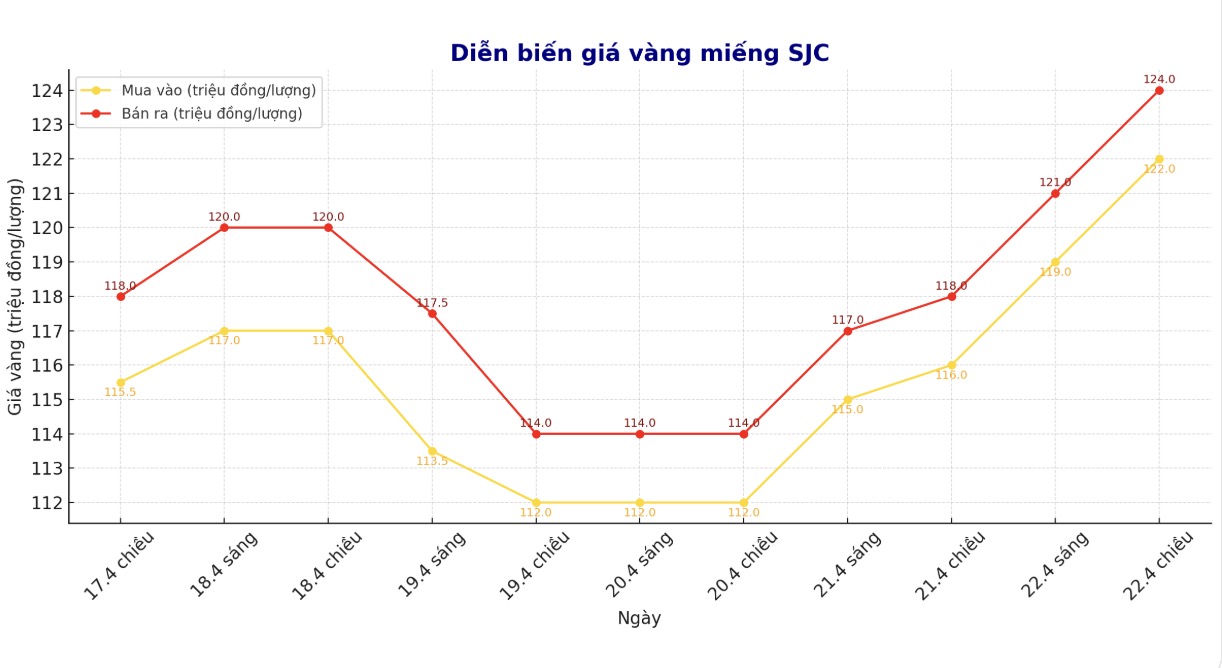

Updated SJC gold price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND122-124 million/tael (buy in - sell out); increased by VND6 million/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 122-124 million VND/tael (buy - sell); increased by 6 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120.5-122.5 million VND/tael (buy - sell); increased by 4.5 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

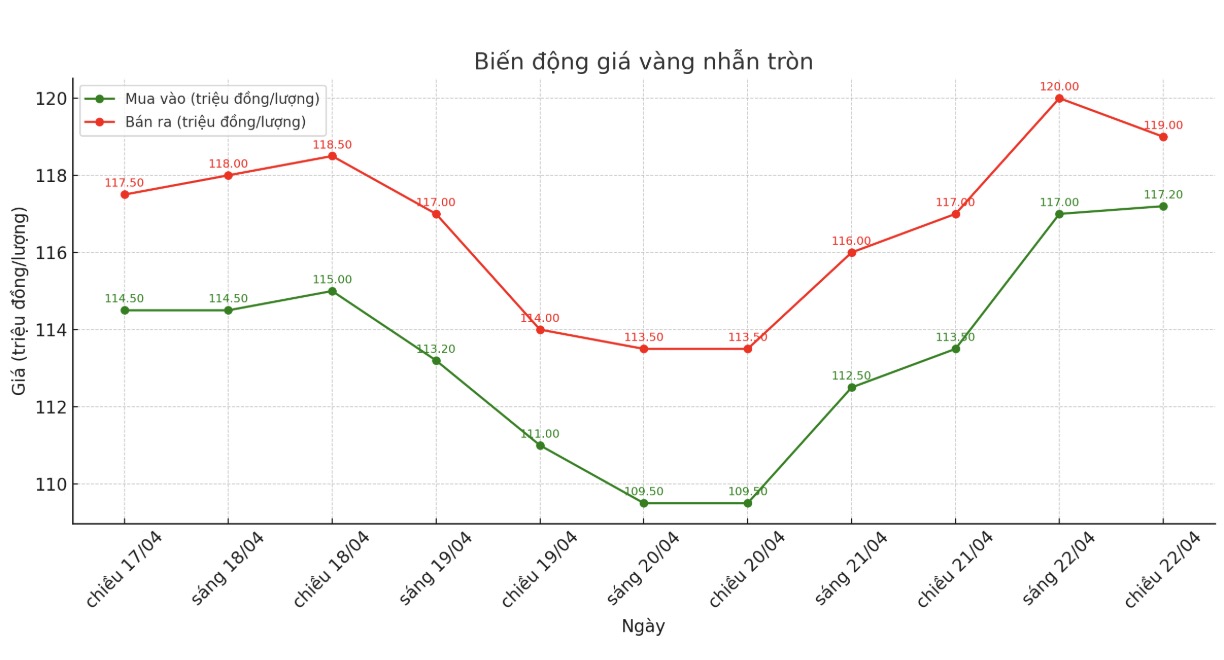

9999 round gold ring price

As of 6:00 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 117.2-119 million VND/tael (buy - sell); an increase of 3.7 million VND/tael for buying and an increase of 32 million VND/tael for selling. The difference between buying and selling prices is at 1.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 119-122 million VND/tael (buy - sell); increased by 4.5 million VND/tael for buying and increased by 4 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

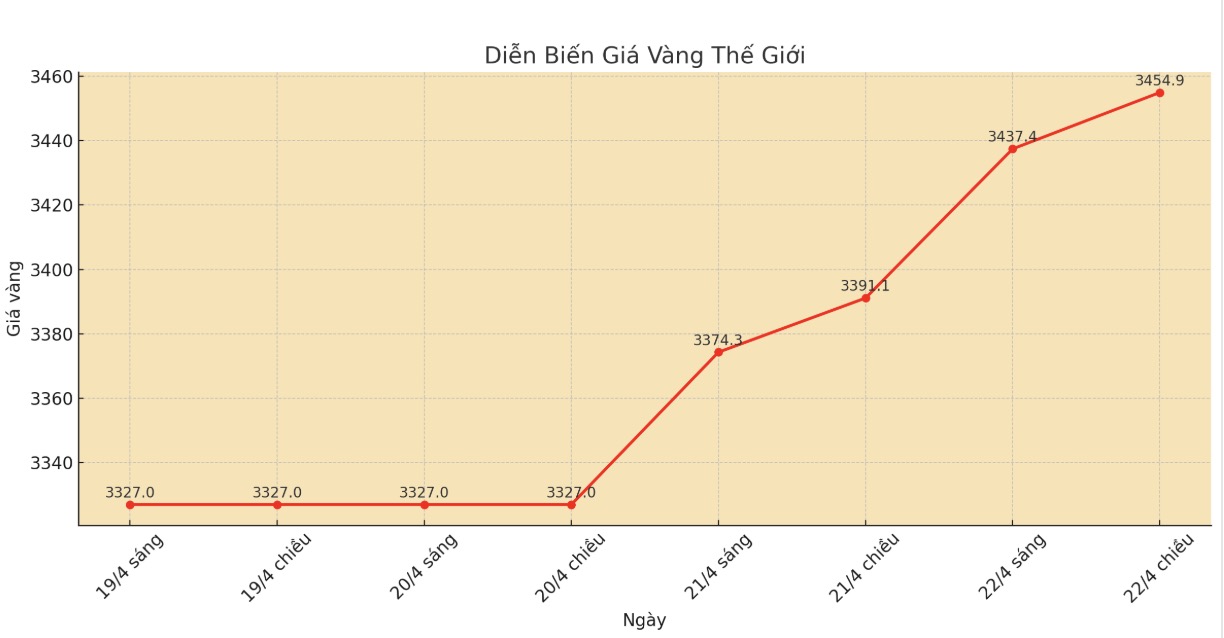

World gold price

As of 6:10 p.m., the world gold price was listed at 3,454.9 USD/ounce, up 63.8 USD.

Gold price forecast

According to Kitco, gold prices continue to increase strongly, investors flock to gold as demand for other traditional safe-haven assets, including the USD and US bonds, weakens.

"With geopolitical volatility and uncertainty continuing to driven risk-off sentiment, investors are increasingly turning to gold as a strategic haven," said analysts at State Street Global Advisors, a marketing firm at GLD.

Mike McGlone - senior commodity strategist at Bloomberg Intelligence - commented that gold prices surpassing the 3,200 USD/ounce mark could be just the beginning of another stronger increase, even towards 4,000 USD/ounce. Mike McGlone said that we are witnessing "the beginning of the downward market in the US" and a comprehensive change in the way cash flow operates.

We are building a fairly solid foundation around $3,000. Gold prices will move up to $4,000, it is just a matter of time. What happened in the middle was for speculators, of which I was a part, McGlone said.

Meanwhile, Alex Kuptsikevich - Senior Analyst at FxPro - expects gold to surpass $3,500/ounce in the short term.

Sharing with Lao Dong reporter, Dr. Nguyen Tri Hieu - an economic expert predicted that domestic gold prices could reach 125 million VND/tael in the next 2 months.

In the short term, I think gold prices could reach VND125 million/tael. When it will be achieved, no one knows, but the probability in the next two months is about 60%" - the expert predicted.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...