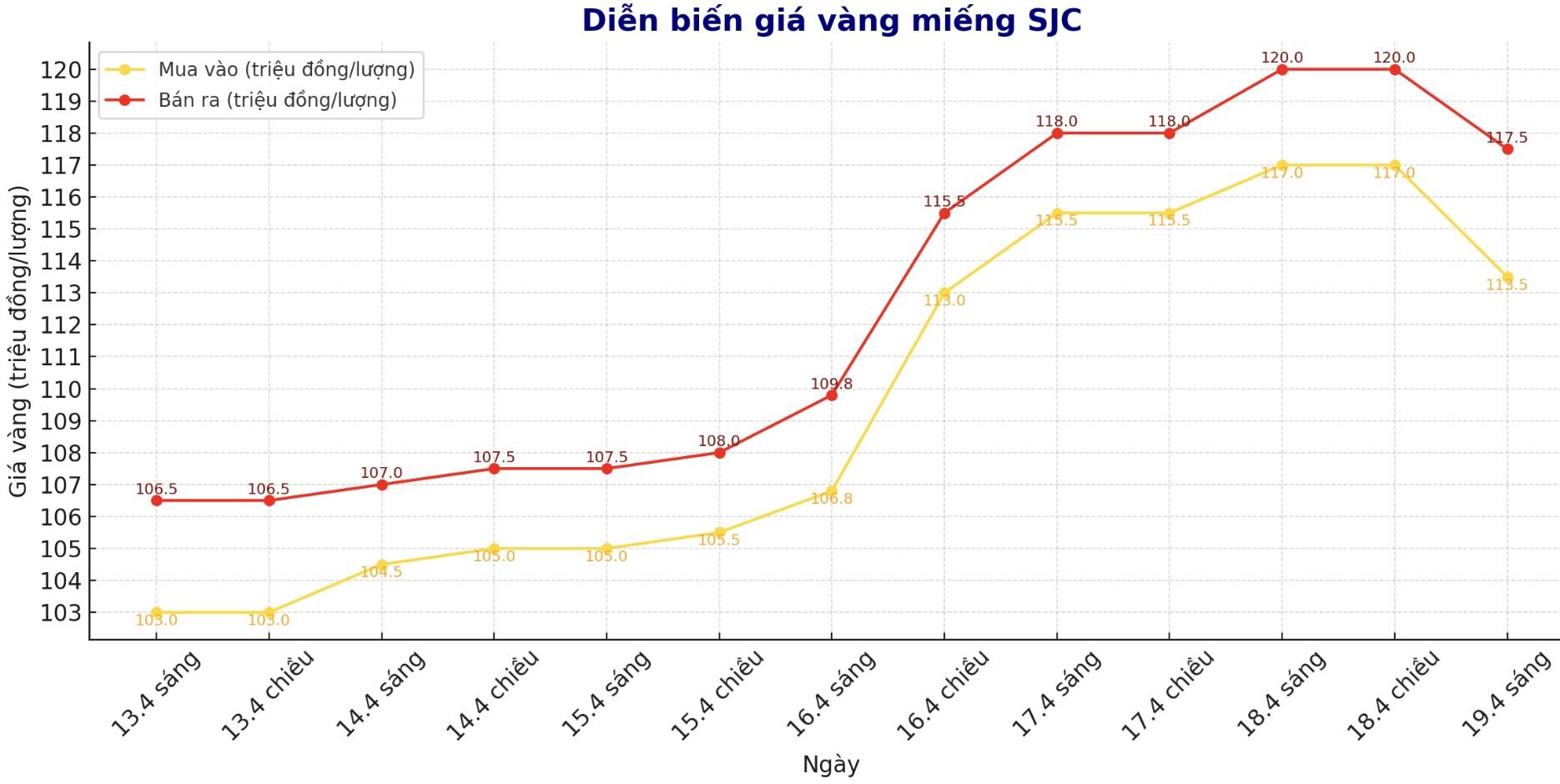

Yesterday morning (September 18), the domestic gold market recorded a skyrocketing increase, reaching an all-time high. Specifically, the price of SJC gold bars is listed at major brands such as SJC, DOJI, Bao Tin Minh Chau at 117-120 million VND/tael (buy in - sell out), a sharp increase of 1.5 to 2 million VND/tael in just one day. The difference between buying and selling prices remains high, about 3 million VND/tael.

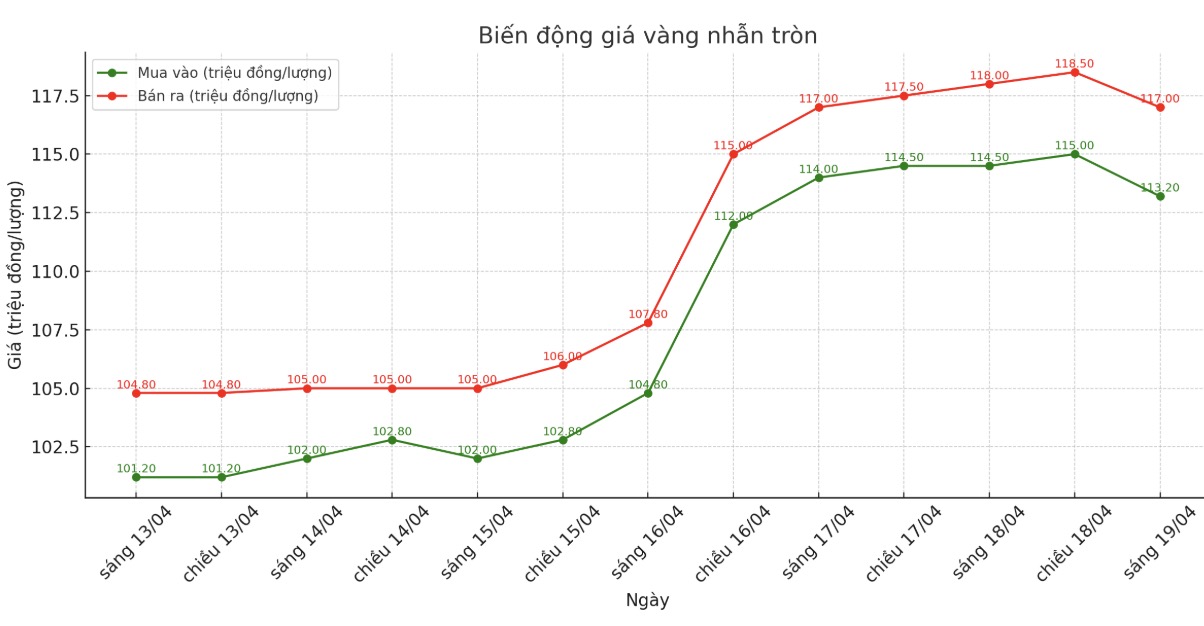

9999 round gold rings are no exception to the hot trend. At DOJI, the price of gold rings was pushed up to 114.5-118 million VND/tael, while at Bao Tin Minh Chau, the price even reached 116.5-1195 million VND/tael.

However, this morning (9:45 a.m. on April 19), the market witnessed a sudden plummet when gold prices simultaneously turned around and fell sharply. SJC gold bars at SJC, DOJI and Bao Tin Minh Chau were all listed at VND 113.5-117.5 million/tael, down VND 3.5 million/tael for buying and VND 2.5 million/tael for selling compared to just one day before. The buy-sell gap was widened to 4 million VND/tael.

Similarly, the price of 9999 round gold rings at DOJI and Bao Tin Minh Chau also decreased sharply. At DOJI, the purchase price decreased by 1.8 million VND/tael, the selling price decreased by 3 million VND/tael. At Bao Tin Minh Chau, the decrease was 3.3 and 2.5 million VND/tael respectively.

Loss of up to 6.5 million VND after a day of buying

The sudden decline in gold prices caused investors who bought on April 18 to immediately suffer heavy losses if they sold on the morning of April 19. This loss comes from a deep decrease combined with a high difference between buying and selling.

The sudden " plummeting" of gold prices overnight has clearly exposed the great risks of the "bottom-hiding - peak-hiding" strategy in the precious metals market. With the difference between buying and selling prices still maintained at a high level (3-4 million VND/tael), investors need to consider carefully before making a decision to spend money.

Financial experts recommend that in the context of the world gold price continuously fluctuating strongly, investors should closely monitor signals from the international market, especially policies from central banks of many countries. Short-term investment based on emotions can cause investors to suffer losses.

The sudden drop in the morning of April 19 is a warning for those who are "surfing" emotionally. In an unpredictable market, the possibility of gold prices turning around and falling sharply is entirely possible. Allocating cash flow appropriately and clearly defining investment goals will be the key to helping investors avoid risks.

See more news related to gold prices HERE...