Updated SJC gold price

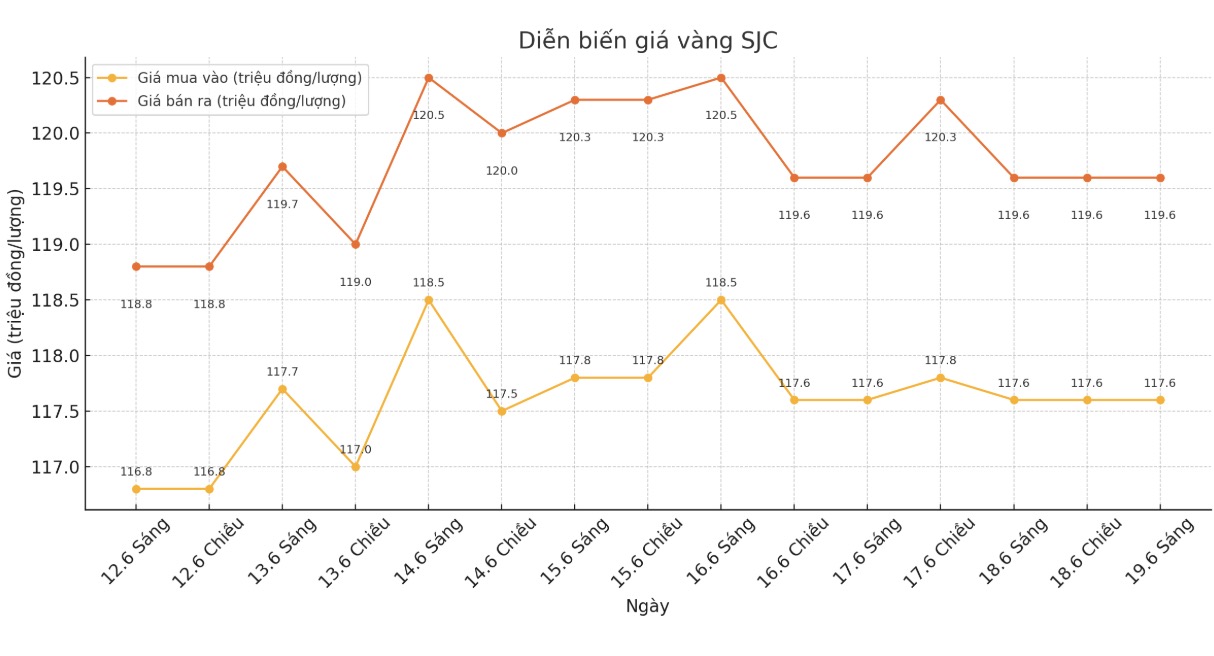

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.6-119 1.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.6-119 1.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.6-119 1.6 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-119 1.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

9999 round gold ring price

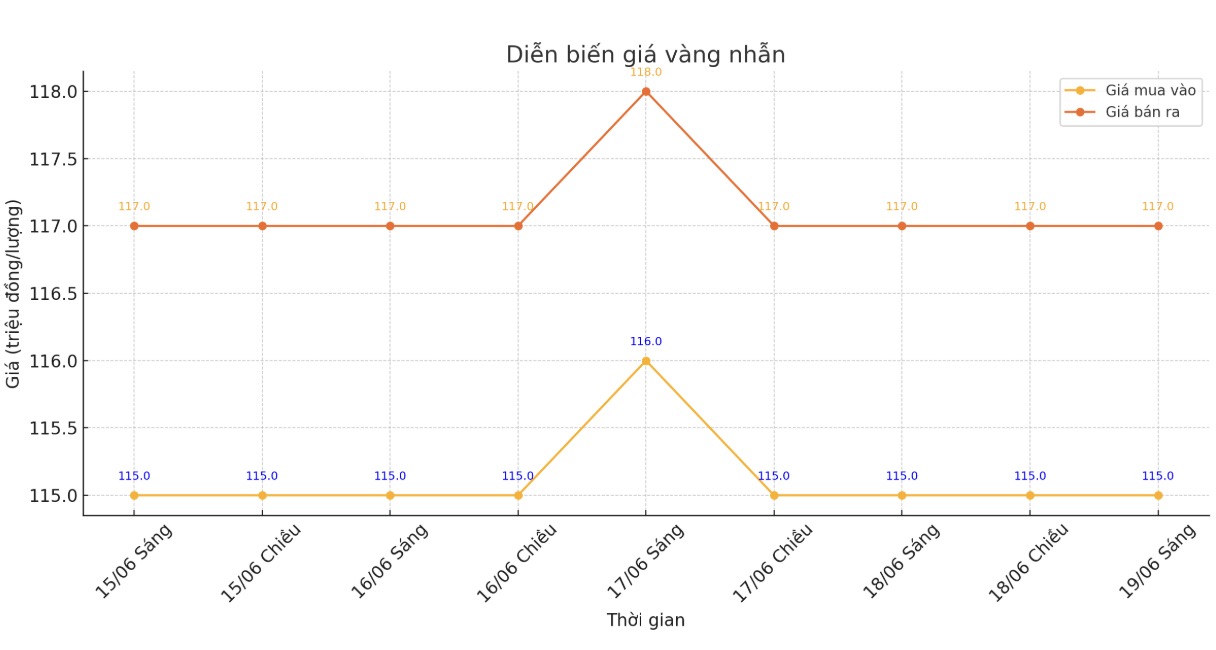

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.8-117.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.7-116.7 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

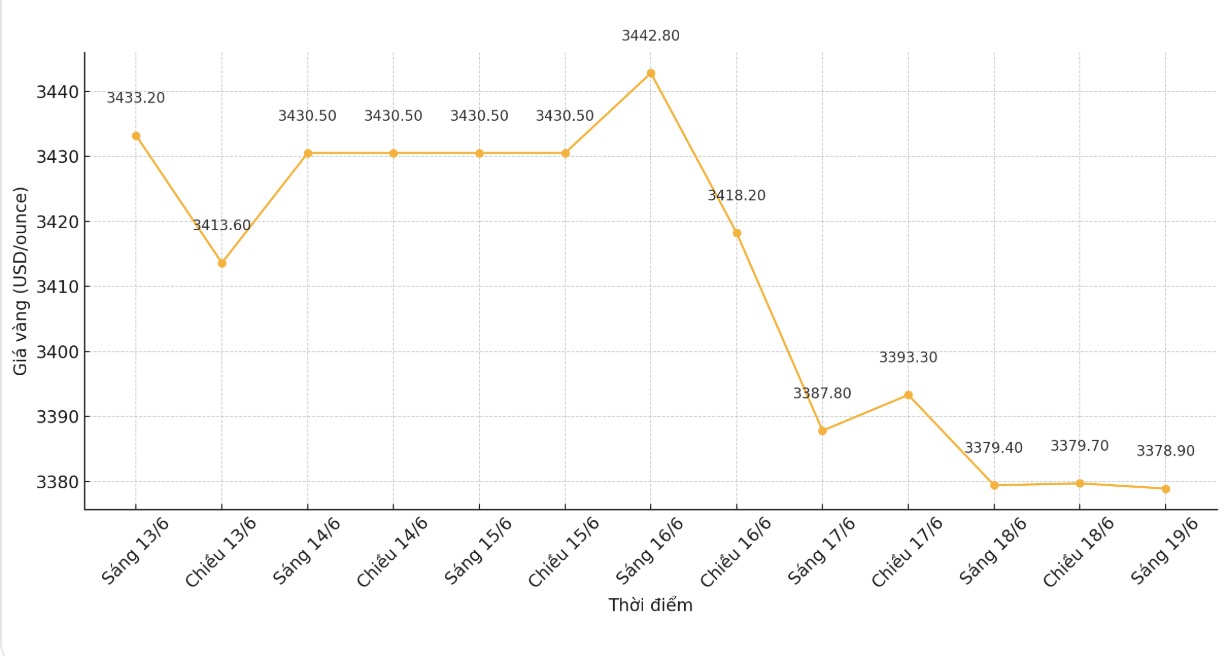

At 8:53, the world gold price was listed around 3,378.9 USD/ounce, not much change compared to 1 day ago.

Gold price forecast

Gold prices are in a tug-of-war as the Federal Open Market Committee (FOMC) has just released a statement saying that US interest rates will remain unchanged as expected.

However, the statement also emphasized that inflation is still a concern. The market has barely responded much to the FOMC's statement and is now waiting for the press conference of US Federal Reserve Chairman Jerome Powell, which is expected to start soon.

David Morrison of Trade Nation said that despite the Israel-Iran military conflict that could draw the US into the conflict, there are no signs of panic from investors. Of course, on the US side, events are taking place very far away... But there is also a sense that investors are betting on a short and fierce conflict, which will then bring a more stable situation in the Middle East than at present. Maybe this is how they look back at recent history. But if so, that is a rather optimistic view. And the question is: Will it consider US military participation?

Despite the decline in gold prices, commodity analysts at Bank of America believe that gold prices are still likely to reach 4,000 USD/ounce in the next 12 months.

This assessment was made as investors continue to worry about the growing US government budget deficit.

" marking concerns about financial sustainability are unlikely to ease, regardless of the outcome of Senate negotiations. Interest rate fluctuations and a weaker US dollar will help gold, especially if the US Treasury Department or the US Federal Reserve (FED) finally intervene to support the market.

Therefore, while war and conflict are often not a long-term driver, we see a path for gold to increase to $4,000/ounce in the next 12 months," the analysts said in the report.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...