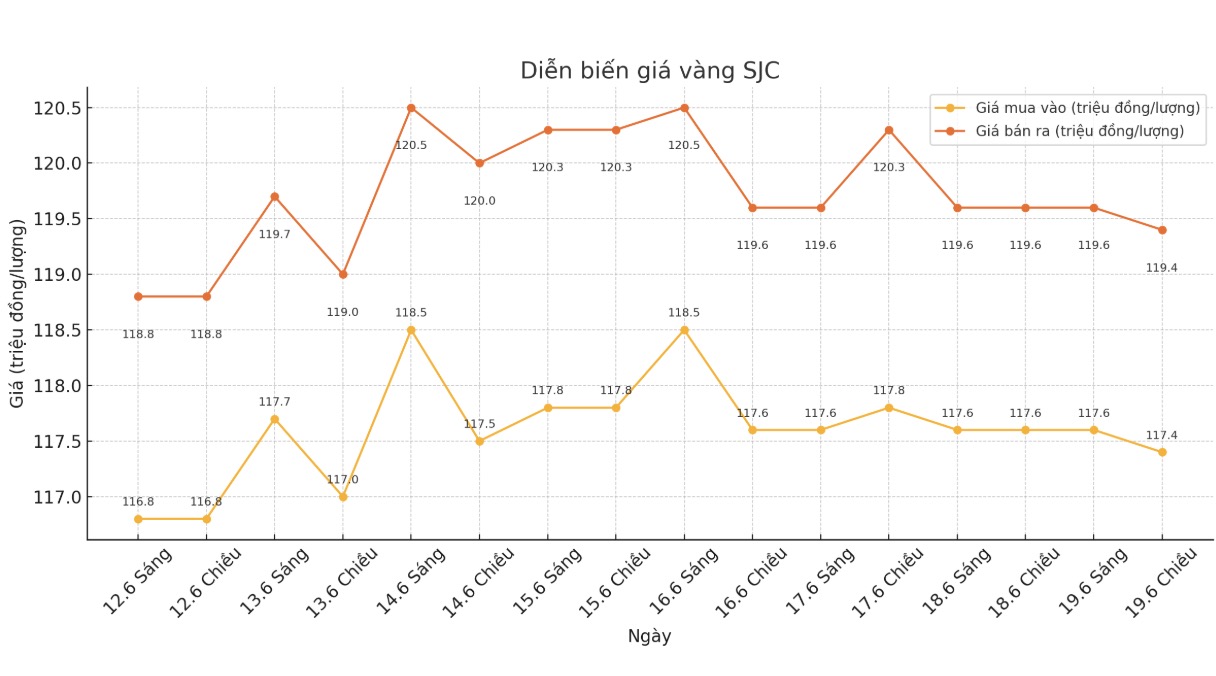

SJC gold bar price

As of 6:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.4-119 1.4 million VND/tael (buy in - sell out); down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.4-1194 million VND/tael (buy in - sell out); down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.4-1194 million VND/tael (buy in - sell out); down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.8-119 1.4 million VND/tael (buy in - sell out); down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

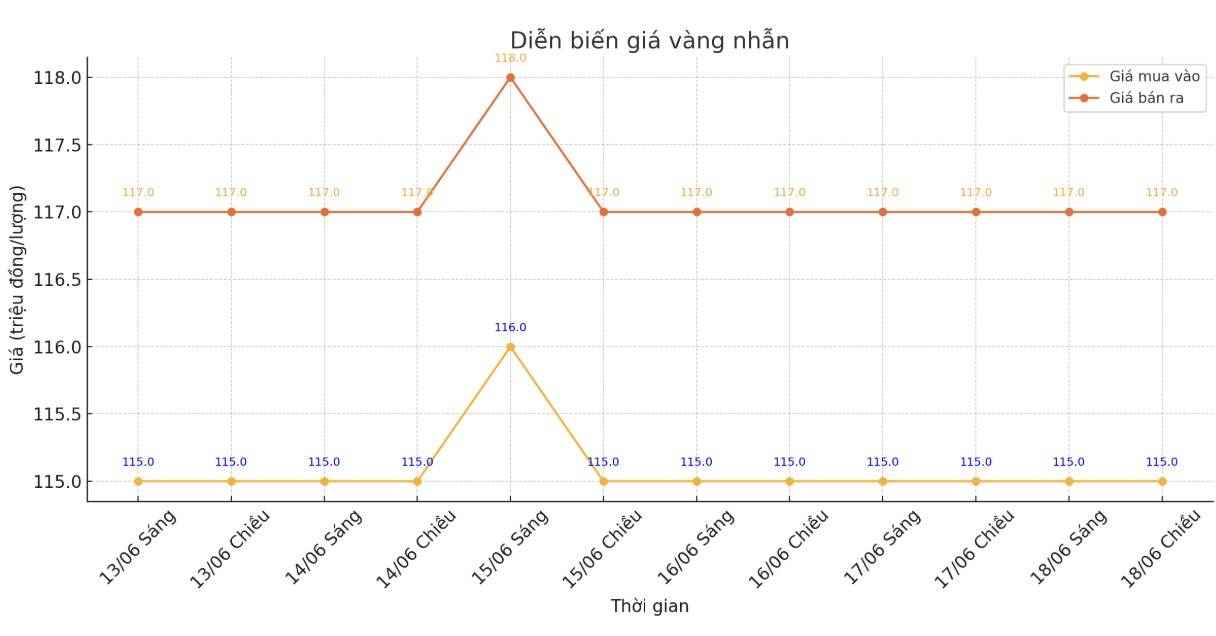

9999 gold ring price

As of 6:30 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND 114.5-116.5 million/tael (buy in - sell out), down VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.6-117.6 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.6-116.6 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

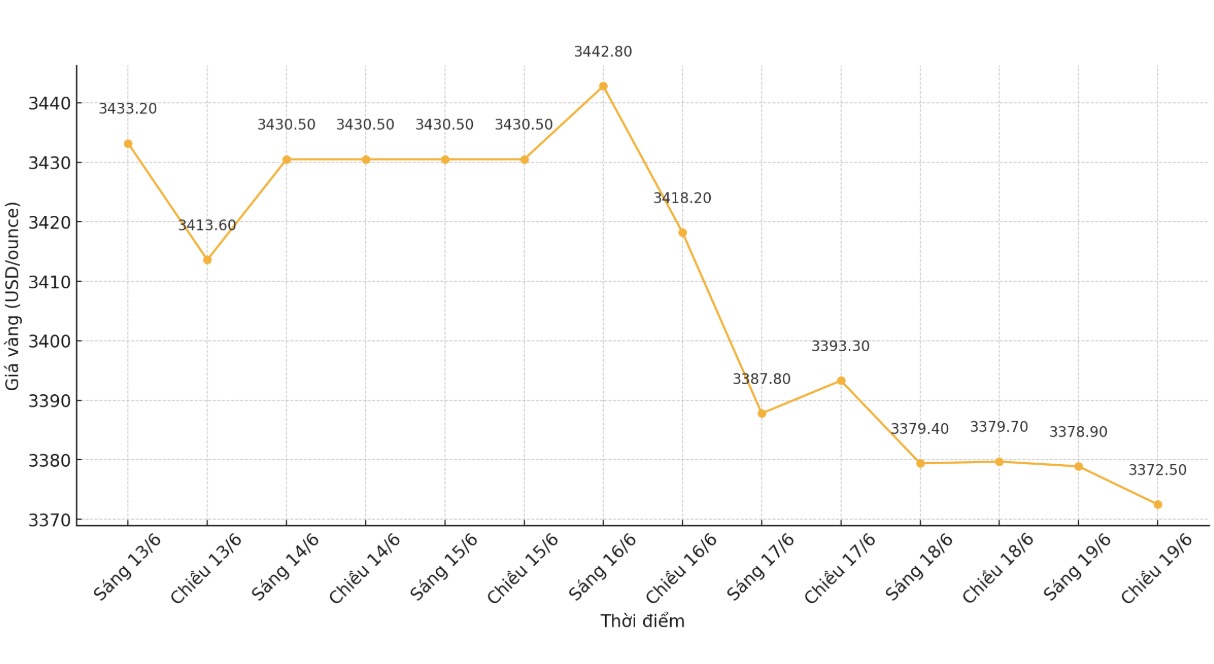

World gold price

The world gold price was listed at 6:35 p.m. at 3,372.5 USD/ounce, down 7.2 USD.

Gold price forecast

Gold prices fell on Thursday despite concerns about the escalation of the conflict between Israel and Iran. However, some experts say that cash flow is flowing back into precious metals and gold may soon increase in price again.

We are seeing a flow of safe-haven money into gold, which is not surprising given the war situation between Iran and Israel, said Fawad Razaqzada, market analyst at City Index and FOREX.com.

Mr. Razaqzada added that the stock market is also supporting gold prices.

Israel has recently said it has attacked Iran's only remaining nuclear power plant in operation along the Gulf, which could lead to a major escalation in the air war against Iran.

Meanwhile, the US Federal Reserve (FED) kept interest rates unchanged at its meeting on Wednesday and still forecast to cut interest rates by 0.5 percentage points this year, but has delayed the cut plan due to more difficult economic prospects.

However, Fed Chairman Jerome Powell warned against over-expecting the plan, noting the risk of significant inflation as higher import tariffs are approaching.

Gold is often considered a safe asset in times of geopolitical and economic instability, and often tends to increase in price when interest rates are low.

In other metals, platinum fell 2.5% to $1,289.71, after hitting its peak since September 2014 in the previous session.

According to analysts, platinum prices are supported by increased Chinese imports, concerns about supply, high rental rates and investor interest when gold prices are high, causing consumers to seek cheaper alternatives.

The demand in the platinum market shows that there is still room for price increases in the coming time - Tim Waterer - Head of Market Analysis Department at KCM Trade said.

Palladium fell 1.1% to $1,036.74, while silver fell 1.2% to $16.31 an ounce.

See more news related to gold prices HERE...